Ethereum Merge: What You Need to Know

We’ve spent the past several weeks of this newsletter wading into deep technical and philosophical debates around future of Ethereum – with topics ranging from maximal extractable value (MEV), to the threat of censorship on Ethereum, to what makes a ‘true’ zero-knowledge Ethereum Virtual Machine, or zkEVM.

But now, at long last, the Ethereum Merge is finally around the corner. This week, I’d like to take a step back and quickly address a few of the myths and misconceptions that have popped up surrounding the Merge, Ethereum’s transition to proof-of-stake scheduled for around Sept. 15.

I’d also like to request input from the Valid Points Community. If you have any questions that are not answered in the FAQ – no matter how technical – please send them to [email protected].

This article originally appeared in Valid Points, CoinDesk’s weekly newsletter breaking down Ethereum’s evolution and its impact on crypto markets. Subscribe to get it in your inbox every Wednesday.

Will Ethereum fees decrease after the Merge?

No.

Ethereum transaction fees are not expected to change as a result of the Merge. Future network updates, like danksharding and proto-danksharding, may help to address Ethereum’s high network fees, but these updates are not expected until 2023 at the earliest.

The main salve for Ethereum’s transaction fee woes remains rollups – third-party networks like Arbitrum and Optimism that bundle transactions and process them separately from Ethereum’s mainnet.

Read more: Scaling Ethereum Beyond the Merge: Danksharding

Will Ethereum transaction speeds increase after the Merge?

Yes, but barely.

On average, Ethereum blocks are issued once every 13 or 14 seconds in today’s proof-of-work (PoW) system. After the merge, proof-of-stake (PoS) blocks will be issued in regular 12-second intervals. This is not an improvement that most users will notice, and it still places Ethereum behind rival blockchain networks like Solana and Avalanche (though well ahead of Bitcoin, where a new block is mined every 10 minutes on average).

Just like with transaction fees, those looking for improved transaction speeds will need to look to Ethereum’s third-party rollups.

Read more: What Are Rollups? ZK Rollups and Optimistic Rollups Explained

Will the Merge increase the price of ether (ETH)?

It’s hard to say.

With so many variables and unknowns, it is impossible to predict what will happen to Ethereum’s token price as a result of the Merge.

The Ethereum community has for years positioned the Merge as a massive upgrade to the network’s core technology. Along with addressing concerns about the network’s environmental impact, PoS will introduce a new form of utility for Ethereum’s native ether (ETH) token in the form of staking.

But the Merge is not guaranteed to boost the ETH price. The Merge will also introduce changes to the rate at which ether is issued and how it is distributed. These changes could be positive or negative depending upon whom you ask. There is also a risk (however small) that the Merge will fail, or that PoS will prove less secure than PoW.

There is also speculation the Merge has already been priced in by the market.

Read more: Is Ethereum’s Merge Priced-In?

Is proof-of-stake better than proof-of-work?

There are trade-offs.

According to the Ethereum Foundation, the nonprofit that funds Ethereum ecosystem development, PoS will cut Ethereum’s energy usage by around 99.95%. PoS advocates also argue that PoW mining centralizes control in the hands of those who can afford to buy fancy crypto mining rigs, called ASICs. They say PoS – which hands network control to those who “stake” crypto with the network – makes attacks economically infeasible and self-defeating.

PoW proponents counter that PoS staking carries its own centralization and security risks, making it possible for malicious actors to directly “buy” control of the network. They also point out that PoS is a less battle-tested system than PoW, which has proven resilient as the backbone of the two largest blockchain networks.

When is the Merge happening?

Around Sept. 15, 2022.

Why no hard date? Each block on Ethereum’s PoW network carries a difficulty number representing how hard miners must work to add it to the network. Instead of kicking in at a specific date, the Merge is scheduled to take effect once the cumulative difficulty of all mined Ethereum blocks hits a certain number – the “total terminal difficulty” (TTD).

In August, Ethereum’s core developers set the TTD at 58,750,000,000,000,000,000,000, which will be reached sometime around Sept. 14 or 15. We only have an estimate because block difficulty and issuance rate vary over time.

Will Ethereum fees decrease after the Merge?

No.

Ethereum transaction fees are not expected to change as a result of the Merge. Future network updates, like danksharding and proto-danksharding, may help to address Ethereum’s high network fees, but these updates are not expected until 2023 at the earliest.

The main salve for Ethereum’s transaction fee woes remains rollups – third-party networks like Arbitrum and Optimism that bundle up transactions and process them separately from Ethereum’s mainnet.

Read more: Scaling Ethereum Beyond the Merge: Danksharding

Will Ethereum transaction speeds increase after the Merge?

Barely.

On average, Ethereum blocks are issued once every 13 or 14 seconds in today’s PoW system. After the Merge, PoS blocks will be issued in regular 12-second intervals. This is not an improvement that most users will notice, and it still places Ethereum behind rival blockchain networks like Solana and Avalanche (though well ahead of Bitcoin, where a new block is mined every 10 minutes on average).

Just like with transaction fees, those looking for improved transaction speeds will need to look to Ethereum’s third-party rollups.

Read more: What Are Rollups? ZK Rollups and Optimistic Rollups Explained

Will the Merge increase the price of ether (ETH)?

It’s hard to say.

With so many variables and unknowns, it is impossible to predict what will happen to Ethereum’s token price as a result of the Merge.

The Ethereum community has for years positioned the Merge as a massive upgrade to the network’s core technology. Along with addressing concerns about the network’s environmental impact, PoS will introduce a new form of utility for Ethereum’s native ether (ETH) token in the form of staking.

But the Merge is not guaranteed to boost the ETH price. The Merge will also introduce changes to the rate at which ether is issued and how it is distributed. These changes could be positive or negative depending upon whom you ask. There is also a risk (however small) that the Merge will fail, or that PoS will prove less secure than PoW.

There is also speculation that the Merge has already been priced-in by the market.

Read more: Is Ethereum’s Merge Priced-In?

Can I become an Ethereum validator or staker?

Yes, if you have some ETH.

It is already possible to “stake” 32 ether and earn rewards for validating Ethereum’s PoS Beacon Chain. Staked ether will accrue network rewards, but it will be impossible to withdraw until an update expected around six to 12 months after the Merge.

Staking requires some know-how; if you screw up or go offline, your stake can be “slashed” (ie, reduced).

Those with less blockchain expertise can stake via centralized services like those offered by Coinbase (COIN) or Kraken. In addition to handling the technical nitty-gritty, these services – in exchange for a cut of users’ rewards – open up staking to those with less than 32 ETH.

Also popular for those with less than 32 ETH are liquid staking pools like Lido and Rocket Pool. When users stake via these services, they are handed “staked ETH” tokens which trade at a slight discount to regular ETH.

Read more: Top Questions on Ethereum Proof-of-Stake and Ether Staking

What will happen to staked ether after the Merge?

Staked ether will stay locked up with the network until around six to 12 months after the Merge.

At that point, those who have staked ether themselves will be able to withdraw their stake, along with whatever rewards it has accrued.

Those who stake via centralized staking services or pools will need to keep an eye out for announcements on how withdrawals will be handled.

Will Ethereum users or ETH holders need to take any action after the Merge?

No.

If you hold ether (ETH) today, you won’t need to claim new “PoS ETH” or “ETH2” tokens. Your balance will remain exactly the same after the Merge, and you’ll be able to resume using the network as if nothing has changed.

While Ethereum users will not need to take any action come the Merge, Ethereum software providers and node operators (the computers that operate the Ethereum network) will need to update their software to ensure they are communicating with the latest version of the network.

What’s all this noise about PoW “forks”? Will I receive free money if I hold ETH?

Some Ethereum miners, reluctant to let go of the network’s old consensus mechanism, have announced plans to “fork,” or form a splinter network from Etheruem’s PoW chain. From what we can tell so far, these miners intend to just clone the main blockchain – balances and all – and continue operating their own PoW versions of Ethereum post-Merge.

If you hold ETH before the Merge, you may automatically receive a balance of tokens on these new PoW forks. The process of claiming these tokens will differ depending on the chain. If you hold ETH on a centralized exchange like Coinbase, the exchange will need to list forked tokens in order for you to claim your share (and it’s not at all clear if they will).

But buyers beware. Some forked ether tokens might have value immediately following the Merge, but leaders in the Ethereum community warn that PoW Ethereum forks will just be thinly-veiled cash grabs.

Read more: Ethereum Proof-of-Work Forks: Gift or Grift?

Can the Merge fail?

Yes, but it’s unlikely.

Ethereum’s transition from proof-of-work to proof-of-stake will mark the first experiment of its kind. If the Merge succeeds, it will represent a massive feat of engineering and human coordination. If it fails, it risks wiping out hundreds of billions of dollars in value (ether’s market cap is close to $200 billion, and many other valuable tokens are built on top of the network).

The Merge is only now moving forward because its core developers and other stakeholders have run through over a dozen successful tests and Merge simulations (see: shadow forks and testnet Merges). There’s still a chance that the Merge might fail, but such an outcome seems extremely unlikely.

Read more: Merge Testing on Ethereum: What Is It and Why Does It Matter?

Will the Ethereum network “pause” as a result of the Merge?

No.

The Merge will happen instantaneously after the final PoW block is mined. From that point forward, the network will continue to operate with the issuance of the first PoS block.

Ethereum users will not need to take any action to upgrade to the PoS chain.

What’s on the Ethereum roadmap after the Merge?

After the Merge, Ethereum’s core developers will continue working on the open-source network as they did before, with improvements to network fees, speeds and security slated for the months and years ahead.

One focus for developers post-Merge will be sharding, which aims to expand Ethereum’s transaction throughput and decrease its fees by spreading network activity across several “shards” – almost like lanes on a highway. (Updates of this sort were initially slated to accompany the Merge – originally called “Ethereum 2.0,” or “ETH2” – but were deprioritized with the success of third-party rollups at addressing some of the same problems).

Also on the roadmap is enshrined proposer builder separation (PBS), which will separate the “builders” that add transactions to blocks from the “proposers” who put them forward for approval from the wider network. PBS is pitched as a way to help tackle Ethereum’s maximal extractable value (MEV) problem.

Read more: Ethereum After the Merge: What Comes Next?

What happens to proof-of-work miners after the Merge?

After the Merge, Ethereum miners – many of whom have invested in fancy mining-optimized computers – will be unable to mine new blocks on the network. Many miners will abandon mining and “stake” ether to earn rewards on the PoS network.

For those who wish to put their mining hardware to continued use, they’ll need to move to another proof-of-work network, like Ethereum Classic.

After the Ethereum Merge, some miners also plan to create a “forked” version of the proof-of-work blockchain – basically, a clone of the blockchain that still runs using the old miner-friendly system. It is unclear whether these chains will gain enough traction to become lucrative for miners in the long term.

Pulse check

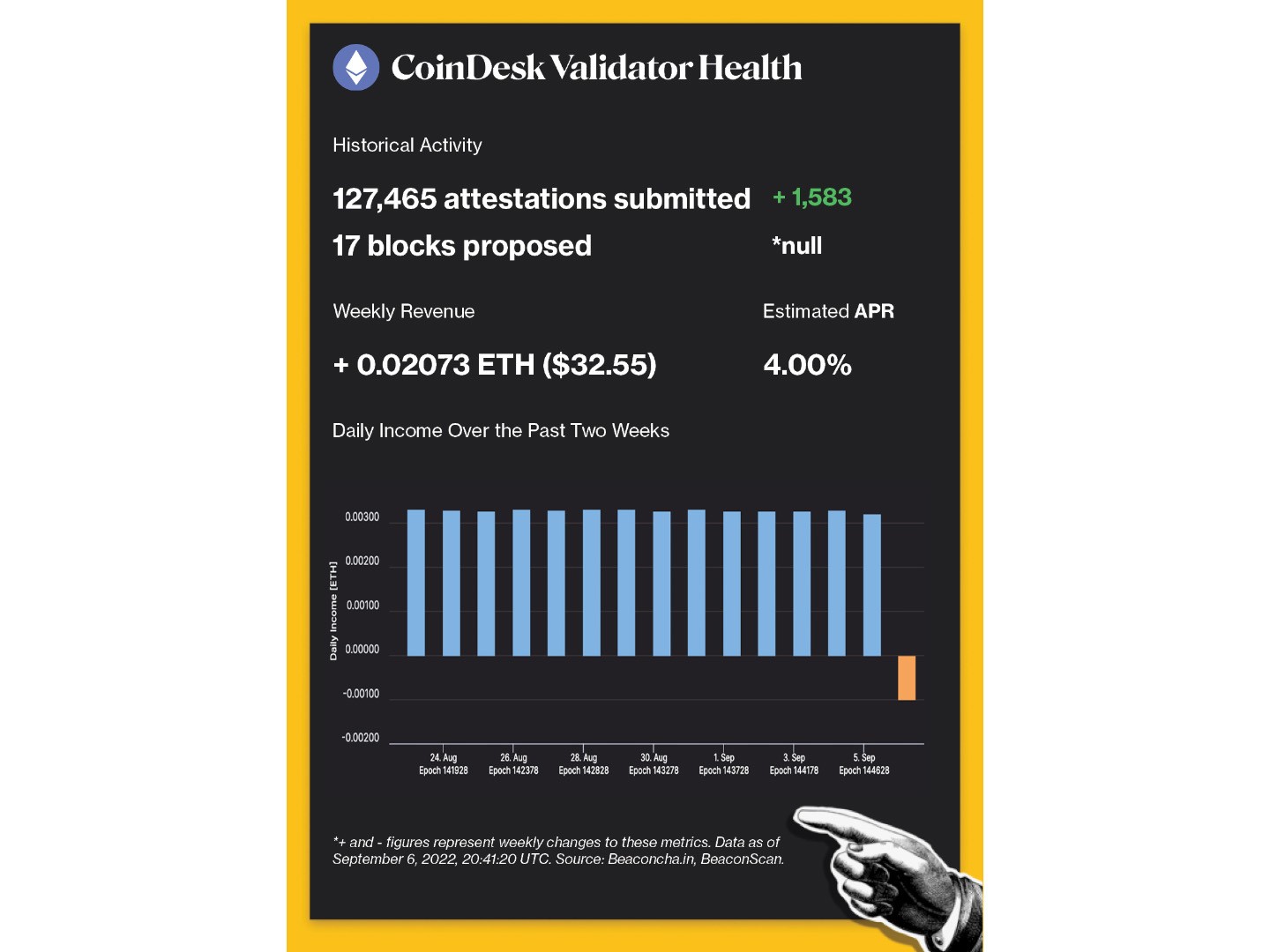

The following is an overview of network activity on the Ethereum Beacon Chain over the past week. For more information about the metrics featured in this section, check out our 101 explainer on Eth 2.0 metrics.

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking venture will be donated to a charity of the company’s choosing once transfers are enabled on the network.

Validated takes

Binance to stop supporting USDC.

- WHY IT MATTERS: Binance, the issuer of the third-biggest stablecoin and the world’s largest cryptocurrency exchange, both by volume, said it will convert all investments in USDC into its Binance USD (BUSD) token on Sept. 29. After the date, customers transferring their USDC to Binance will see the tokens be automatically converted into Binance’s stablecoin. However, customers will be able to withdraw money denominated in USDC. USDC’s $52 billion market value leads BUSD’s $19 billion. Read more here.

The Merge is officially underway.

- WHY IT MATTERS: Activated on Tuesday, the Bellatrix upgrade is the network’s final “hard fork” before the Merge. The activation of the Bellatrix upgrade on the Ethereum blockchain triggers the beginning of the Merge, which will likely be completed sometime around Sept. 13-16. It prepares Ethereum’s proof-of-stake Beacon Chain – also called its Consensus layer – for a Merge with Ethereum’s mainnet Execution layer. Read more here.

Aave stopped loaning ETH ahead of the Merge.

- WHY IT MATTERS: Between Aug. 30 and Sept. 2, the Aave community overwhelmingly voted to stop loaning ether, setting aside democratized finance’s free market principle to mitigate protocol-wide risks that may arise from crypto traders betting on the Merge, Ethereum blockchain’s upcoming technological overhaul. “Ahead of the Ethereum Merge, the Aave protocol faces the risk of high utilization in the ETH market. Temporarily pausing ETH borrowing will mitigate this risk of high utilization,” the proposal highlighted by research firm Block Analitica said. Read more here.

Factoid of the week

Factoid

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Siacoin

Siacoin  Ravencoin

Ravencoin  Holo

Holo  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Lisk

Lisk  Ontology

Ontology  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD