How The USDC Depeg Will Impact DeFi, Expert Explains

Following the closure of Silicon Valley Bank (SVB), the value of the world’s fifth-largest cryptocurrency, USD Coin (USDC), plummeted to an all-time low on Saturday. The U.S.-based company behind the coin, Circle, revealed that $3.3 billion of the $40 billion in USDC reserves backing it was held at the financial institution.

These events and the subsequent collapse of the bank affected decentralized finance (DeFi) protocols and the subtle equilibrium between its moving parts. The depeg of the USDC stablecoin has caused a massive chain reaction, causing turmoil for crypto projects and investors.

According to expert DeFi Ignas, the USDC depegging shocked the foundation of decentralized peer-to-peer financial services.

How The Depeg Of Circle’s USDC Affected The Industry?

After the banking crisis and widespread panic, DeFi protocol MakerDAO issued an emergency proposal on March 11. Therein, the community called for restrictions on minting DAI using USDC to prevent panic selling by investors. In this sector, the number of withdrawals increased after the incident with USDC.

From a customer perspective, the capital held on USDC as a stablecoin couldn’t be converted to another token or redeemed for fiat currency, waiting for Circle news or USDC to re-peg to the US dollar.

On Friday, other protocols and projects revealed their exposure to Circle’s Silicon Valley Bank reserves, including failed crypto-lender BlockFi, Avalanche, Yuga labs, Proof, and Paxos.

DeFi Ignas says DeFi is built on USDC liquidity, considered the safest collateral. However, for the researcher, if the reserves are held in cash in traditional financial institutions, trust in USDC ultimately relies on trust in traditional finances (TradFi), the banking system, and the government.

For the expert, DeFi is a “failure” because it relies on centralized stablecoins, web2 infrastructures, and traditional on-ramping payment processes, giving the government the power to decide to shut down most components of DeFi at any time if it chooses to do so.

On-Chain Finance Instead Of DeFi

Decentralized finance platforms don’t require third parties to process transactions; all activity is conducted between users peer-to-peer or between users and the platform. However, if a link of DeFi is based on TradFi, it compromises the entire protocol, according to the expert.

Rebranding DeFi as On-chain Finance allows it to retain “key” DeFi benefits. For example, securing the self-custody wallets as a store for “private keys,” boosts its liquidity, leading to a larger buy-side market.

Another benefit that a rebranding of DeFi could lead to is increased “composability,” which allows a chain of decentralized applications to be connected in tandem, increasing efficiency as assets can be used within multiple applications simultaneously, with zero friction costs and no permissions required.

One protocol moving in the direction of on-chain finance highlighted by DeFi Ignas is FRAX. The vision of the FRAX protocol is to provide highly scalable, decentralized, and algorithmic money in place of fixed-supply digital assets like Bitcoin.

According to DeFi Ignas, Frax aims to get as close to the Federal Reserve (Fed) as possible, thereby removing the risk of USDC and failing banks like Silicon Valley Bank or Signature Bank. He added:

Overall, the USDC crash is embarrassing to DeFi as the risk stemmed from a TradFi bank. It’s now clear to everyone that DeFi is more decentralized than we pretended it to be. So, rebranding it to on-chain finance would equalize the current reality of what DeFi really is.

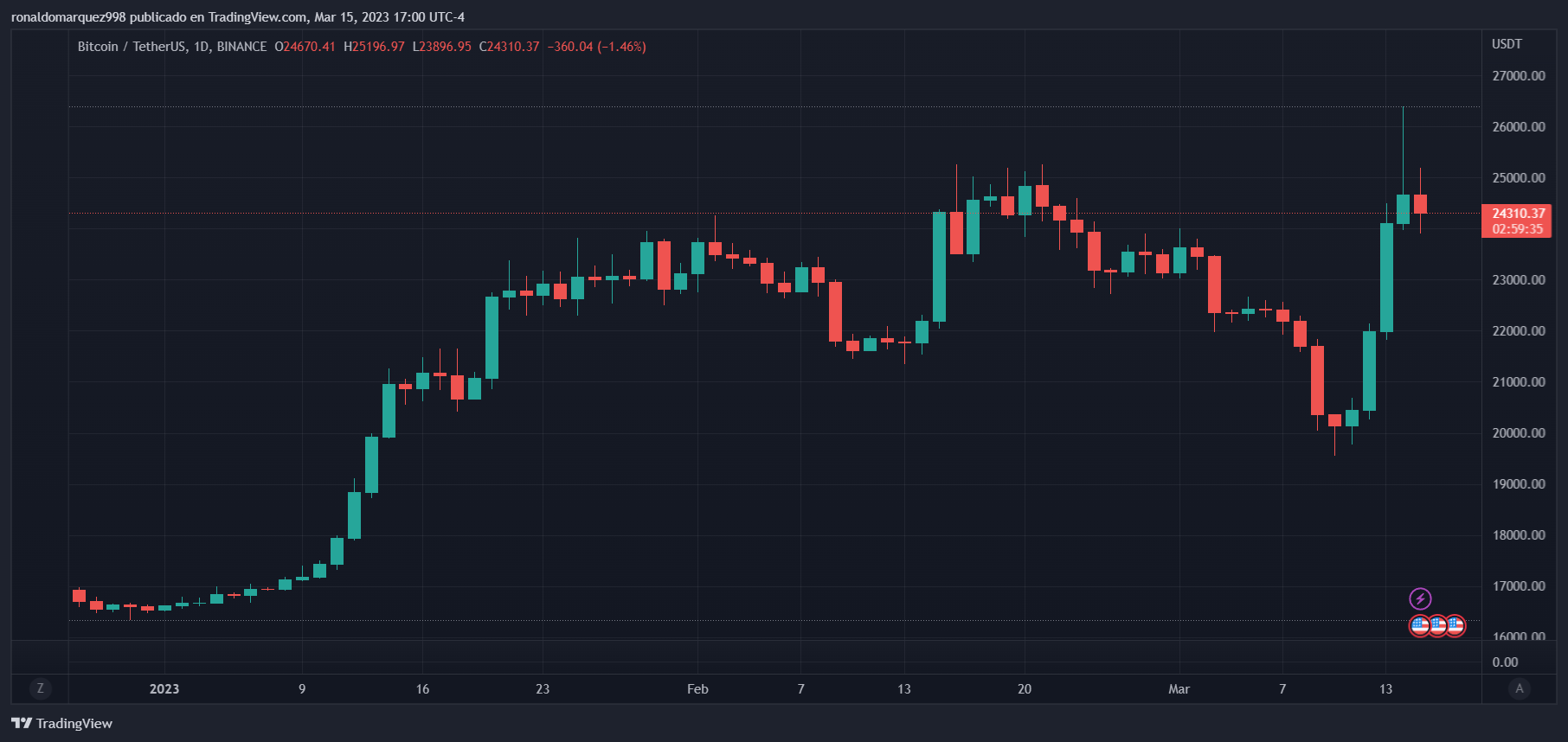

USDC has regained its 1:1 peg with the dollar, but the recent drop below $0.87 has shaken investor confidence. In the DeFi sector, the consequences will continue to ripple in the coming months as users’ confidence remains shaken.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Siacoin

Siacoin  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Hive

Hive  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  HUSD

HUSD