Ethereum Selling Pressure To Be Lower Than Feared After Shanghai Upgrade, Says CryptoQuant – Here’s Why

On-chain analytics platform CryptoQuant is optimistic that Ethereum (ETH) will not come under severe selling pressure as feared following the Shanghai upgrade scheduled for next week.

CryptoQuant says that the Shanghai upgrade, which is expected to allow the unstaking of Ethereum on April 12th, is unlikely to trigger above-normal selling pressure.

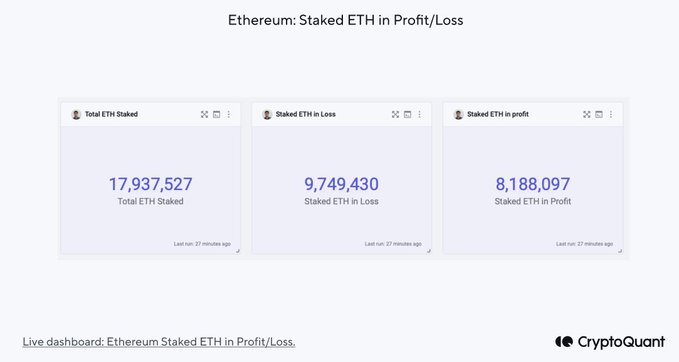

According to CryptoQuant, the selling pressure is likely to be lower than feared due to the fact that most of the staked Ethereum is below the price it was bought at.

“There is an ongoing fear that the activation of withdrawals on April 12th with the Shanghai upgrade would bring more than usual selling pressure.

However, our profit and loss analysis shows otherwise.

With the current ETH prices, more than half of the staked ETH (9.7 million out of 17.9 million) is currently at a loss.

For the sole reason that the significant staked ETH is currently at a loss, we believe that the selling pressure will be lower than expected.”

Source: CryptoQuant/Twitter

CryptoQuant further says that a significant number of the Ethereum staked by the liquid staking solution Lido is also in the red.

“Also, it is worth noting that a significant portion of the deposits made by the Lido pool is currently underwater.”

Source: CryptoQuant/Twitter

According to Binance Research, there are over 16.5 million staked Ethereum, which is approximately 14% of the total supply.

Ethereum is trading at $1,867 at time of writing.

Generated Image: Midjourney

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Siacoin

Siacoin  Holo

Holo  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Augur

Augur  Energi

Energi