Ethereum Price Takes a Fall With 4 Weeks Till the Merge, But Still Up 94% in 2 Months

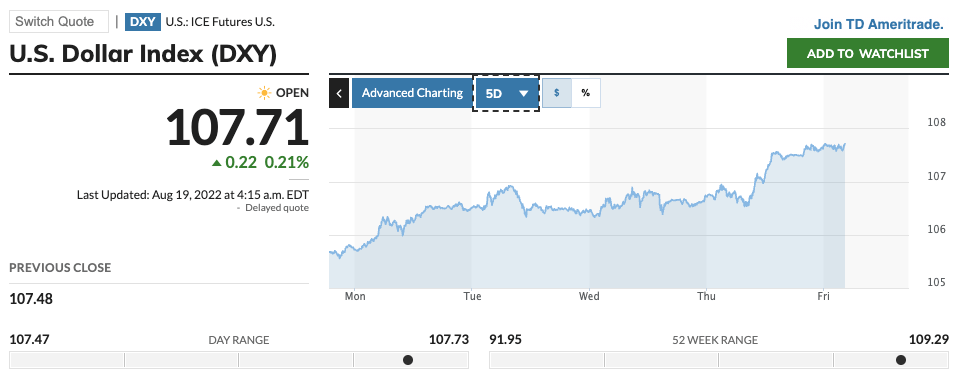

On Friday (August 19), the $ETH price is down around 6% — which is not that bad considering that $ADA, $SOL, $DOT, $MATIC, and $AVAX are suffering double-digit percentage losses — thanks to the current “risk-off” mood that has resulted in the U.S. Dollar Index (DXY) surging to nearly 108 this week.

Source: MarketWatch

This could mean trouble for #stocks and #crypto.

The $DXY just closed above 107.30, which means the next stop is most likely 108.70.$BTC $ETH pic.twitter.com/BwKnzgxokp

— Justin Bennett (@JustinBennettFX) August 18, 2022

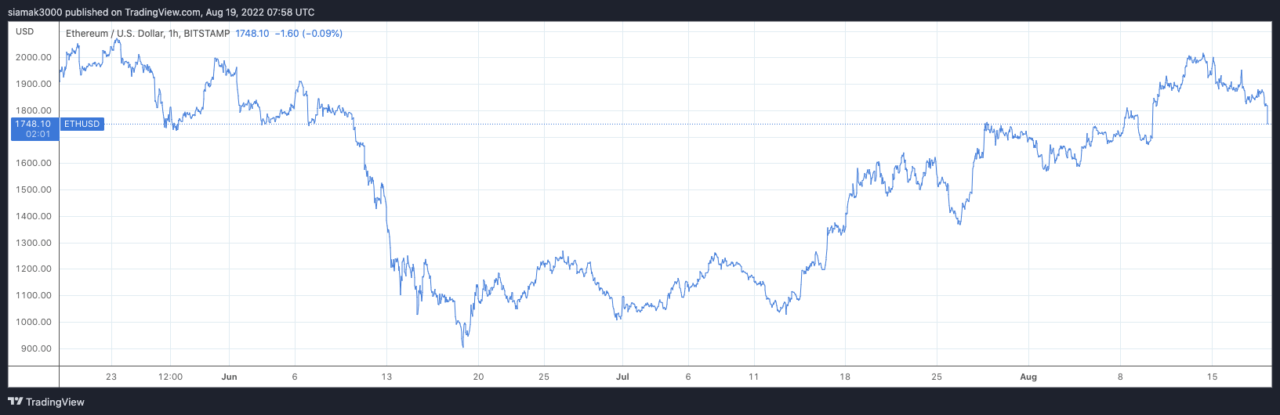

According to data by TradingView, on crypto exchange Bitstamp, ETH-USD is currently (as of 7:58 a.m. UTC on August 19) trading around $1,748.10, down 5.25% in the past 24-hour period, but up 93.72% since the intraday low on June 19.

Source: TradingView (3-Month ETH-USD Price Chart)

Ethereum’s upcoming “Merge” protocol upgrade — expected to take place around September 15/16 — is when the Ethereum network is making the transition from proof-of-work (PoW) to proof-of-stake (PoS).

Here is how Ethereum Foundation explains the Merge, which is expected to take place around September 15:

“The Merge represents the joining of the existing execution layer of Ethereum (the Mainnet we use today) with its new proof-of-stake consensus layer, the Beacon Chain. It eliminates the need for energy-intensive mining and instead secures the network using staked ETH. A truly exciting step in realizing the Ethereum vision – more scalability, security, and sustainability.

“It’s important to remember that initially, the Beacon Chain shipped separately from Mainnet. Ethereum Mainnet – with all it’s accounts, balances, smart contracts, and blockchain state – continues to be secured by proof-of-work, even while the Beacon Chain runs in parallel using proof-of-stake. The approaching Merge is when these two systems finally come together, and proof-of-work is replaced permanently by proof-of-stake.

“Let’s consider an analogy. Imagine Ethereum is a spaceship that isn’t quite ready for an interstellar voyage. With the Beacon Chain, the community has built a new engine and a hardened hull. After significant testing, it’s almost time to hot-swap the new engine for the old mid-flight. This will merge the new, more efficient engine into the existing ship, ready to put in some serious lightyears and take on the universe.“

Australian crypto investor and analyst Miles Deutscher, who recently joined “Crypto Banter” to host a daily DeFi show, explained earlier today why the Merge may not be fully priced in:

Seeing a large portion of CT fading the $ETH merge gives me hope that maybe it isn’t fully priced in..

— Miles Deutscher (@milesdeutscher) August 19, 2022

And crypto analyst Ali Martinez offered today this technical analysis of Etheruem’s latets price action:

#Ethereum appears to have broken out of a rising wedge. The technical formation forecasts that $ETH could enter a 28% correction toward $1,300. #ETH pic.twitter.com/rcwbW3xyuo

— Ali Martinez (@ali_charts) August 19, 2022

Data shows that 675,500 addresses had previously bought 8.91 million $ETH between $1,700 & $1,750.#Ethereum must hold above this demand zone to have a chance of recovering. Otherwise, these addresses could try to break even in their positions, triggering a correction to $1,300. pic.twitter.com/aGIHbb4LcM

— Ali Martinez (@ali_charts) August 19, 2022

Image Credit

Featured Image via Unsplash

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Holo

Holo  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  HUSD

HUSD  Energi

Energi