ETH Supply Drops to an 11-month low, Price Dips to $1,090

Ethereum’s price plunged from the 24-hour highest high of $1140 to $1084.86 within the past 24 hours, a few hours after the news of an FTX hacker moving another $16 million worth of Ethereum to different wallets. Additionally, the amount of ETH in supply for the last three and five years has dropped to an 11-month low of 13,968,345.949, according to Glassnode.

? #Ethereum $ETH Amount of Supply Last Active 3y-5y (1d MA) just reached a 11-month low of 13,968,345.949 ETH

View metric:https://t.co/IuPSW2dlPi pic.twitter.com/GALl8C1Ai9

— glassnode alerts (@glassnodealerts) November 22, 2022

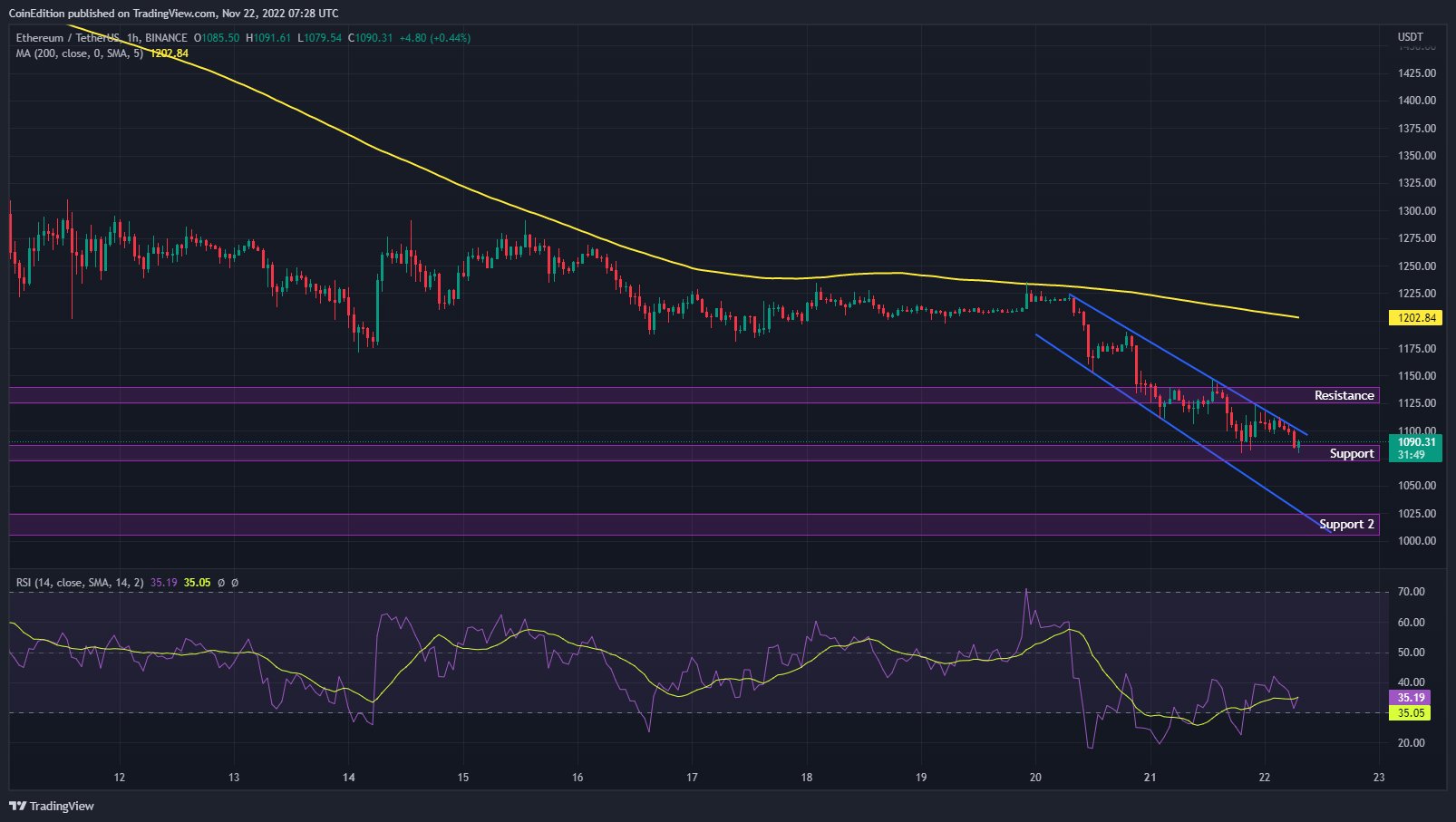

The price is forming a bullish flag on the 1-Hour chart of Ethereum analysis. Ethereum price also touched the upper trendline of the bullish flag three times. Although the bullish flag pattern usually happens in the bull market, there is less chance of Ethereum recovering from the current bearish trend.

ETH/USDT 1-Hour price chart (Source: TradingView)

Moreover, it is now trading below the 200 moving average, indicating no buying pressure in the market. After the FTX crash, many potential buyers and investors have put off investing in crypto. At the time of writing, the RSI value is now 30.33, which denotes that Ethereum is now facing an oversold or undervalued condition.

The support zone lies between $1,086-$1,076, and the resistance sits at $1,139 and $1,124. If the price breaks down the support level and trades lower, we can see new bottom support of Ethereum around $1,012.

The market capitalization dropped 3.28%, to $133,166,828,452.38, and selling pressure rose, as seen by a 12.83 % increase in volume to $13,261,316,675.64 in the 24-hour trading volume data, causing the market to retreat from its resistance level. Furthermore, throughout the previous week, Ethereum’s price fell 13.03 percent.

To halt the current downward trend on the charts, Ethereum bulls must maintain control above the current support level and push prices higher.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur