Ethereum (ETH) Price Falls Sharply Despite Merge Set for Early September

Despite the Ethereum merge being expected to reduce emissions by 88% and potentially make ETH deflationary, the price has fallen considerably in August.

Ethereum has been falling underneath a descending resistance line since reaching an all-time high price of $4,868 in November 2021. The downward move has so far led to a local low of $880 in June 2022. The low also coincided with a new all-time low in the weekly RSI (green circle).

The price rebounded shortly after, causing the RSI to move outside of its oversold territory.

The relief rally culminated with a local high of $2,031 on Aug. 14, 2022 (red icon) and ETH has been falling since. The top served to validate the $1,920 area as resistance (red icon).

ETH/USD Chart By TradingView

Falling from resistance

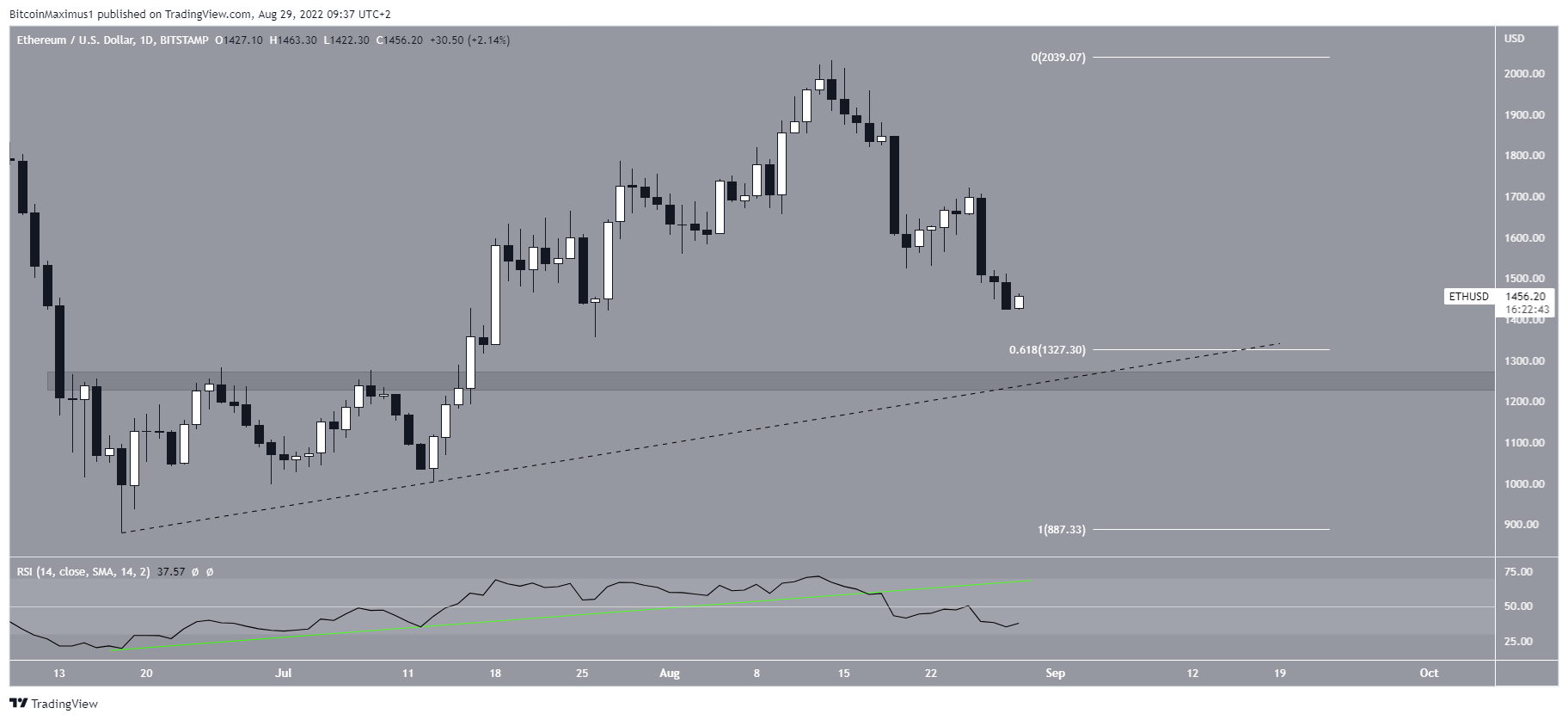

The readings from the daily chart support the validity of the rejection from the weekly chart. The reason for this is that the RSI broke down from an ascending support line after the price reached the aforementioned Aug. 14 high.

If the downward movement continues, there is a confluence of support levels found between $1,250 and $1,330. This support is created by:

- The 0.618 Fib retracement support level (white)

- A horizontal support area

- A potential ascending support line (dashed)

The line has not yet been validated enough times, so its exact slope remains uncertain.

ETH/USD Chart By TradingView

Future ETH trajectory

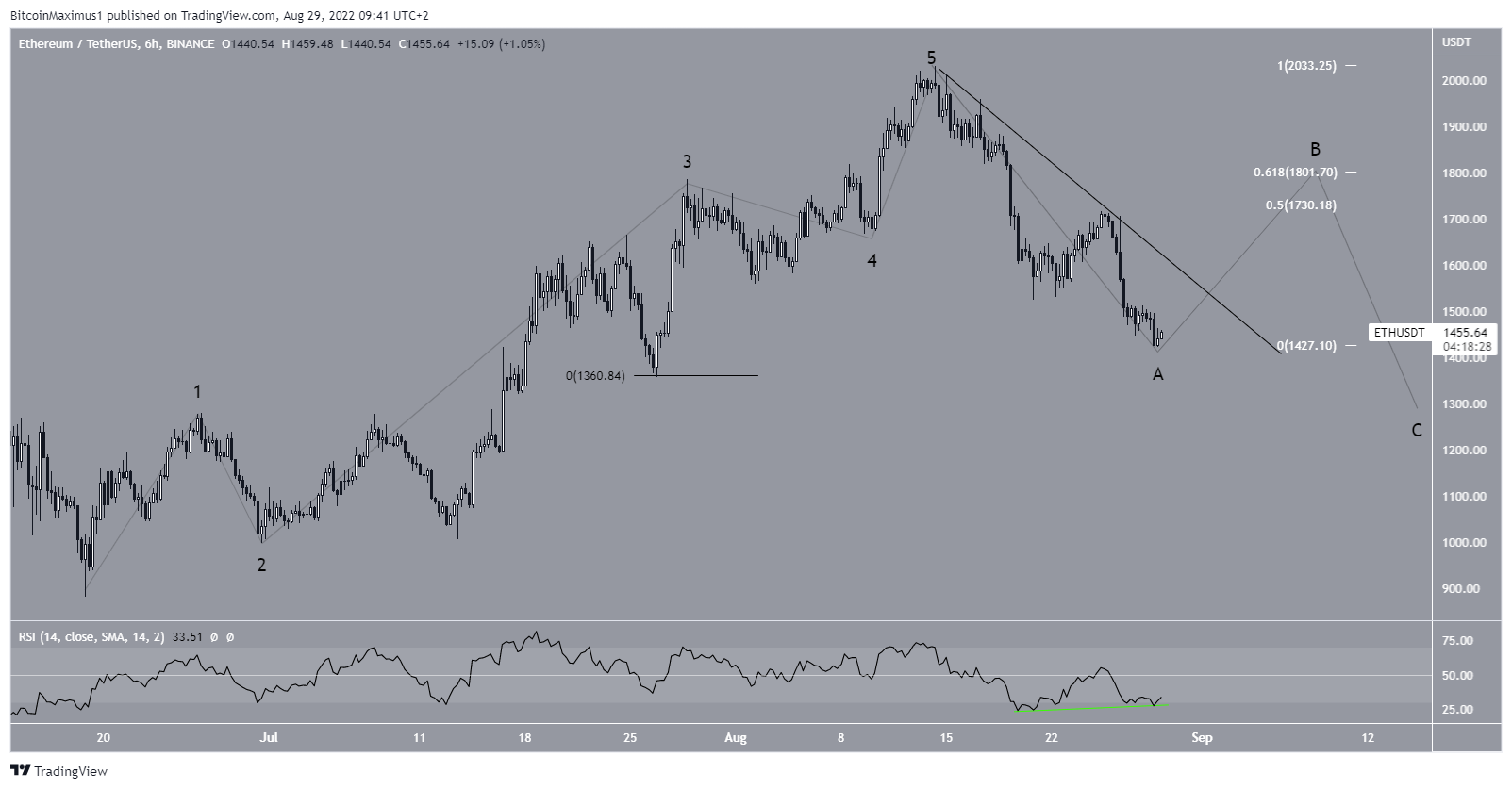

The most likely wave count suggests that since the June low, Ethereum completed a five-wave upward move.

If so, it is likely forming an A-B-C corrective structure and is close to the bottom of wave A.

The six-hour RSI has begun to generate a bullish divergence (green line). If the divergence materializes, it could cause a breakout from a short-term descending resistance line and initiate the beginning of wave B.

If correct, the count would suggest that ETH will reach a high between $1,730 and $1,800 before decreasing to complete wave C.

ETH/USDT Chart By TradingView

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Qtum

Qtum  Synthetix

Synthetix  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond