Ethereum non-zero addresses hit all-time high despite the price drop

Ethereum (ETH) is witnessing an uptick in adoption rate despite the latest market-wide slump. Its non-zero addresses recently hit an all-time high value amid a 7-day decline of 8.25% in the asset’s price.

The number of non-zero addresses holding ETH climbed to 100.82 million today, marking the highest value ever witnessed.

? #Ethereum $ETH Number of Non-Zero Addresses just reached an ATH of 100,815,131

View metric:https://t.co/beS1MtIgAZ pic.twitter.com/S0NWk9AQu4

— glassnode alerts (@glassnodealerts) June 12, 2023

Information from the Glassnode chart reveals a consistent upward trajectory in non-zero ETH addresses, with only a minor decline observed in late 2021. This sustained growth persisted through the market challenges experienced in 2022, especially the turmoil caused by the Terra and FTX implosions.

Consequently, non-zero addresses have recently surged to their highest value. This metric underscores the growing interest in ethereum and crypto assets, as more market participants enter the scene despite the occasional turbulence.

You might also like: Bitcoin wallets holding at least 1 BTC reach 1m mark

Non-zero ETH addresses are addresses holding a positive balance of ETH. In other words, they have a value of the asset greater than zero. This metric is often used to measure the level of activity and engagement within the Ethereum network, as it indicates the number of addresses currently holding some form of value.

An increase may indicate growing interest from individuals or businesses, more widespread token ownership, growing decentralized applications (dApps) and smart contract usage, or the accumulation of assets by long-term holders. All these factors contribute to the overall health and vitality of the Ethereum ecosystem.

As reported by crypto.news last week, the cumulative balance of the ten largest ethereum addresses recently hit an all-time high of 31.8 million ETH valued at $59.47 billion at the time of the report. This was due to an impressive accumulation campaign observed among these addresses, Santiment revealed.

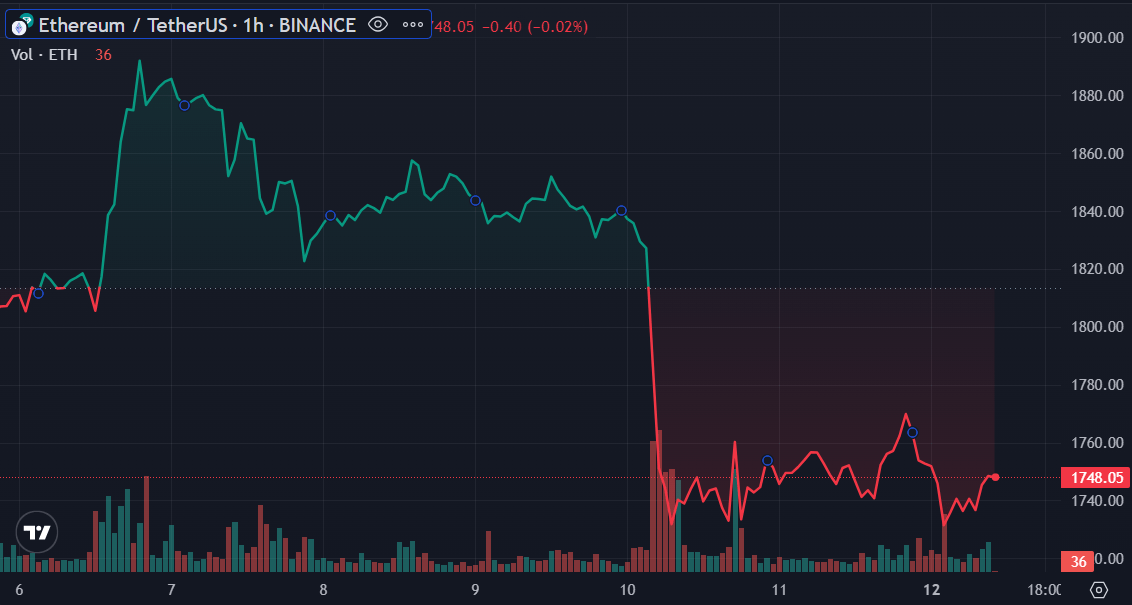

The increase in these metrics coincides with a period of decline for ETH, prompted by the downturn in the market. Notably, on June 10, ETH experienced a decrease of 4.83% following the SEC’s complaints against Binance and Coinbase. This decline represented the most significant intra-day loss for the asset in over a month.

ETH price – June 12 | Source: Trading View

ETH registered a meager 0.07% gain on June 11 to invalidate what would have been a 3-day losing streak. However, the asset started today on a bearish note. ETH is 0.59% down today, currently changing hands at $1,742 at the time of writing.

Read more: Top crypto exchanges see notable negative net flows, volumes down

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  EOS

EOS  KuCoin

KuCoin  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Nano

Nano  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur