ETH Slows Down Ahead of FOMC Meeting, What’s Next? (Ethereum Price Analysis)

Ethereum experienced a considerable increase in the final days of October, resulting in a green monthly candle. To continue this growth, the cryptocurrency must retain $1,500 as support.

Technical Analysis

By Grizzly

The Daily Chart

After 40 days, the price of ETH officially surpassed $1,500 towards the end of October. Since then, the cryptocurrency has slowed down after hitting the resistance zone of $1650-$1700 (in red).

With the test of this resistance and the approaching FOMC meeting, it appears that some traders have opted to close their long positions. As a result, the bullish momentum has weakened slightly.

If Ethereum can establish $1,500 as support and does not close below this crucial mark, it could retest $1,700, which overlaps the 200-day moving average.

Alternatively, if the Federal Reserve does not signify any willingness to slow rate hikes later in the year, selling pressure on high-risk assets is likely to increase. In this case, the return of the upward trend would be out of the question.

Key Support Levels: $1500 & $1370

Key Resistance Levels: $1700 & $2000

Daily Moving Averages:

MA20: $1420

MA50: $1374

MA100: $1526

MA200: $1676

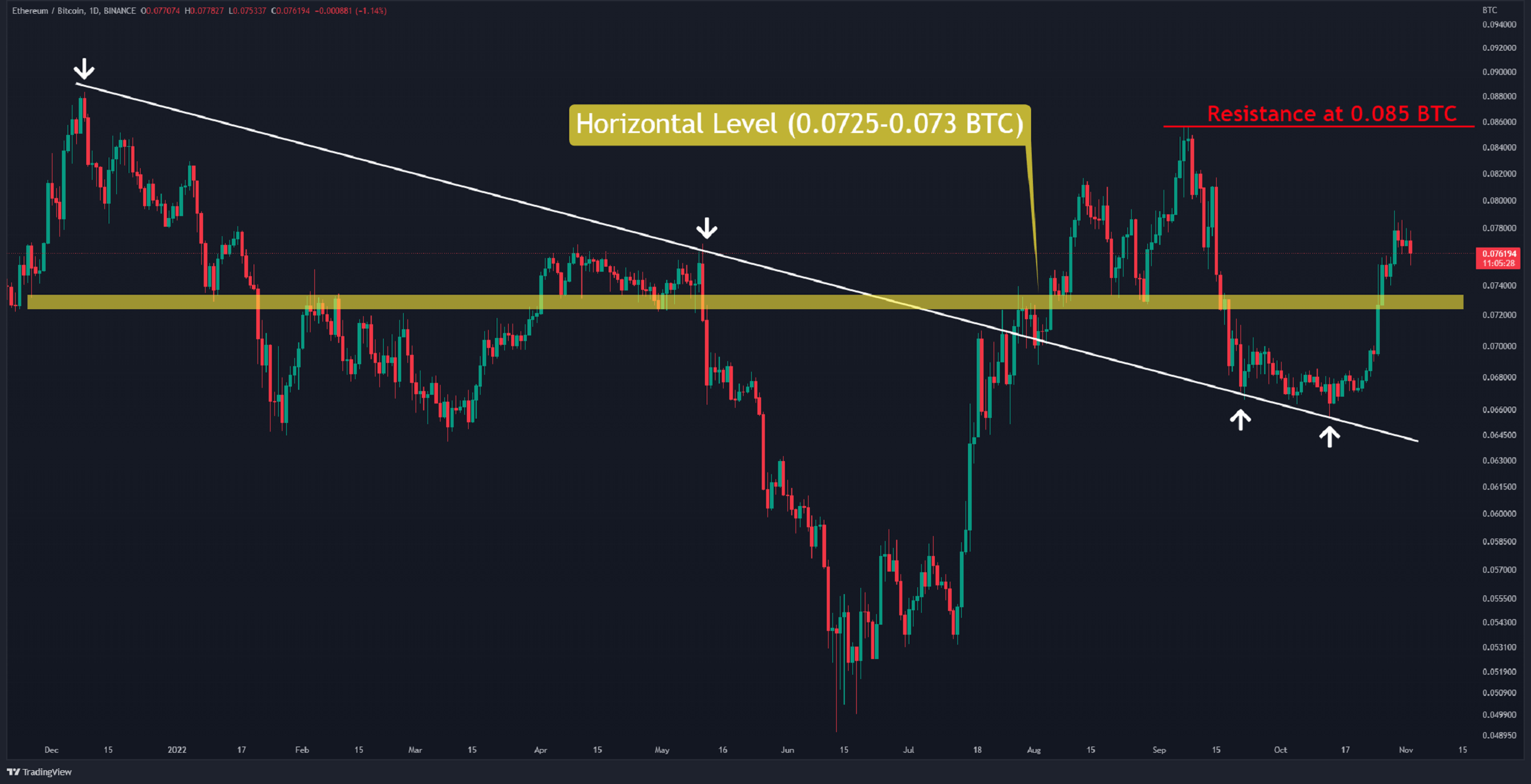

The ETH/BTC Chart:

Against Bitcoin, the descending line (in white) continually prevented the price from falling in the previous month, which allowed the cryptocurrency to recover.

The horizontal level (in yellow) was broken around 0.073 BTC as a result of this move. 0.073 BTC looks likely to be tested as support right now. If the pair can stay above this level, a move to retest the resistance at 0.085 BTC (in red) would also become more probable.

Key Support Levels: 0.073 & 0.07 BTC

Key Resistance Levels: 0.08 & 0.085 BTC

Sentiment Analysis

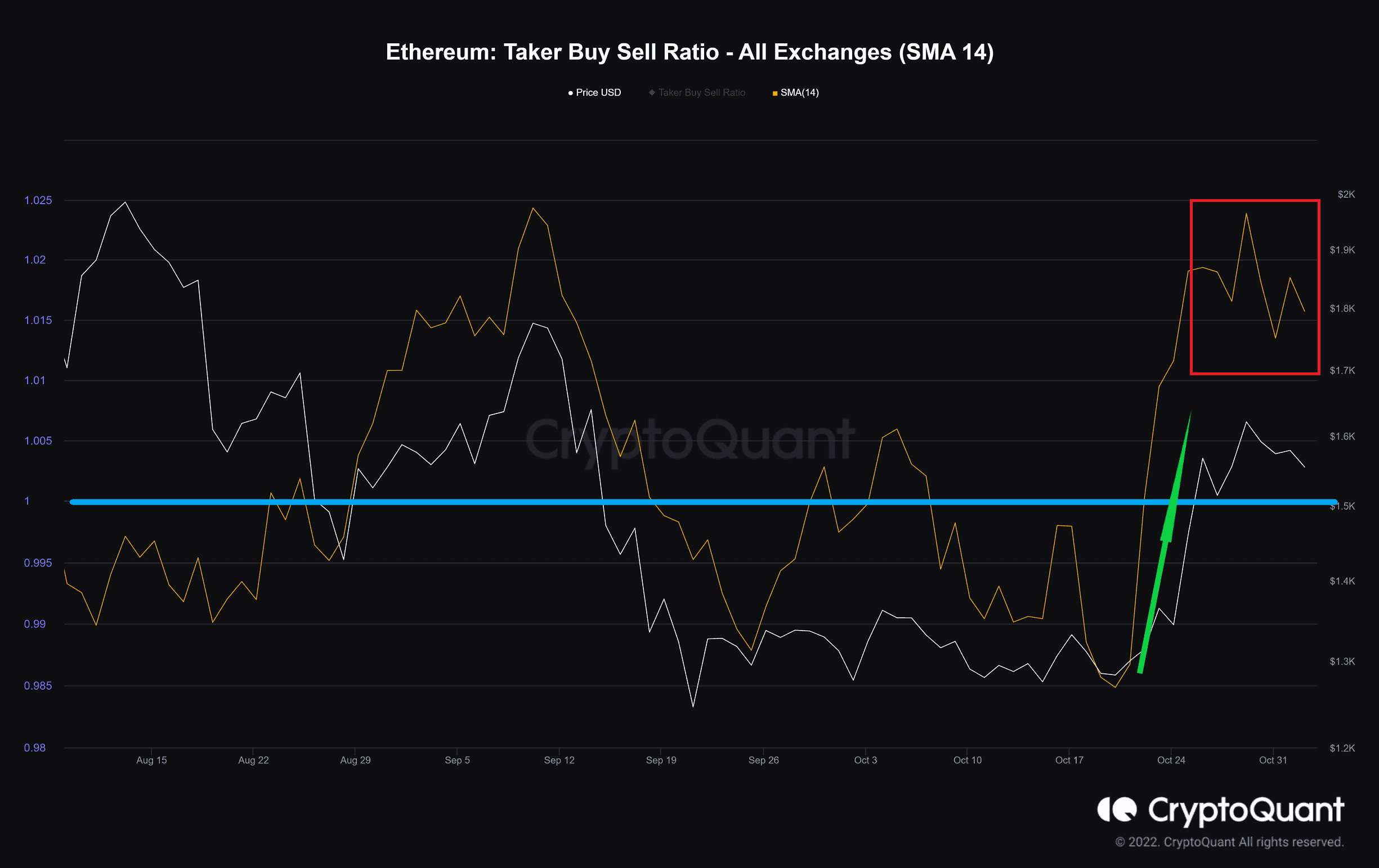

Taker Buy Sell Ratio (SMA 14)

Definition: The ratio of buy volume divided by the sell volume of takers in perpetual swap trades.

Values over 1 indicate bullish sentiment is dominant.

Values under 1 indicate bearish sentiment is dominant.

The derivative market is dominated by bullish sentiment. The large increase in this index, which implies that many buy orders were filled by takers, caused the price to soar. However, this sentiment appears to be weakening.

The FOMC meeting tonight is currently the focus of everyone’s attention, as it could have some impact on upcoming trends in the market.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Ethereum Classic

Ethereum Classic  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  0x Protocol

0x Protocol  Dash

Dash  Zilliqa

Zilliqa  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Nano

Nano  Pax Dollar

Pax Dollar  Numeraire

Numeraire  DigiByte

DigiByte  Waves

Waves  Status

Status  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD