Is the Worst Behind Bitcoin? Glassnode Co-Founders Look at State of BTC After Another Fed Rate Hike

The creators of one of the top on-chain analytics firms in the crypto space are weighing in on Bitcoin (BTC) after the Federal Reserve issued another interest rate hike.

In Glassnode’s latest newsletter, Jan Happel and Yann Allemann say that Bitcoin is trading below $20,000 due to “intense pressure” brought about by a fresh rate hike to the tune of 75 basis points (bps).

According to Happel and Allemann, the Fed’s hawkish stance is overshadowing fundamental developments in the crypto space, driving Bitcoin to face increased risk coupled with bearish momentum.

“Both the monetary policy and regulatory fronts are offering nothing other than headwinds to crypto.”

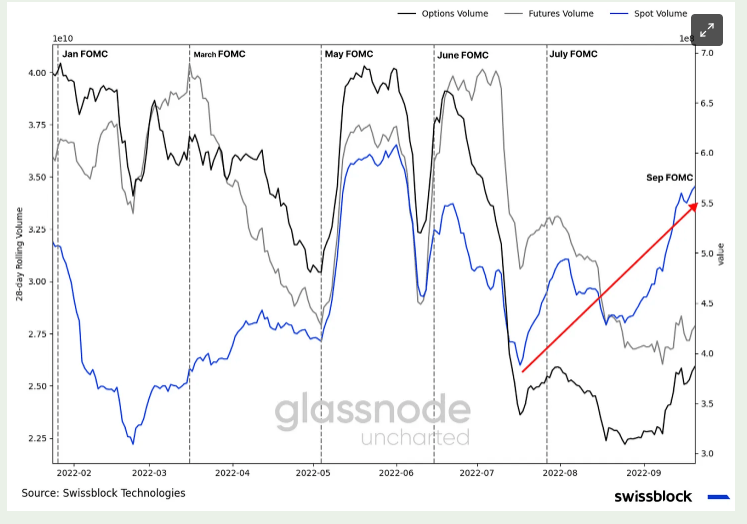

On top of an unfavorable macro backdrop, the Glassnode co-founders also say that BTC’s rising volume amid a bearish trend could portend more for pain for Bitcoin holders.

“Whenever spot volume backs a downward trend, it tends to extend into the near future, and a reversion requires substantial buying pressure.”

Source: Glassnode

The duo also highlights that traders and speculators are showing signs that they are not optimistic about the prospects of BTC.

“The futures-to-spot volume ratio is well below one, and since the 50 bps surprise rate hike in June, it has trended downward steadily. This development indicates less confidence and speculation in the system.”

Overall, the Glassnode executives predict that Bitcoin will continue to trade in a wide range within a bearish environment.

“According to J. Powell’s remarks, a subsequent 75 bps rate hike, previous FOMC (Federal Open Market Committee) weeks, and the state of the system, Bitcoin likely continues to trade in the $17,000-$25,0000 trading range. Even though the spot market saw an uptick in traded volume, the options and futures market denoted selling pressure amidst a high-risk and bearish regime.”

At time of writing, Bitcoin is swapping hands for $19,033, down over 1% on the day.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  Synthetix Network

Synthetix Network  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Decred

Decred  Zcash

Zcash  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur