Lido TVL hits 10-month high as LDO ranks among top gainers

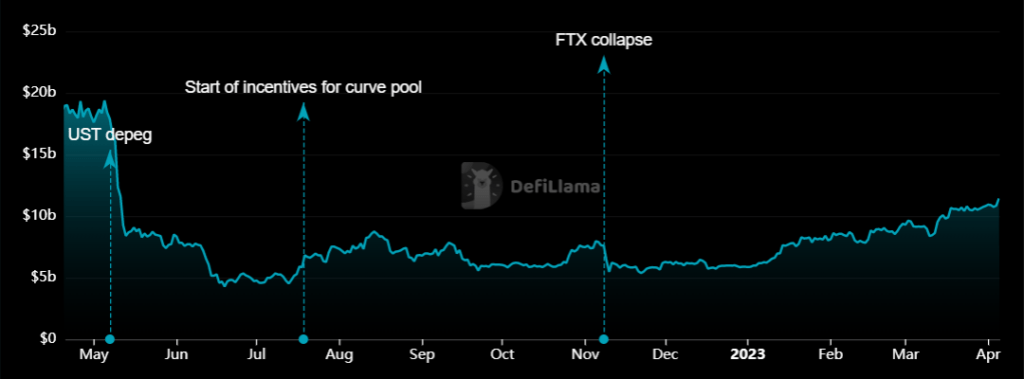

Lido, a leading multi-chain crypto staking solution, is witnessing an impressive surge in its total value locked (TVL), as its value recently skyrocketed to a 10-month high of $11.5 billion.

Meanwhile, Lido DAO (LDO), its native token, is up 10% in the past 24 hours, making it the highest gainer among the top 50 crypto assets.

The last time Lido’s TVL saw this height was before the Terra collapse in May 2022. In addition to the cascading effect on the broader crypto market, Terra’s implosion had an additional impact on Lido’s TVL as the staking solution is also domiciled on the Terra network. The fiasco brought Lido’s TVL to a low of $4.69 billion in June 2022.

Lido TVL – April 5 | Source: DeFi Llama

The platform’s TVL has struggled to recover since then, and Ethereum’s transition to proof-of-stake last September helped in this journey to recovery. Lido’s value started witnessing a gradual uptick in January, surging from $6.18 billion on Jan. 5 to its current value of $11.5 billion. This marks an 86% increase this year.

You might also like: DeFi TVL recovers after high-profile US banks crumpled

Lido’s value has also increased by 26.21% in the past month. With a dominance of 22.40% of the total DeFi scene, Lido’s growth has also triggered an increase in the aggregate TVL of the DeFi sector, which has surged by 3% in the past 24 hours to a value of $51.32 billion at the time of writing.

Total DeFi TVL – April 5 | Source: DeFi Llama

Market watchers have ascribed this rapid growth in Lido’s TVL to the surge in staked ethereum (ETH), as the Shanghai upgrade edges closer. As disclosed by Lido in a tweet this month, the ratio of staked has surged to 15% of the total ETH supply.

+15% of the ETH supply is now staked ? pic.twitter.com/FkXbCzMHQv

— Lido (@LidoFinance) April 2, 2023

This metric is crucial to Lido’s value because over 30% of all staked ETH are deposited through Lido, per data from Dune Analytics. Moreover, on-chain analyst Patrick revealed that liquid staking services now account for $16.23 billion of all DeFi deposits as of this month.

From the 5th largest category of DeFi last June to the 2nd largest now, Liquid Staking’s share of all DeFi deposits has grown significantly over the past year. pic.twitter.com/VvjPDsORWH

— Patrick | Dynamo DeFi (@Dynamo_Patrick) April 2, 2023

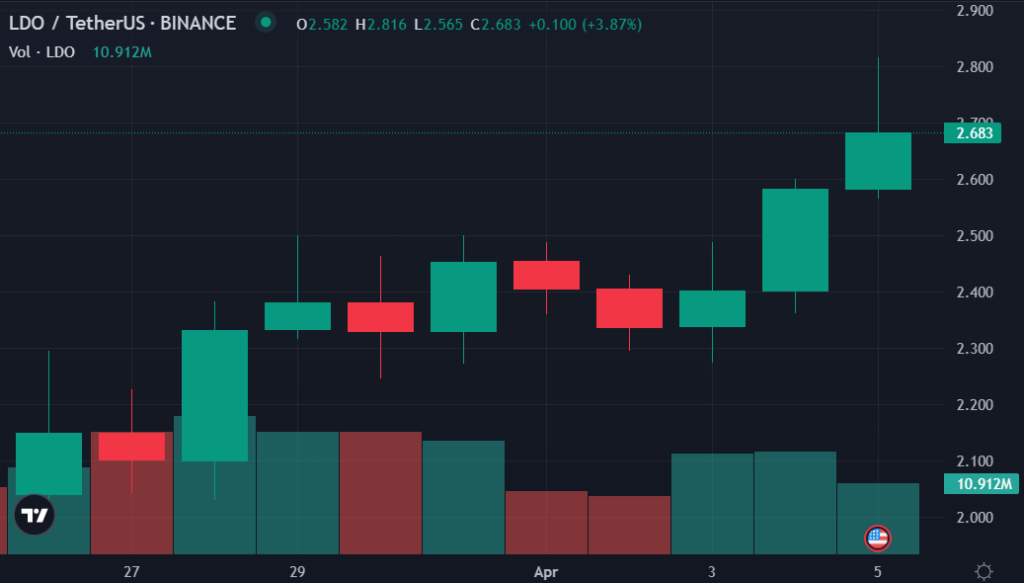

Lido DAO token rallies by 12%

In addition to the surge in Lido’s TVL, the protocol’s native token has registered impressive gains. LDO is witnessing a 10.42% gain in the past 24 hours, making it the biggest gainer among the top 50 assets within the time frame. The asset has also surged by 11.30% in the past week.

LDO price – April 5 | Source: crypto.news

LDO rallied from $2.36 yesterday to a high of $2.8 earlier today, marking an 18% increase in less than 24 hours. The asset faced stern resistance at the $2.8 zone, but has remained above the $2.6 territory. LDO is currently trading for $2.68 at the time of writing.

Read more: SEC chair Gary Gensler addresses crypto regulation and consumer protection

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  Gate

Gate  NEO

NEO  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Siacoin

Siacoin  Ravencoin

Ravencoin  Holo

Holo  0x Protocol

0x Protocol  Qtum

Qtum  Zcash

Zcash  Basic Attention

Basic Attention  Dash

Dash  NEM

NEM  Decred

Decred  Lisk

Lisk  Ontology

Ontology  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Status

Status  Nano

Nano  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD