Quant Analyst PlanB Says Bitcoin Price Action Mirrors Pattern That Preceded Epic Rally to $69,000

Popular quantitative analyst PlanB says Bitcoin’s (BTC) current price action mirrors a pattern that preceded the massive rally that catapulted BTC to its all-time high.

The pseudonymous trader argues to his 1.8 million Twitter followers that $20,000 “is the new” $4,000 for BTC.

After breaking $19,000 in late 2017, Bitcoin plummeted to below $4,000 by late 2018. BTC hovered around that $4,000 level until April 2019, when it started moving upwards. The top crypto asset by market cap then largely continued its ascent until November 2021 when it printed its all-time high of $69,000.

$20K is the new $4K pic.twitter.com/HCnIla45KA

— PlanB (@100trillionUSD) October 16, 2022

Bitcoin is trading at $19,606 at time of writing and is up 1.7% in the past 24 hours. BTC has been trading around the $20,000 level since mid-June.

PlanB also notes that the percentage of Bitcoin in loss currently mirrors the levels it was at during great buying opportunities in 2011, 2015 and 2019.

Great buying opportunity (like 2011, 2015 and 2019) or this time is different, that is the question. pic.twitter.com/Wh1Pp44xgR

— PlanB (@100trillionUSD) October 13, 2022

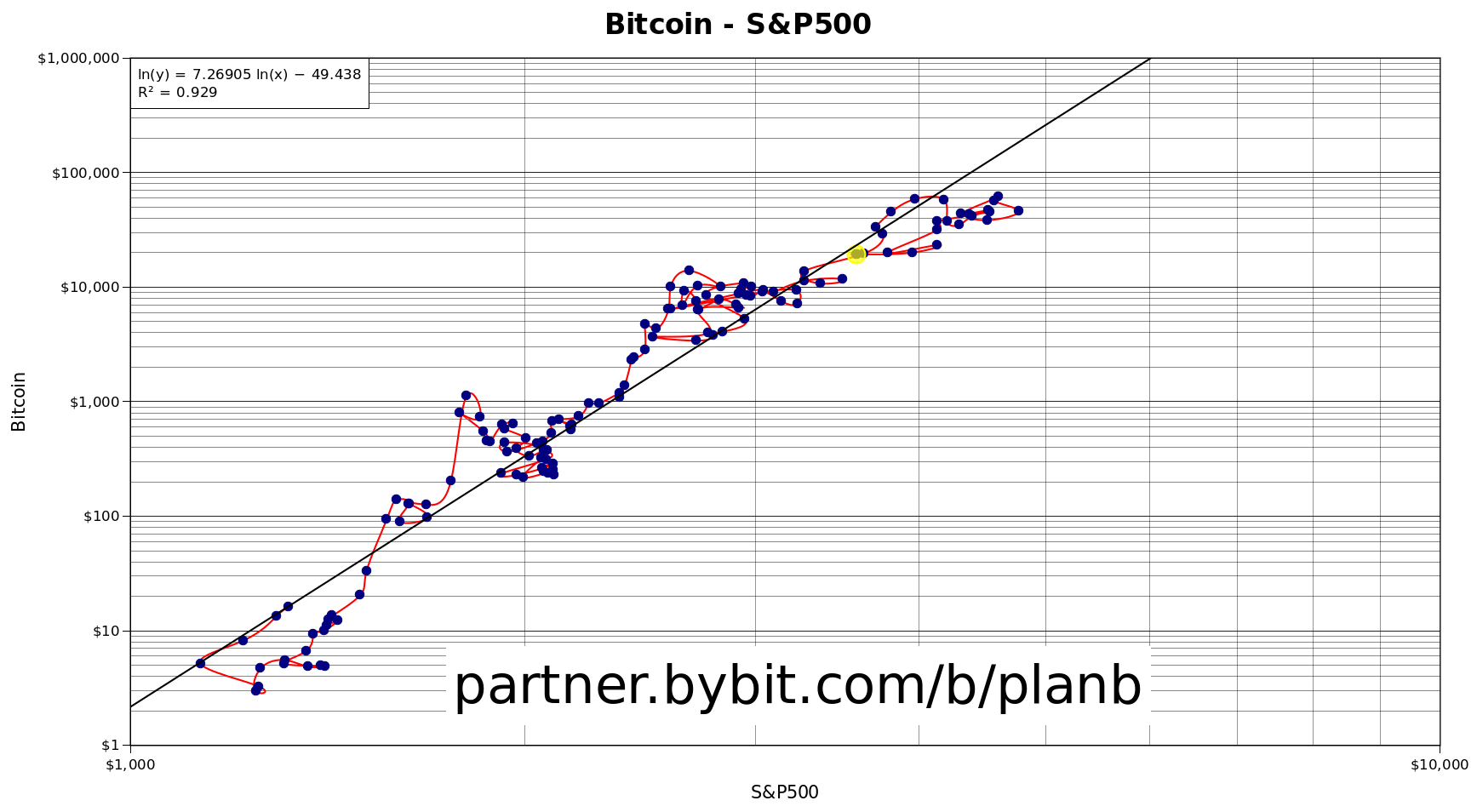

Looking at the correlation between Bitcoin and the S&P 500, the analyst predicts that both BTC and the stock market index will eventually recover from the current bear market.

“It’s only recently that people started complaining about the correlation between Bitcoin and S&P500, only since they both decreased in value. But the correlation has always been there since S&P500 increased from 1,000 [points] to 4,000 [points] and BTC from $1 to $20,000. Both will rise again.”

Source: 100trillionUSD/Twitter

PlanB also notes that most of the Bitcoin selling in the past 12 months came from traders who are cutting their losses after buying BTC at $60,000, as well as some older buyers who are taking profits after accumulating BTC for less than $15,000.

Featured Image: Shutterstock/Xavier Fargas

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond