Institutional Investor Sentiment Remains Negative As Bitcoin Outflows Continue

Institutional investor sentiment has been on the rocks for some time now. This follows the market trend with bitcoin falling below $22,000 and the total crypto market cap finally making its way below $1 trillion once more. With this, institutional investors continue to show a more bearish attitude toward the market. The numbers for last week are in, and the outflows from various digital assets show that big money is not betting on bitcoin.

Institutional Investors Exit Bitcoin

The exit from bitcoin by institutional investors has been a couple of weeks in the making now. The last two prior weeks had seen these investors pulling their money out of the digital asset. Now, these volumes were not the largest ever seen by any margin, but they paint a grim picture for institution investing going forward.

For the third week in a row, bitcoin had recorded outflows in the market. Most of the bearish sentiment from investors had fallen on the digital asset, and it recorded another week of outflows with a total of $15 million. It is $6 million lower than outflows recorded for the prior week.

The bullish trend has also spread to short bitcoin over this time. Where the short bitcoin had seen inflows of a total of $2.6 million for the prior week, it only saw inflows of $0.2 million. So not only does this show that institutional investors are pulling out of long positions, they continue to reduce short exposure too. This could indicate that they expect the market prices to remain muted for a while after this.

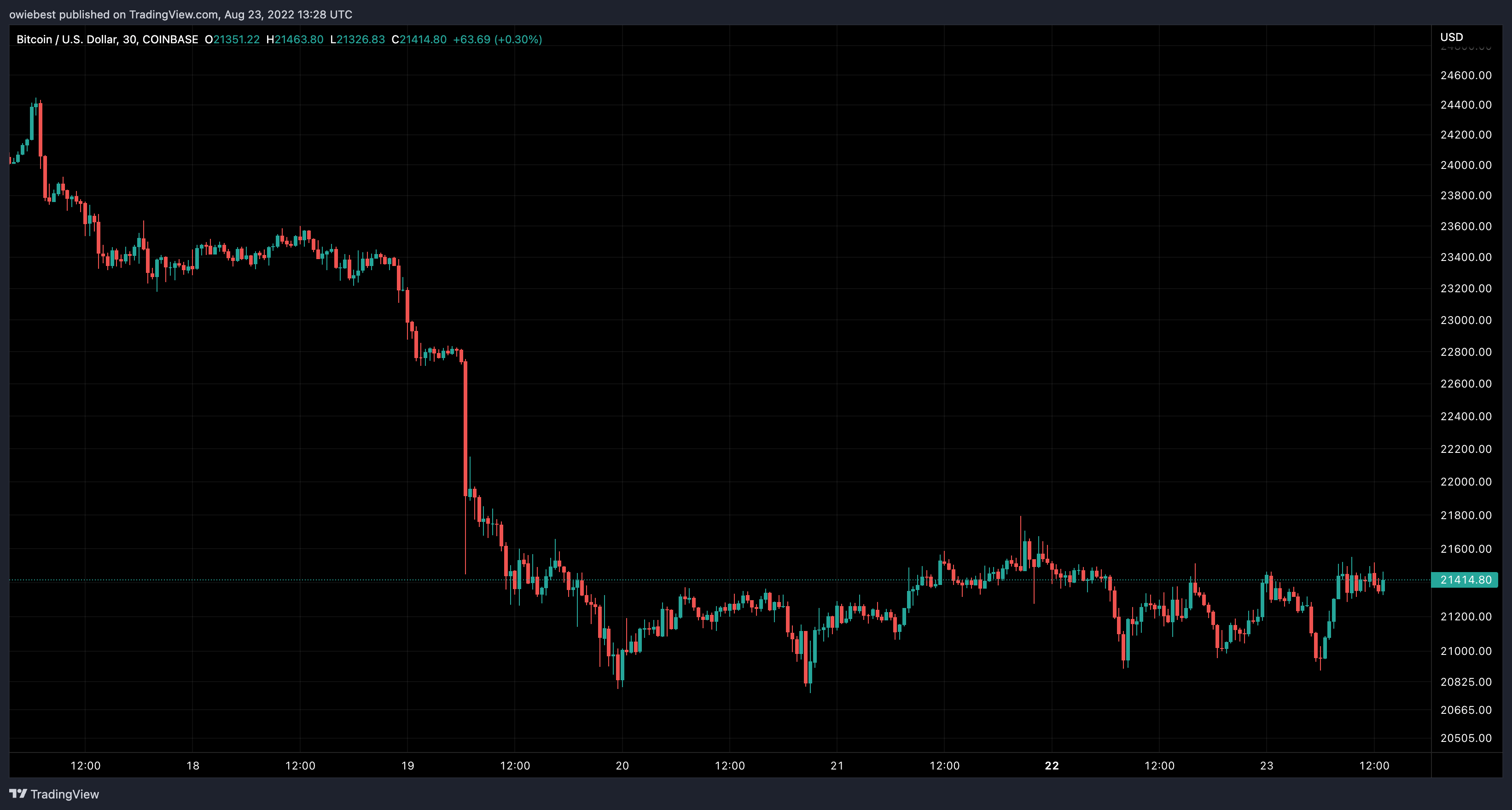

BTC continues to trend low | Source: BTCUSD on TradingView.com

Another part of the market that also saw outflows was the digital investment products. The prior week, the outflows had been $17 million. Last week, they came out to a total of $9 billion.

Inflows In Unlikely Places

Ethereum has not been a favorite of institutional investors for a while now. The altcoin had borne the brunt of its bearishness for the longest time, leading to months of consecutive outflows. However, things seem to be looking up for the digital asset.

The last week saw inflows come into Ethereum totaling $3 million for this time. This follows the announcement that the Merge would be happening in September, turning the market sentiment in favor of the digital asset once more.

Altcoins seemed to be the only ones receiving any sort of inflows for last week too. Although their volumes came out not very encouraging, there were still inflows nonetheless. Assets like Cardano saw inflows of $0.5, presumably following the renewed bullishness in Ethereum. However, Solana did not see any favor from institutional investors with outflows of $1.4 million.

With the majority of outflows coming from the US, Germany, and Sweden, blockchain equities recorded outflows of $1.6 million for the same time period.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Siacoin

Siacoin  Ravencoin

Ravencoin  Holo

Holo  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  NEM

NEM  Dash

Dash  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur