ETH Nearing Key Support: $1K to Be Retested if it Breaks (Ethereum Price Analysis)

Despite a 7% spike for Ethereum in the last 48 hours, followed by a steep decline, the possibility of a bullish rally remains low. The price has yet to recover from the major drops that took place in September.

The first step towards bullish sentiment would be to reclaim the critical level of $1,550.

Technical Analysis

By Grizzly

The Daily Chart

As seen below, an ascending triangle pattern (in yellow) has developed on the ETH/USDT trading pair chart. This pattern is textbook bullish (most breakouts’ direction is to the bullish side), but the price is still nowhere near breaking the top of this triangle.

The horizontal level of $1,550 (in red) has become crucial support since early August but now has become a strong resistance. This is the first significant barrier before attempting for $2000.

Assuming the price can not surpass the $1,550 mark and drops to the bottom of the triangle, the possibility of breaking to the downside increases with each attempt. Additionally, if ETH drops below $1,240, a retest of $1,000 is not out of the question.

In conclusion, the above-mentioned horizontal levels of $1,420 and $1,550 should be watched closely.

Key Support Levels: $1240 & $1000

Key Resistance Levels: $1550 & $2000

Daily Moving Averages:

MA20: $1473

MA50: $1597

MA100: $1479

MA200: $1985

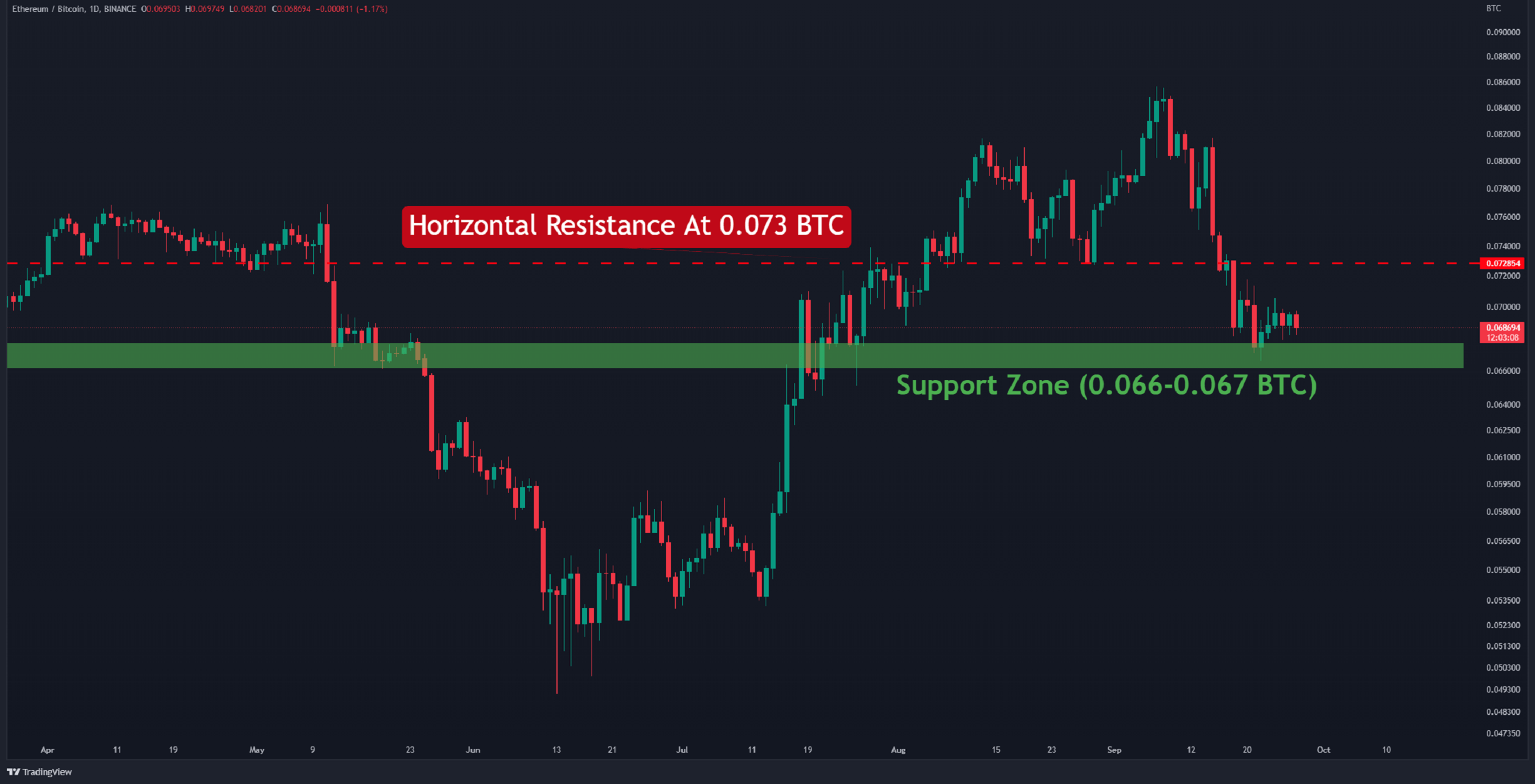

The ETH/BTC Chart

Against Bitcoin, the price action has not changed structurally over the past week. Buyers maintain the critical level of 0.066-0.067 BTC (in green). Unless ETH breaks below, another attempt to breach the horizontal barrier at 0.073 BTC is likely (marked in red).

Breaking above this level is critical since it would be interpreted as a trend reversal sign.

Key Support Levels: 0.067 & 0.065 BTC

Key Resistance Levels: 0.073 & 0.08 BTC

On-chain Analysis

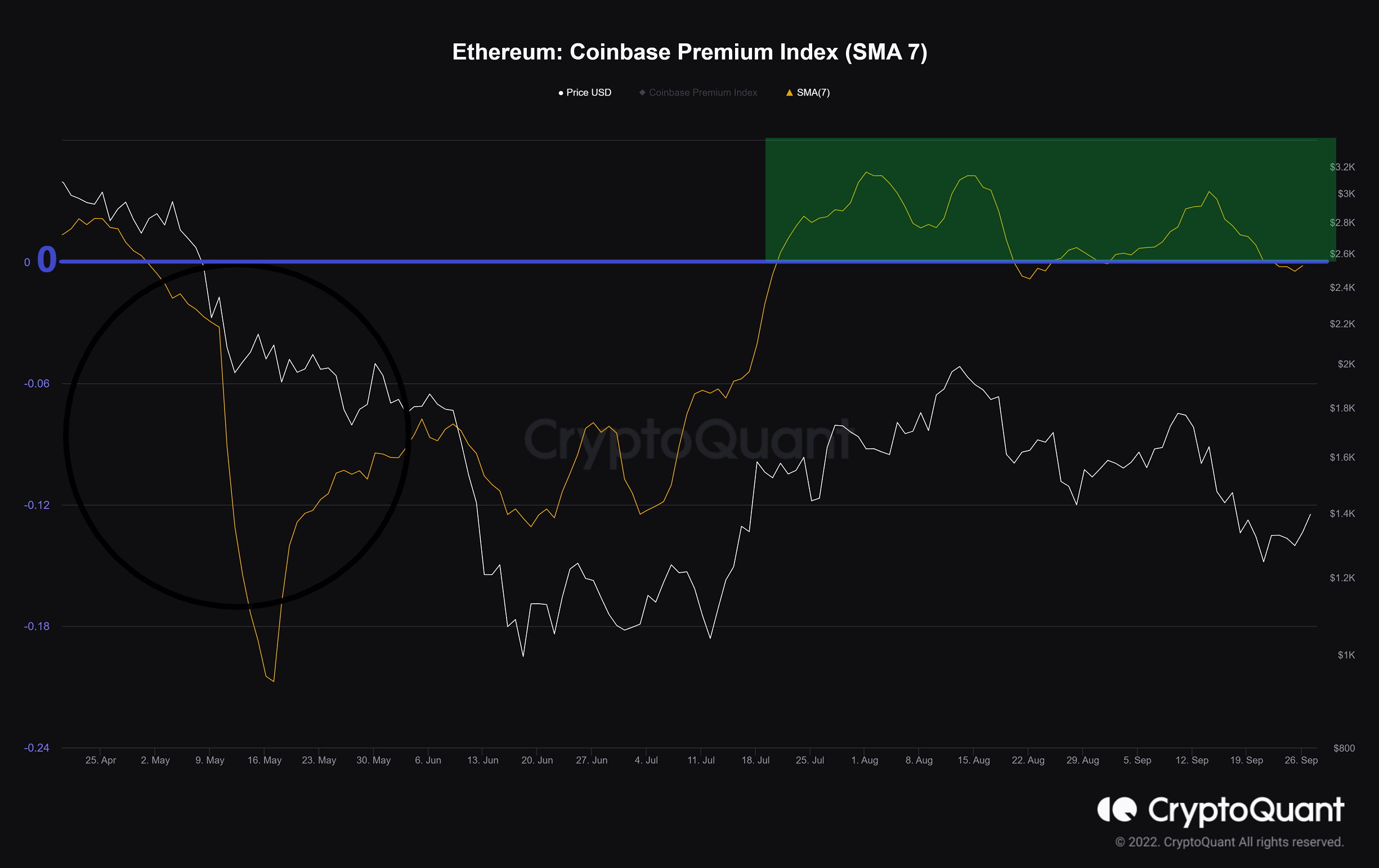

Coinbase Premium Index (SMA 7)

Definition: The differing percentages between Coinbase Pro price (USD pair) and Binance price (USDT pair). High premium values could indicate intense buying pressure on behalf of US-based investors.

As this metric rises, US investors are steadily shifting away from their feelings of doubt and uncertainty. Because USA macroeconomic data heavily influence financial markets, it is vital to analyze the movements of American traders.

This index is still below the zero line (in blue), and gaining momentum above it signals a favorable sentiment.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Siacoin

Siacoin  Ravencoin

Ravencoin  Holo

Holo  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur