How likely is Bitcoin price to return to $19,000 before FOMC minutes?

- Bitcoin price shows a recovery above intermediate support at $16,624.

- A resurgence of buying pressure at this barrier could trigger a quick run-up to $17,000 and higher.

- Invalidation of the bullish thesis will occur with a four-hour candlestick close below $16,211.

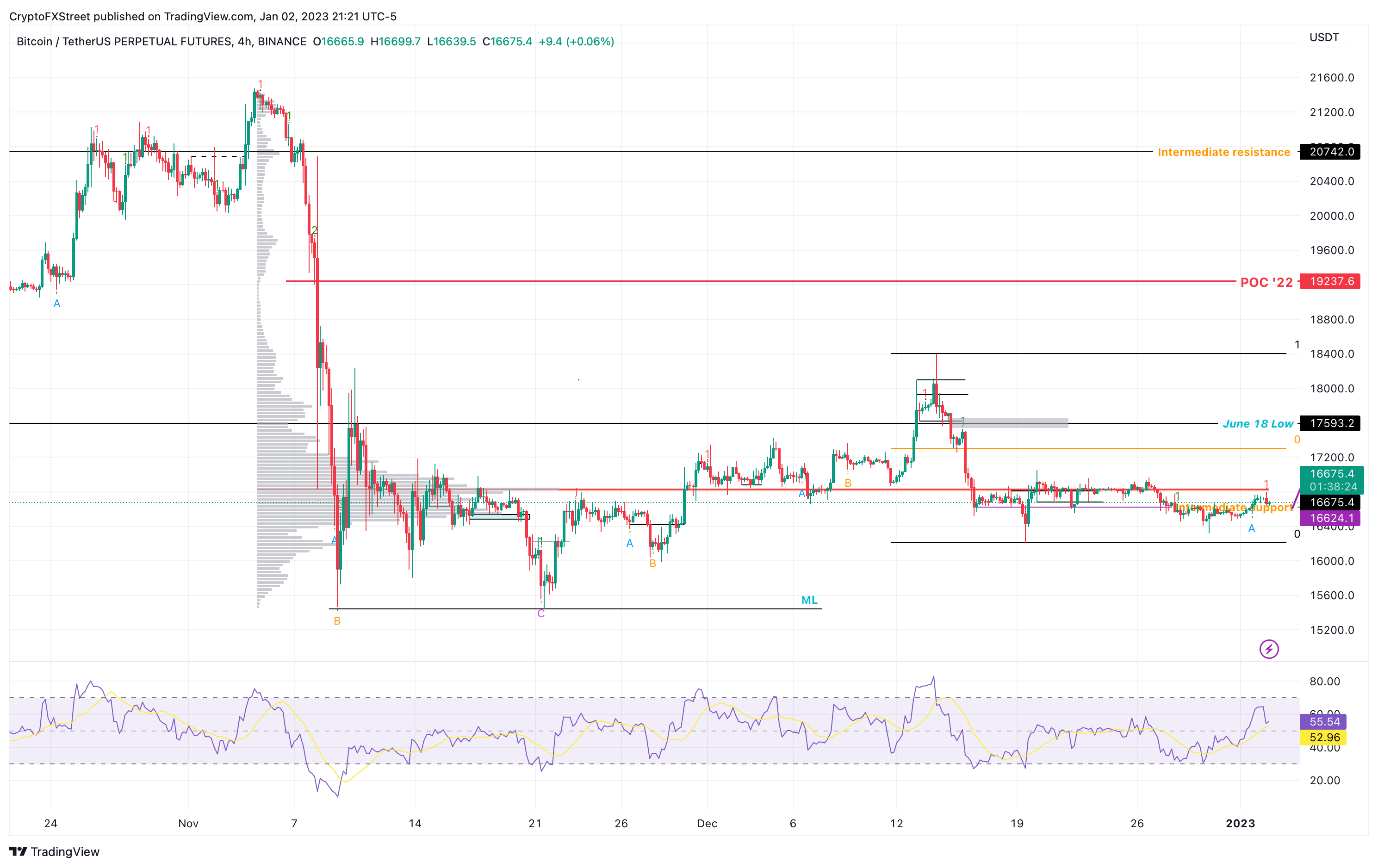

Bitcoin price shows a clear exhaustion of bullish trend after recovering above a stable support level. This move is likely setting up the stage for a rally for BTC bulls after a quiet end to 2022. While the big crypto could take a while to trigger this move, the Federal Open Market Committee’s (FOMC) December readout, set to be released on January 5, could serve as a tailwind to the bullish outlook.

Bitcoin price ready to make noise in 2023

Bitcoin price sawrecovery above the intermediate support level at $16,624 after a 3% climb over the last three days. This slow but steady move has now flipped the aforementioned level into a support floor. In doing so, the Relative Strength Index (RSI) has also recovered above the midpoint at 50, suggesting a resurgence of bullish momentum.

A retest of the RSI’s midpoint followed by a bounce will indicate that BTC bulls are defending this level and could hint at a rally for Bitcoin price. Therefore, investors need to consider a retest of $16,624 as a level to accumulate.

The confirmation of the bullish move will arrive after BTC flips the Point of Control (POC) at $16,800. This level is the highest traded volume level since November 5. Hence, flipping this hurdle will confirm the presence of willing buyers and could result in Bitcoin price triggering a move to $17,306, which is the midpoint of the mid-December’s 11% crash.

Beyond the midpoint, Bitcoin price could aim to retest the range high at the $18,401 hurdle. In a highly bullish case, BTC could reach for the 2022 POC at $19,237. This move would indicate a 15% upswing for the big crypto and its holders from the $16,624 support level.

BTC/USDT 4-hour chart

Supporting this move to not just $17,306 but $19,237 is IntoTheBlock’s Global In/Out of the Money (GIOM) model, which shows no resistance level up to $19,132. Here, roughly 6.45 million addresses that purchased nealy 3.3 million BTC are “Out of the Money.” Therefore, a move into this cluster of underwater investors could trigger a sell-off from investors looking to break even.

Hence, a local top could form roughly around $19,000.

BTC GIOM

On the other hand, the upside scenario for Bitcoin price will be invalidated if BTC flips the range low at $16,211 into a resistance level on the four-hour timeframe. While manipulation could trigger a quick selloff below the aforementioned level, investors need to wait for confirmation to close their long position, which will arrive if BTC produces a lower low below $16,211.

In such a case, Bitcoin price could eye the liquidity below the November 28 swing low at $15,970, and even the equal lows formed at $15,443.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Siacoin

Siacoin  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Qtum

Qtum  Zcash

Zcash  Basic Attention

Basic Attention  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Hive

Hive  Status

Status  Nano

Nano  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD