FTX exploiter triggers weekend crash, here’s what to expect from Bitcoin price

- FTX exploiter has made bold moves over the weekend, triggering a market sell-off.

- If Bitcoin (BTC) price can bounce off the $15,550 support level it could trigger an 18% upswing to $18,784.

- Invalidation of this outlook will occur on a daily candlestick close below $15,550.

Bitcoin price experienced a sell-off over the weekend as the hackers who stole roughly $600 million from the now-defunct FTX exchange decided to offload their holdings. While BTC crashed due to illiquid market conditions on the weekend, there are chances for a recovery bounce to occur.

FTX exploiter and clever plans

FTX exploiter has been extremely active over the last 48 hours after siphoning nearly $600 million worth of crypto from the bankrupt exchange FTX on November 12. The hacker seems to be leveraging crypto bridges and decentralized pools to clean the exploited funds.

Peckshiled alerts show that 1,990 $ETH worth $2.40 million were swapped for 140.03 renBTC worth $2.32 million. This move caused a lot of panic over the weekend, triggering a 10% crash in ETH so far.

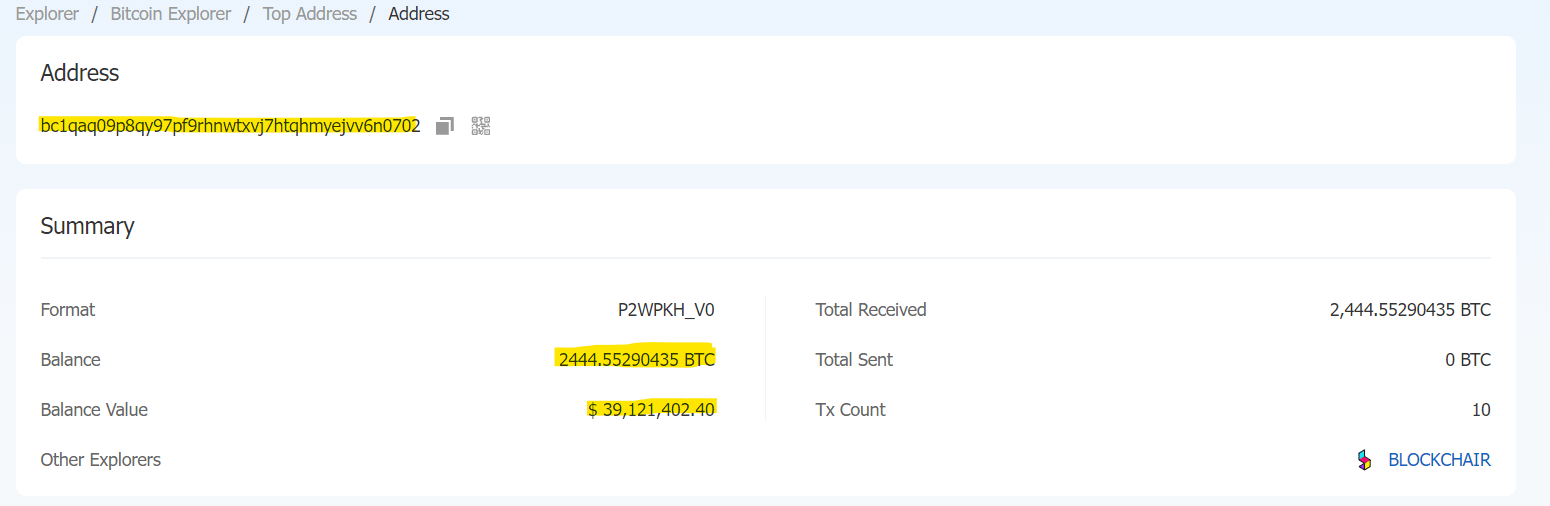

From a trading perspective, the exploiter could use the panic to their advantage by opening short positions before swapping ETH for BTC. The hacker currently holds roughly 2444.55 BTC worth nearly $40 million.

The stolen funds could be swapped for different assets so that the exploiter can capture maximum price movement, aka profits. However, doing this on the weekdays is unlikely to help the hacker’s case as there is massive liquidity.

Therefore, traders need to be extra careful over the weekends and watch out for another sell-off.

FTX exploiter holdings

Bitcoin price unchanged from big picture perspective

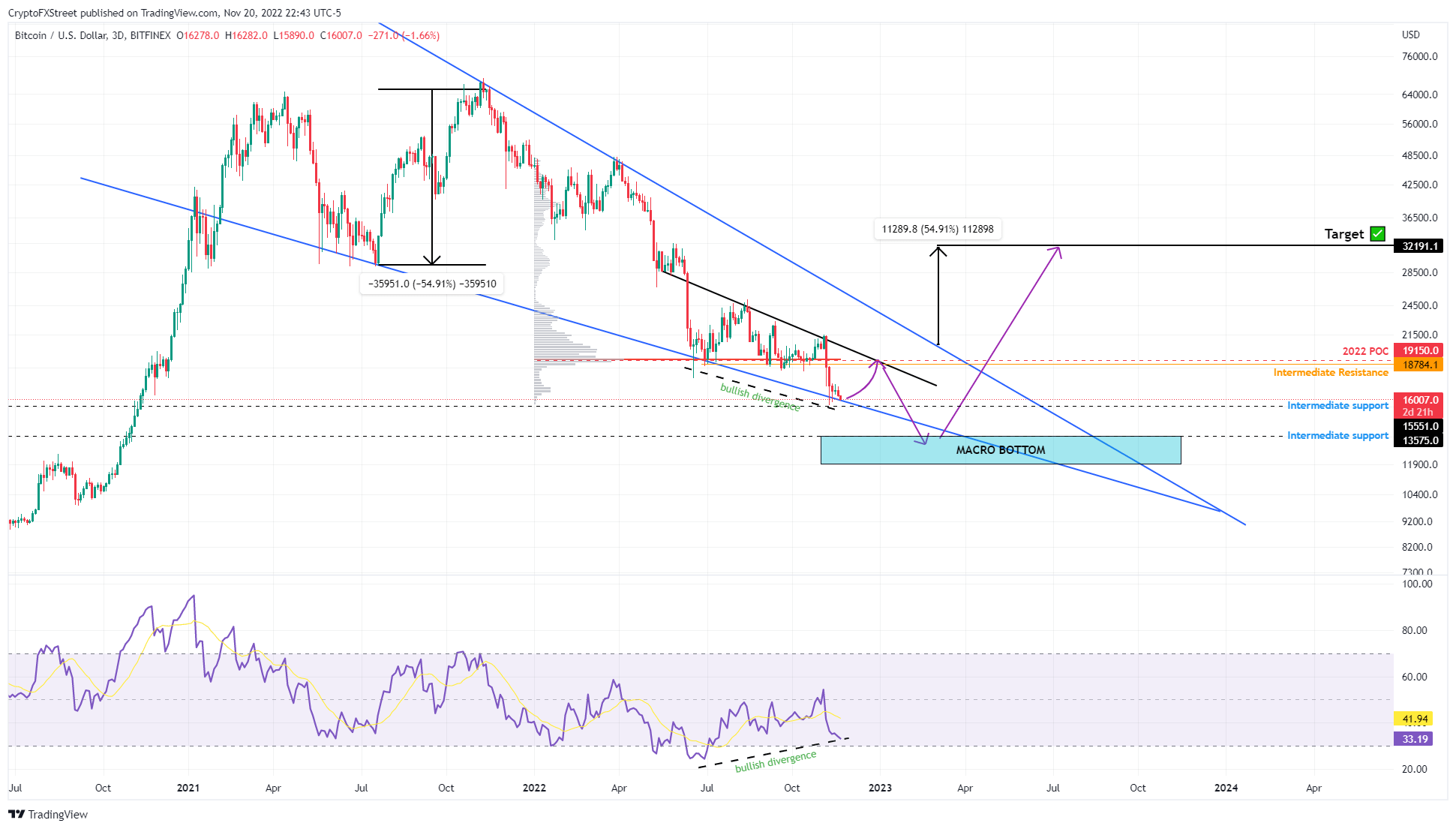

Bitcoin price is tagging the lower limit of the falling wedge pattern reported on November 18. Since the $15,550 support level coincides with the setup, a bounce could be a likely scenario, especially if the hacker does not make big moves.

The plan for BTC, as discussed in the previous weekly report, has not changed. The bullish divergence is still in play and could trigger an 18% upswing to $18,784. Due to the presence of the highest traded level of 2022 at $19,150, the Bitcoin price rally could be capped here.

Only a flip above these hurdles, followed by a decisive three-day candlestick above $20,560, will indicate a breakout from the falling wedge. Since this technical formation forecasts a 55% upswing, investors need to prepare for a long-term play in which Bitcoin price could slowly but steadily move to $32,191.

Investors should note that this 55% rally in Bitcoin price is a long-shot based on massive ‘ifs’ and should be taken with a grain of salt.

BTC/USDT 1-day chart

While the outlook for Bitcoin price tries to remain optimistic, the FTX exploiter’s actions could render the technicals moot. A flip of the $15,550 support level into a resistance, preferably on a three-day or a weekly chart, will invalidate the bullish outlook.

In such a case, the chances of Bitcoin price visiting the macro bottom, extending from $13,575 to $11,898 are high.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  NEM

NEM  Decred

Decred  Zcash

Zcash  Dash

Dash  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur