Fidelity’s Timmer: Bitcoin Rally Got Overheated

Jurrien Timmer, Fidelity’s director of global macro, recently commented on the state of Bitcoin, comparing its current market dynamics to those of gold.

Timmer suggests that Bitcoin is now marching to the same rhythm as gold but warns that the leading cryptocurrency may have gotten a bit ahead of itself, hinting at potential overvaluation at the $30,000 mark.

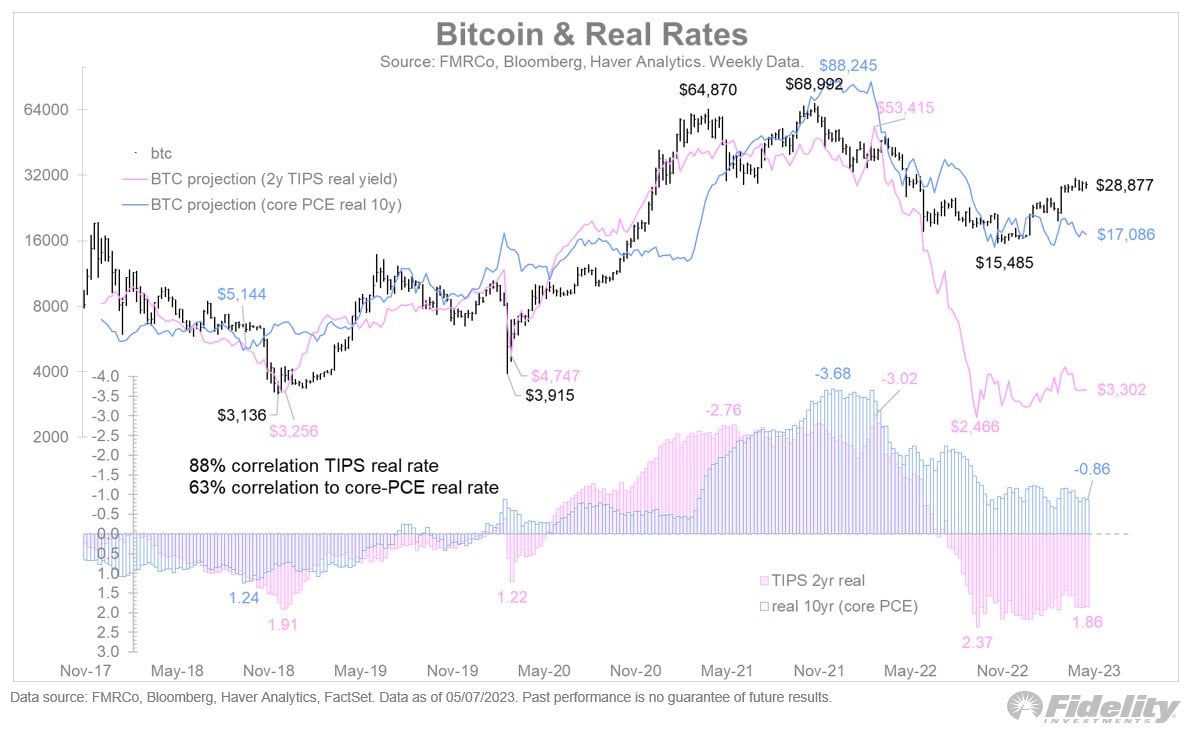

In his analysis, Timmer has highlighted an 88% inverse correlation between Bitcoin and the two-year real TIPS yield, and a 63% inverse correlation to the PCE-derived real rate. This correlation analysis, based on data since 2018, puts Bitcoin in a similar position to gold in terms of its reaction to real rate drivers.

In layman’s terms, what Timmer is suggesting here is that Bitcoin’s price tends to move in the opposite direction of these two economic indicators. If the returns on certain government bonds go up, or if inflation rises, we can expect the price of Bitcoin to generally go down, and vice versa. It is important to note, though, that these are just tendencies; they do not happen every time, and other factors can also influence Bitcoin’s price.

Timmer has also pointed out a key difference in the regression models for gold and Bitcoin. Gold follows a linear regression, while Bitcoin’s is exponential. Timmer interprets this as a sign of Bitcoin’s role as a «high-powered inflation hedge.» This powerful hedge potential, coupled with its growing popularity among investors, has positioned Bitcoin as a highly aspirational asset.

The executive’s insights shine a spotlight on Bitcoin’s strong correlation with gold, but his caution about Bitcoin’s potential overvaluation emphasizes the need for investor prudence.

The Bitcoin price has dropped to its lowest since March 17, with an over 12% decrease since May 6, decoupling from traditional risk assets like the Nasdaq.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  NEM

NEM  Decred

Decred  Zcash

Zcash  Dash

Dash  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  HUSD

HUSD  Augur

Augur