Following Bitcoin’s Latest Correction, This is the Crucial Level it Must Hold (Price Analysis)

Bitcoin’s price has been struggling to break above a significant resistance level and is currently experiencing a pullback, following the recent red days on Wall Street. Is it just a short-term correction or a beginning of a new bearish leg?

Technical Analysis

By: Edris

The Daily Chart

On the daily timeframe, the price dropped shortly after getting rejected from the critical $25K level. The 50-day moving average around the $22K level would be the first likely support level, followed by the 200-day moving average around the $20K psychological support area.

If these dynamic support levels fail to hold, a further drop toward the $18K level would be imminent. However, if the price rebounds from either of these levels, another retest and potential breakout above the $25K resistance zone would be highly probable.

The RSI indicator, which has signaled the recent rejection with a clear bearish divergence, is trending around the 50% threshold, indicating the momentum equilibrium on the daily timeframe.

The 4-Hour Chart

Analyzing the 4-hour chart, the price has declined after multiple rejections from the $25K area and is heading toward the $22,500 support level. A breakdown of this level would potentially lead to a deeper decline toward the $20K and even the $18K level in the coming weeks.

On the other hand, the RSI is getting close to the oversold zone in this timeframe, which could result in a temp rebound from the $22,500 level, which might lead to a break above the $25K level.

A breakout above the $25K level would be followed by more bullish price action in the coming weeks, and the bear market could finally be considered over from a technical standpoint.

On-Chain Analysis

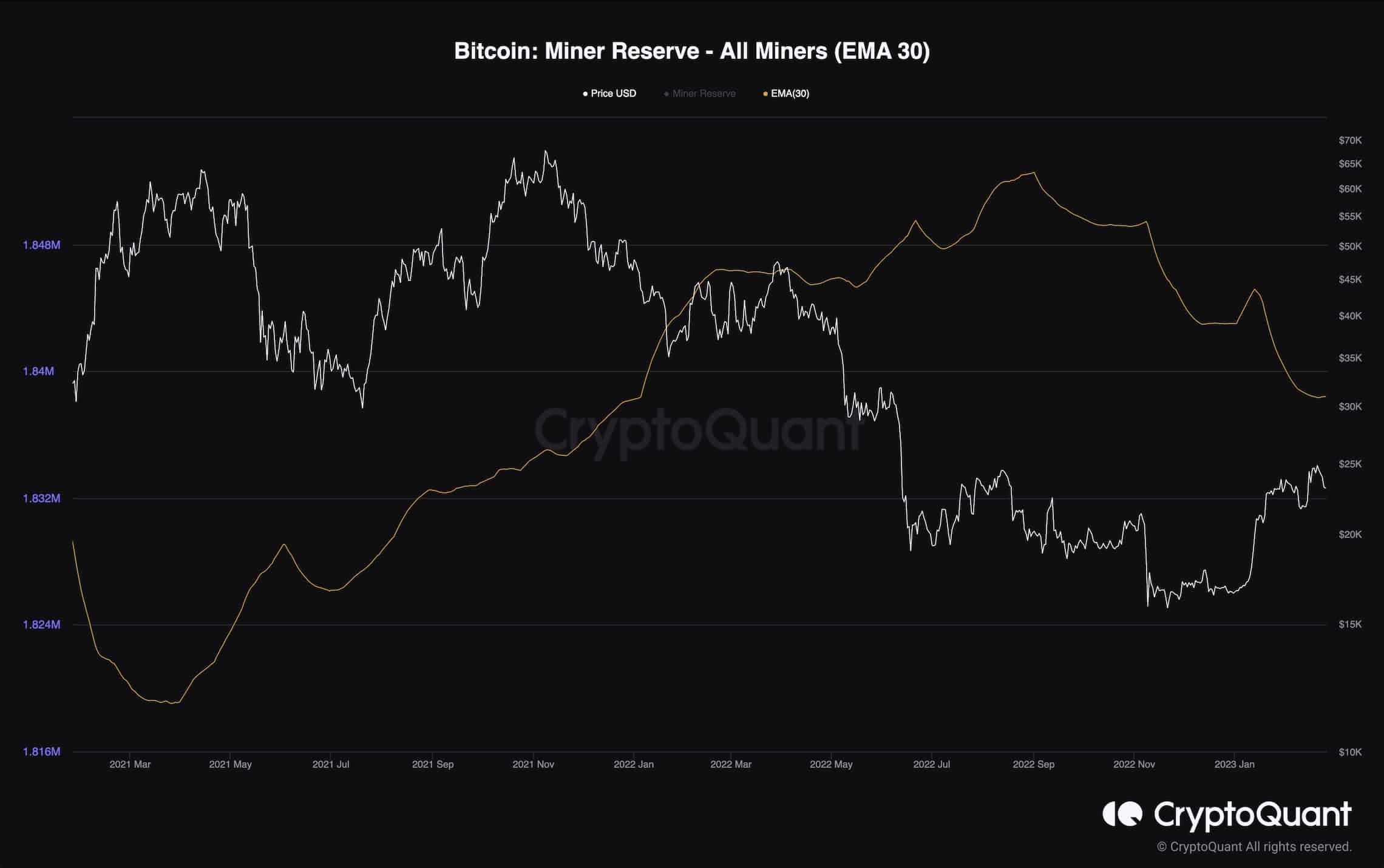

Bitcoin Miner Reserve

Bitcoin’s price has risen lately, and the market sentiment is becoming more positive. However, the miners, a key cohort in the bitcoin market, have yet to show any bullish behavior.

The following chart demonstrates the miner reserve metric, which measures the amount of BTC in miners’ wallets. This metric has been declining over the last few months. Some miners are finally capitulating, and others are selling their BTC to provide liquidity and cover operational costs.

If this trend continues, the selling pressure could overflow the market with excess supply and lead to another price decline.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Enjin Coin

Enjin Coin  Holo

Holo  Siacoin

Siacoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur