Ethereum Slips Below $1,300 as Bears Dominate Market Momentum (ETH Price Analysis)

Ethereum is not out of the woods despite closing last week’s candle in green. The mid-term uptrend is threatened by increasingly high selling pressure.

Technical Analysis

By Grizzly

The Daily Chart

The daily chart remains bearish. The diagonal support (in green) has so far kept the price from falling further but is now in danger of being broken.

Additionally, the 61.8% Fiib level (in yellow) is near this level of support. If the pair closes below $1,210 in a ETH could find itself in a dangerous situation where the selling pressure could increase and lead to a steeper decline. A move like this could result in a flood of stop losses, leading the price to potentially fall as low as $1,000 (in white).

Alternatively, the bearish sentiment will likely start getting invalidated if ETH can increase above $1,400 (in red). As lengthy upper wicks emerge on the chart, this level is strongly defended by sellers.

Key Support Levels: $1210 & $1000

Key Resistance Levels: $1400 & $1550

Daily Moving Averages:

MA20: $1322

MA50: $1462

MA100: $1506

MA200: $1879

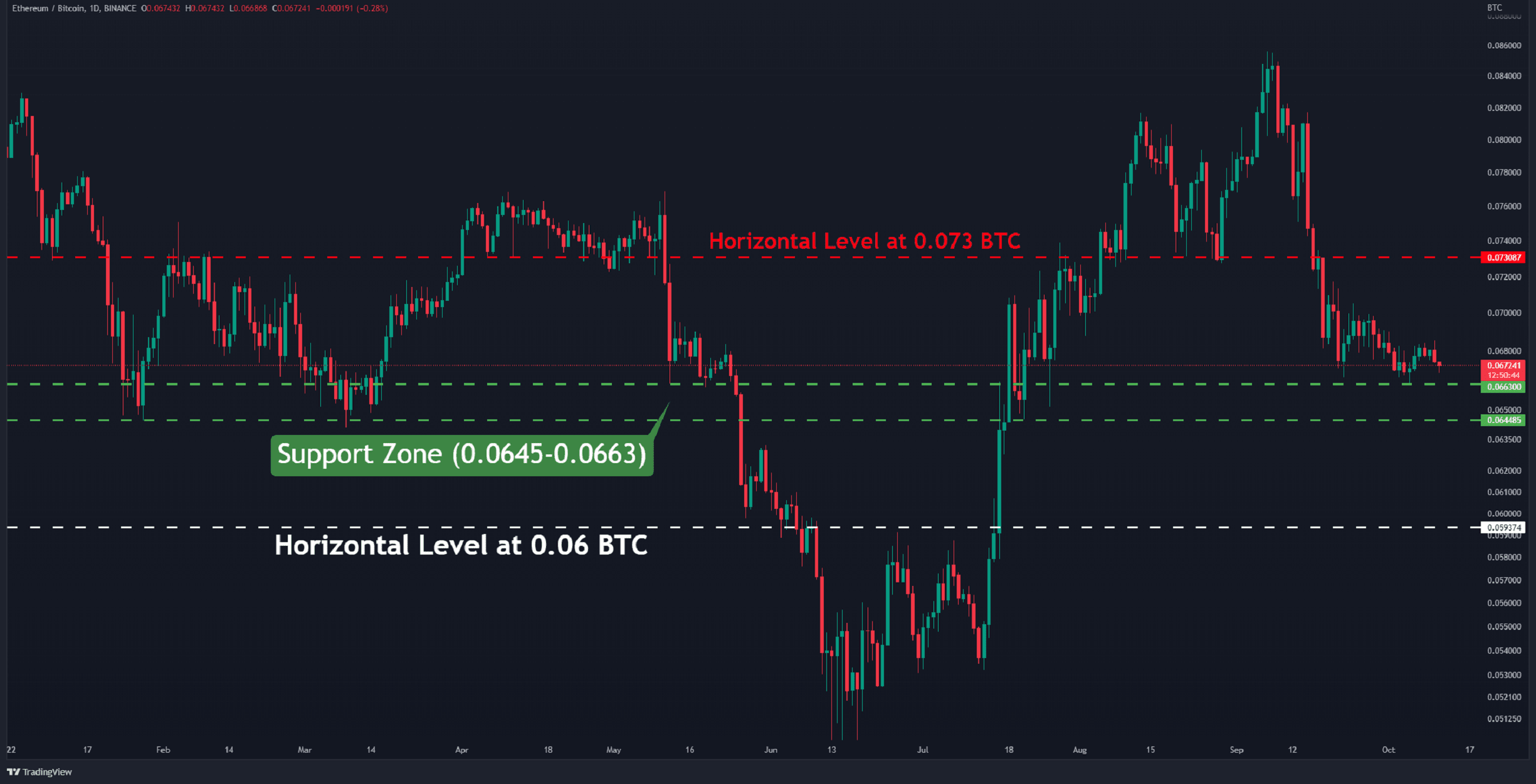

The ETH/BTC Chart

Against Bitcoin, the cryptocurrency is trading above the support zone between 0.0645 and 0.0663 BTC (in green). A break and close below it would pave the way for another leg down towards 0.06 BTC (in white).

This chart’s structure is entirely bearish, and there is no hint of a trend reversal. It appears there is no hope of a substantial upward rise as long as the price remains below the barrier of 0.073 BTC (in red).

Key Support Levels: 0.0645 & 0.06 BTC

Key Resistance Levels: 0.073 & 0.08 BTC

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Siacoin

Siacoin  Holo

Holo  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD