Perplexing Tranquility? Bitcoin’s Implied Volatility Hits Lowest Since October 2020

There is an uncanny sense of calm in the bitcoin (BTC) market despite lingering FTX contagion fears and macroeconomic uncertainty. Analysts are scrambling to explain the perplexing tranquility.

Bitcoin’s annualized seven-day implied volatility, or the options market’s forecast of a likely movement in the underlying asset, has declined to a two-year low of 38.2%, according to data source Amberdata.

The metric – often equated with the degree of uncertainty or fear – peaked at 145% on Nov. 9 and has been falling since, even as the FTX contagion spreads and experts fear a wave of miner bankruptcies.

To Markus Thielen, head of research and strategy at Matrixport, the declining volatility is not surprising.

«Volatility expectations will continue to drop. Lower volatility is one of my favorite trades for 2023,» Thielen told CoinDesk. «The macro outlook is extremely constructive, with inflation falling like a rock and the recent decline in oil making the Ukraine war less relevant.»

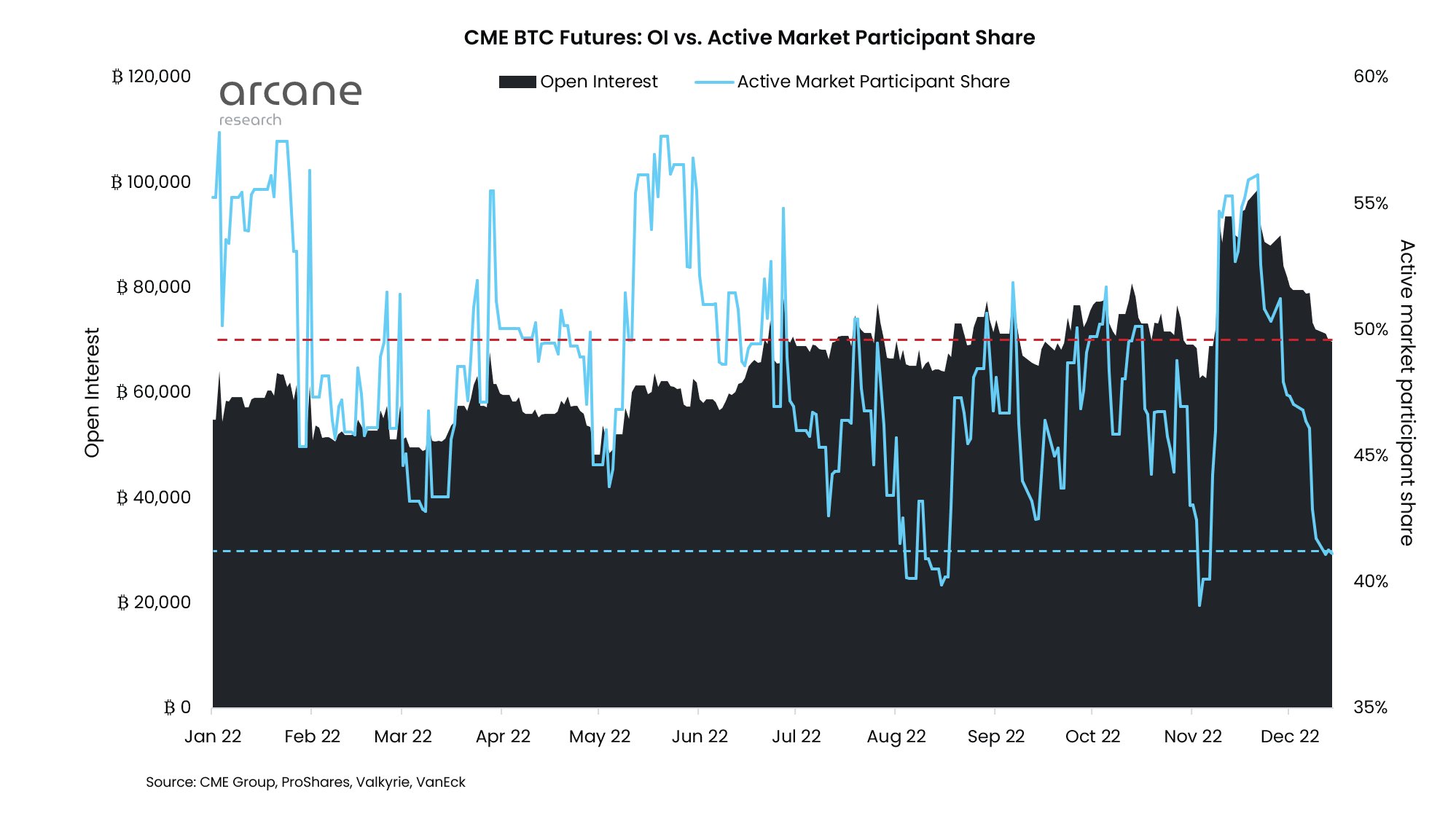

Institutional interest has dwindled, as evidenced by the decline in active bitcoin futures contracts on the Chicago Mercantile Exchange (CME). The so-called futures open interest has dropped to 69,000 contracts, the lowest since October.

Institutional interest has declined, adding to the volatility lull in the crypto market. (Arcane Research)

The share of non-exchange-traded funds (ETFs) in the open interest has hit an all-time low of nearly 41%.

«In the light of muted activity and expected slow times ahead, it’s likely that volatility will continue to compress, which in turn is reflected in options,» Lunde said.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Stellar

Stellar  Chainlink

Chainlink  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  LEO Token

LEO Token  Monero

Monero  Cronos

Cronos  Dai

Dai  Ethereum Classic

Ethereum Classic  OKB

OKB  Algorand

Algorand  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Stacks

Stacks  Tezos

Tezos  Theta Network

Theta Network  IOTA

IOTA  Tether Gold

Tether Gold  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Qtum

Qtum  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Synthetix Network

Synthetix Network  Holo

Holo  Siacoin

Siacoin  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur