It’s Time to Buy Bitcoin But Also Prepare For One More Dip Below $20K: Analyst

On June 18th, Bitcoin’s price dropped to a low of $17,622 on Binance, and the community has been in deep discussions ever since if that was the bottom.

According to an analyst from the cryptocurrency resource CryptoQuant – the bottom may not yet be in, but we are about 1/3rd of the way to forming it.

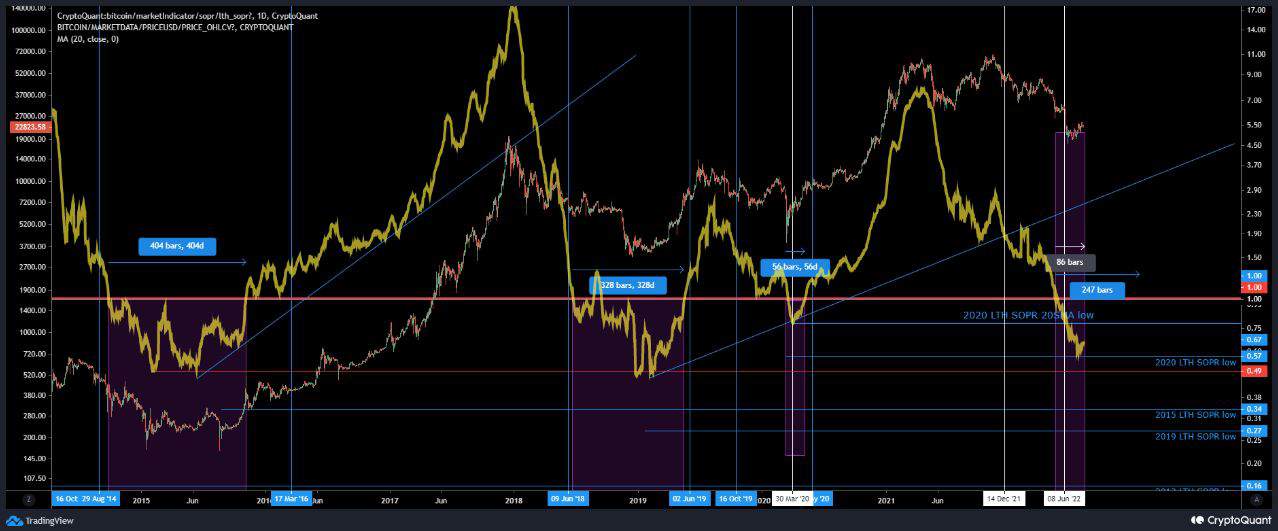

- Tomáš Hančar – analyst at CryptoQuant – revealed that the LTH SOPR 20-day SMA suggests that we are up to “1/3rd into a potential bottoming process.”

- The above indicator is short for the 20-day Simple Moving Average (SMA) of the Long-Term Holders’ Spent Output Profit Ratio (LTH SOPR).

- Data shows that this ratio has spent about three months under the neutral level value of “one,” which, according to the analyst, is 1/3rd of what a bottoming process usually takes.

I’ve roughly measured the historical bottoming processes/cyclical accumulations and ON AVERAGE (that includes the under two months period in March 2022) we should be looking at a ballpark of approximately 250 days of a bottoming process.

- The analyst goes further, involving the indicator’s 20-day moving average ‘smoothing’ line.

As far as the indicator’s 20-day MA smoothing line in technical terms is concerned, between 10th and 14th of July, we’ve seen what looks to be a bounce off of 2020 actual LTH SOPR low, coincidentally not too far off the 0.49 level, which represented the very lows of both 2015 as well as 2018/2019 cyclical bottoms.

- In conclusion, he believes that is time to start scaling in, but with caution, “just in case we get one more chance to buy sub-20k.”

- It has been about 47 days since the latest low, so he thinks it’s better to be sure to have a potential breakout scenario covered as well.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  Synthetix Network

Synthetix Network  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Holo

Holo  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  Ontology

Ontology  NEM

NEM  Decred

Decred  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur