Ethereum (ETH) Price: Are Bulls or Bears Winning the Battle?

The Ethereum (ETH) price has fallen since the beginning of April, when it deviated above a crucial long-term horizontal resistance.

While this could lead to more downside, both a bullish and bearish wave count are still valid. So, the direction of the long-term trend is still unclear.

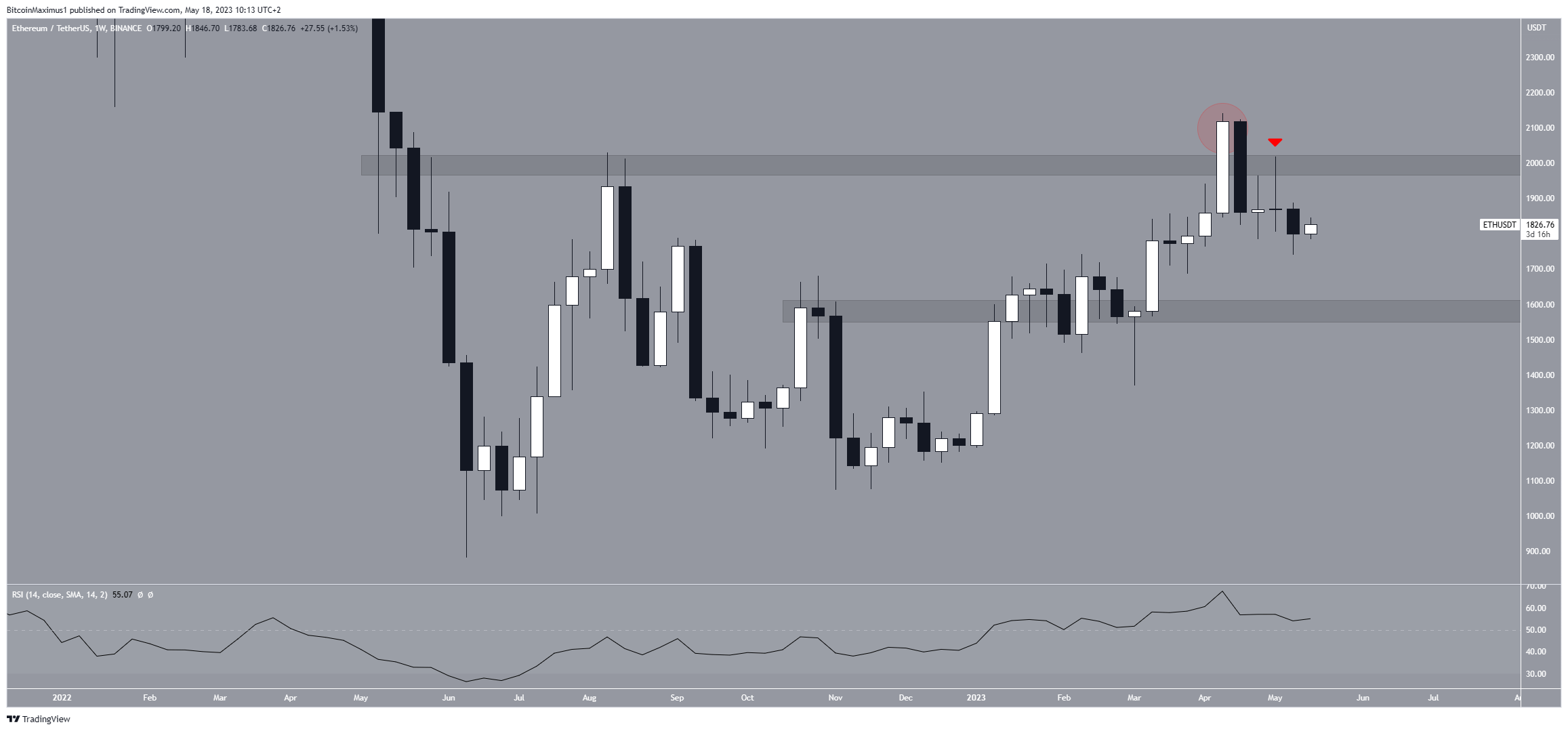

Ethereum Price Fails to Sustain Increase

ETH is the native token of the Ethereum blockchain, created by Vitalik Buterin. The weekly time frame outlook leans on bearish, but also provides some mixed signs.

At the beginning of April, the Ethereum price reached a yearly high of $2,151, seemingly moving above the $1,950 resistance area. However, after a significant decrease the next week, the price fell below the area and validated it as resistance (red icon).

So, the previous breakout is now considered invalid. This movement is considered bearish since buyers could not sustain the increase. The closest support area is at $1,600.

ETH/USDT Weekly Chart. Source: TradingView

However, the weekly Relative Strength Index (RSI) is still bullish. The RSI is a momentum indicator used by traders to evaluate whether a market is overbought or oversold and to determine whether to accumulate or sell an asset.

Readings above 50 and an upward trend suggest that bulls still have an advantage, while readings below 50 indicate the opposite. The current reading above 50 is considered a sign of a bullish trend.

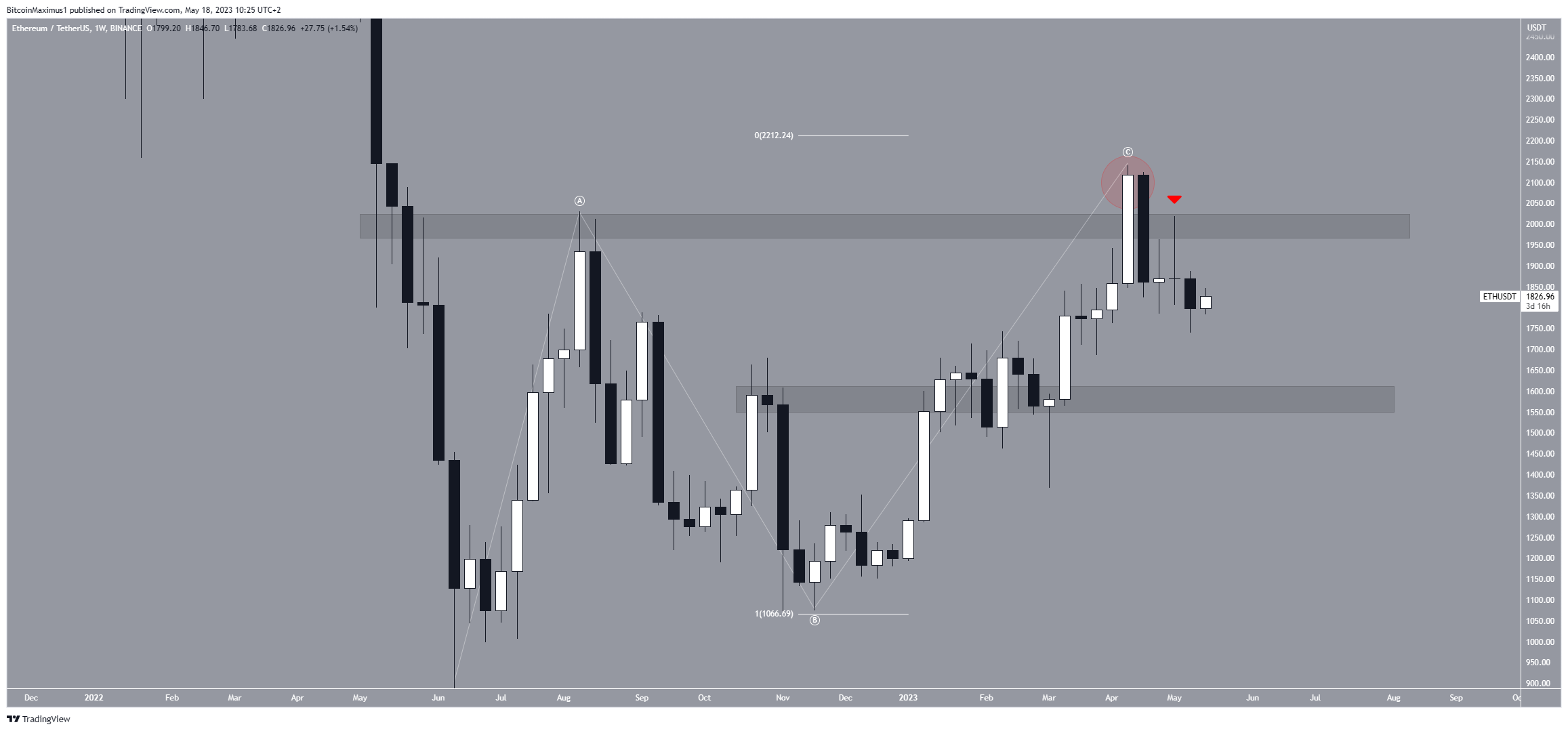

ETH Price Prediction: What Does the Wave Count Say?

Two potential wave counts exist for the future Ethereum (ETH) price. The first one is bearish, stating that the price has completed an A-B-C corrective structure. If so, a significant downward movement that takes the price to new lows will follow.

Utilizing the Elliott Wave theory, technical analysts examine long-term price patterns and investor psychology that recur to determine the direction of a trend.

In this potential count, waves A:C has an exactly 1:1 Fib ratio, which is the most common in such structures. The ETH price will eventually drop below $1,000 if the count is correct.

ETH/USDT Weekly Chart. Source: TradingView

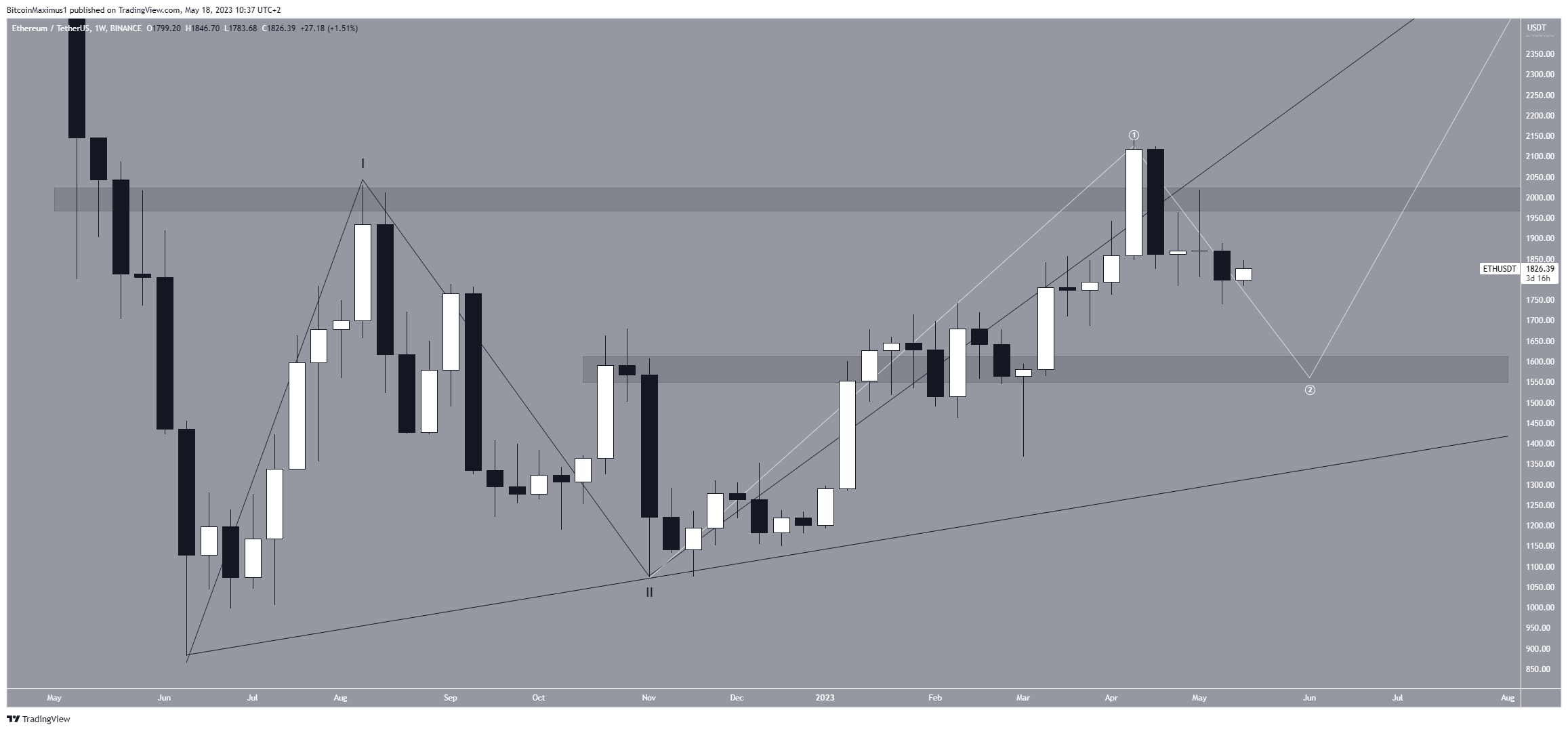

The bullish count suggests that the increase is a bullish 1-2/1-2 wave structure. This means that the price is in sub-wave two (white) of wave three (black).

This is an extremely bullish count in which the slope of the increase accelerates once the price begins sub-wave three.

In order for the count to be correct, ETH has to bounce at the $1,600 support area and initiate a sharp upward movement above $2,000.

Since the second 1-2 should have a steeper slope than the first one, a breakdown below the slope of the first one (black) will invalidate the count.

ETH/USDT Weekly Chart. Source: TradingView

To conclude, the future ETH price trend will be determined by whether the price breaks down below $1,600 or moves above $1,950.

In the case of the former, a decrease toward at least $1,000 will be expected. However, the ETH price can move to $2,500 in the case of the latter.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Ontology

Ontology  Waves

Waves  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren