ETH Supply Drops to an 11-month low, Price Dips to $1,090

Ethereum’s price plunged from the 24-hour highest high of $1140 to $1084.86 within the past 24 hours, a few hours after the news of an FTX hacker moving another $16 million worth of Ethereum to different wallets. Additionally, the amount of ETH in supply for the last three and five years has dropped to an 11-month low of 13,968,345.949, according to Glassnode.

? #Ethereum $ETH Amount of Supply Last Active 3y-5y (1d MA) just reached a 11-month low of 13,968,345.949 ETH

View metric:https://t.co/IuPSW2dlPi pic.twitter.com/GALl8C1Ai9

— glassnode alerts (@glassnodealerts) November 22, 2022

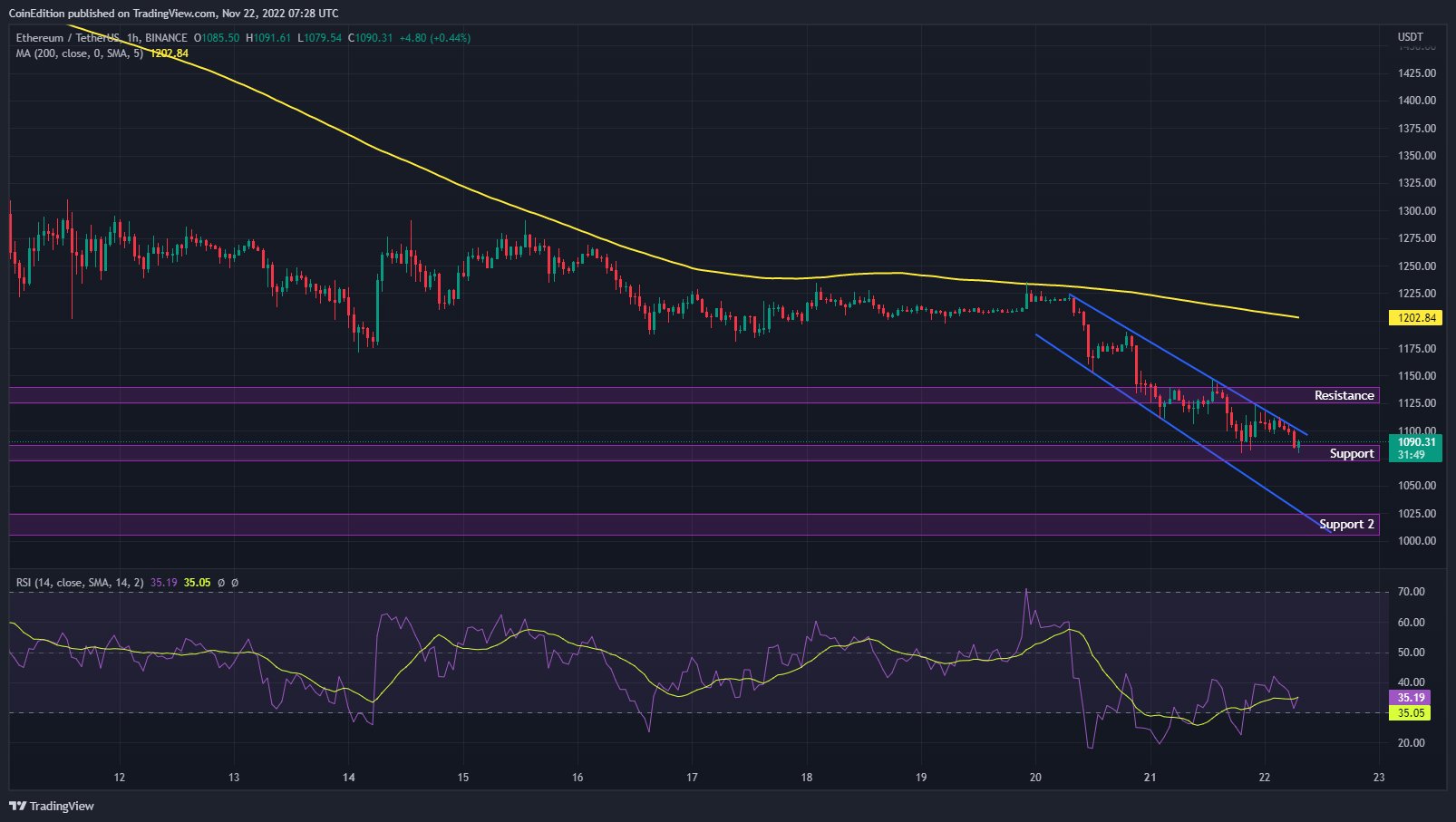

The price is forming a bullish flag on the 1-Hour chart of Ethereum analysis. Ethereum price also touched the upper trendline of the bullish flag three times. Although the bullish flag pattern usually happens in the bull market, there is less chance of Ethereum recovering from the current bearish trend.

ETH/USDT 1-Hour price chart (Source: TradingView)

Moreover, it is now trading below the 200 moving average, indicating no buying pressure in the market. After the FTX crash, many potential buyers and investors have put off investing in crypto. At the time of writing, the RSI value is now 30.33, which denotes that Ethereum is now facing an oversold or undervalued condition.

The support zone lies between $1,086-$1,076, and the resistance sits at $1,139 and $1,124. If the price breaks down the support level and trades lower, we can see new bottom support of Ethereum around $1,012.

The market capitalization dropped 3.28%, to $133,166,828,452.38, and selling pressure rose, as seen by a 12.83 % increase in volume to $13,261,316,675.64 in the 24-hour trading volume data, causing the market to retreat from its resistance level. Furthermore, throughout the previous week, Ethereum’s price fell 13.03 percent.

To halt the current downward trend on the charts, Ethereum bulls must maintain control above the current support level and push prices higher.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Holo

Holo  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD