FTX’s dollar spot index perpetual future hasn’t quite taken off

Daily volumes in trading of FTX’s Dollar Spot Index have declined following a period of volatility in foreign exchange markets.

The new perpetual contract is based on the so-called FTX Dollar Spot Index and went live on October 3. It tracks the performance of a basket of leading global currencies against the U.S. dollar, including the euro, Japanese yen, Canadian dollar, and British pound.

Trading in the index came in just above $1 million on its first day of trading, raising to $1.25 million on day two before trending downwards, according to The Block’s Data Dashboard.

Trading volumes were as low as $52,600 on Saturday before recovering somewhat to just over $122,000 on Sunday. Volumes tripled on Monday to a little over $368,000, while open interest — the value of all outstanding contracts — is $777,000.

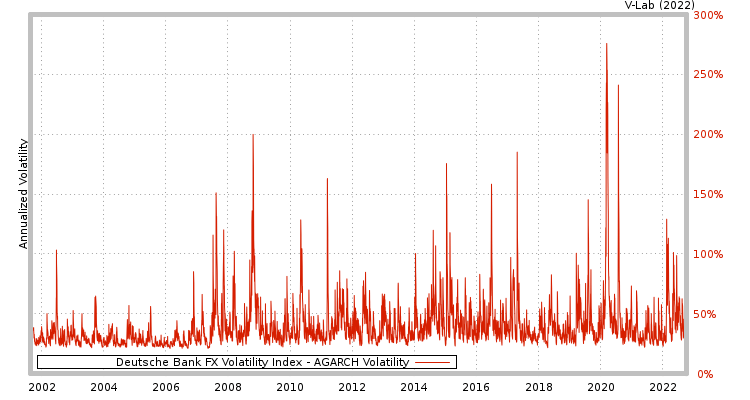

The lack of volume could be linked to waning volatility in foreign exchange markets, according to the Deutsche Bank FX Volatility index.

The launch came amid a sustained period of volatility in foreign exchange markets. Both the British pound and the Chinese yuan fell to record lows versus the U.S. dollar in the same week.

The pound has largely recovered since, although JPMorgan analysts say the damage done by the Treasury’s budget could permanently scar U.K. bonds, known as gilts.

This, coupled with Thursday’s inflation data out of the U.S, may be cause for further volatility in FX markets as equities and cryptocurrencies have been pummeled by recent data releases.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Siacoin

Siacoin  Holo

Holo  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  HUSD

HUSD  Energi

Energi