Research: Bitcoin options traders expect price to hit $30,000 in Q4

Options are financial derivatives in which two parties contractually agree to transact an asset at a stated price before a future date.

Glassnode data analyzed by CryptoSlate suggests options traders are expecting Bitcoin and Ethereum to move higher in Q4.

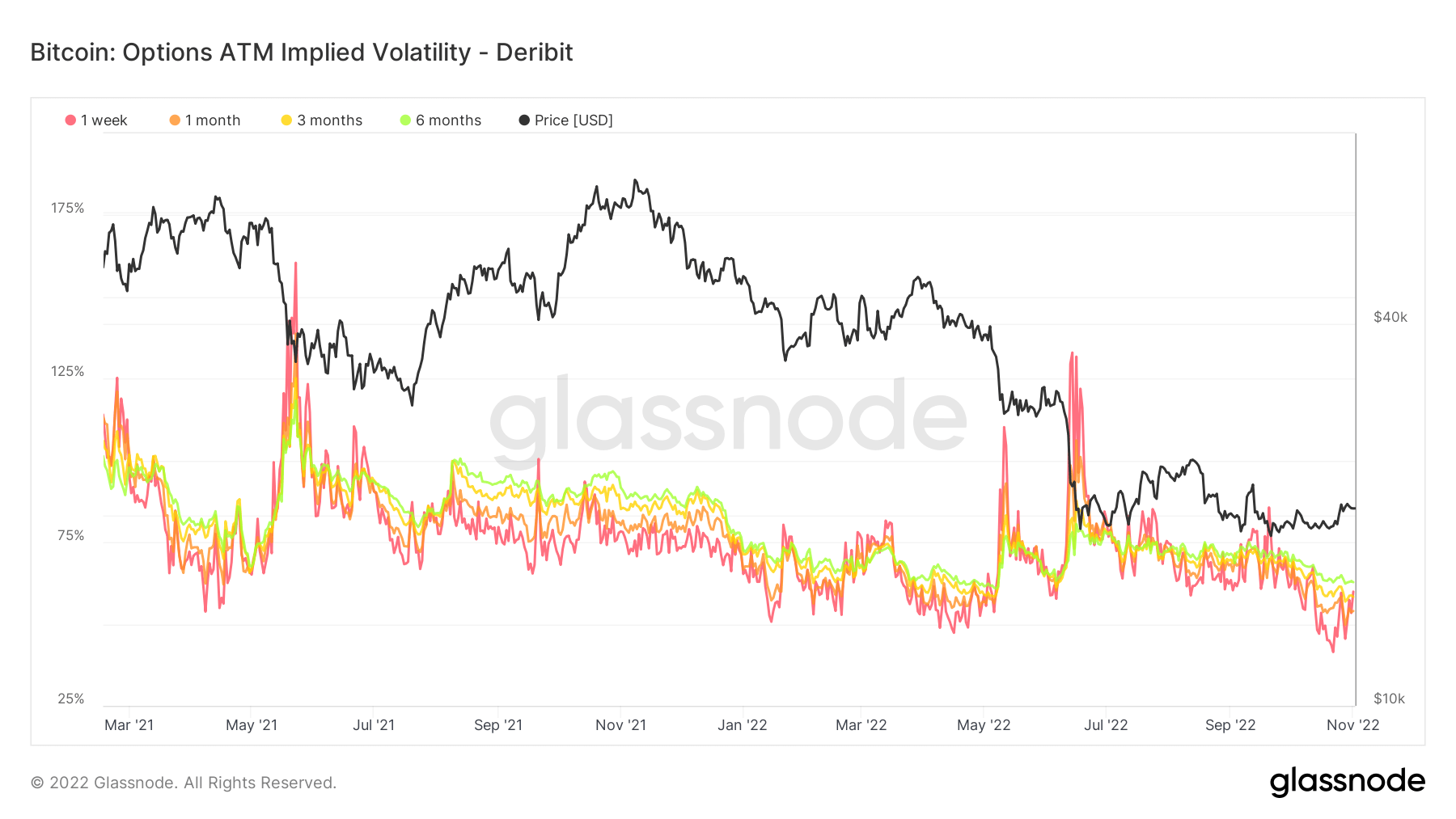

Bitcoin Implied Volatility

Implied Volatility (IV) is a metric that gauges market sentiment toward the probability of changes in a particular asset’s price – often used to price options contracts. IV usually increases during market downturns and decreases under bullish market conditions.

It can be considered a proxy of market risk and is usually expressed in percentage terms and standard deviations over a particular time frame.

A standard deviation (SD) measures how scattered, or distributed data is relative to the mean average. For example, within a normal distribution, 68% of data falls within one standard deviation of the mean, 95% within two SDs, and 97.7% within three SDs.

IV follows expected price movements within one SD over a year. The metric is further supplemented by delineating IV for options contracts expiring in 1 week, 1 month, 3 months, and 6 months from the present.

The chart below shows that Bitcoin IV has since fallen from summer highs to stabilize and become less volatile in the year’s second half. Based on past instances of falling IV, this may be a precursor to bullish conditions brewing in Q4.

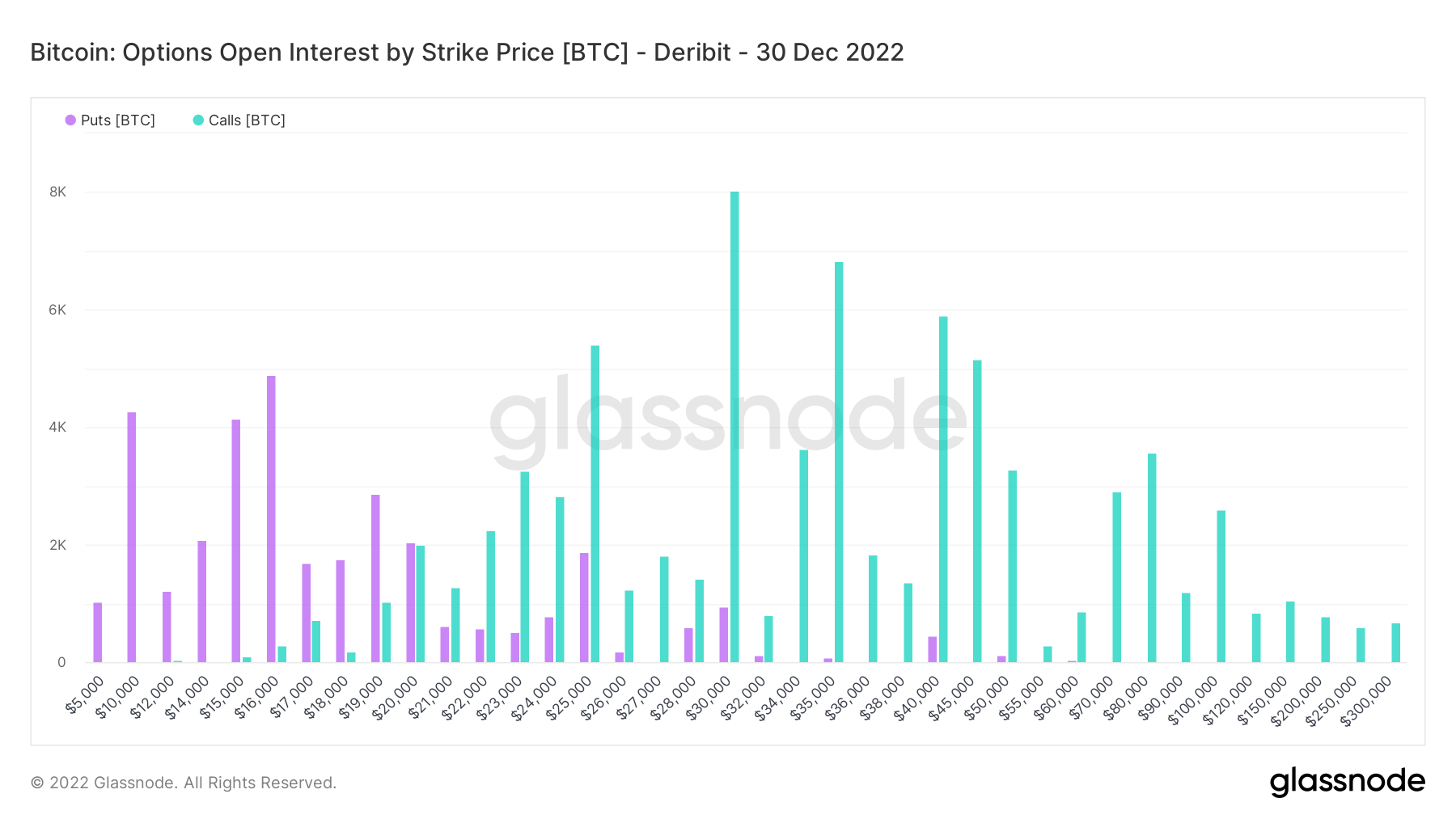

Open Interest

Open Interest (OI) refers to the total number of outstanding derivatives contracts, in this case, options, that have yet to be settled.

Puts are the right to sell a contract at a specific price by an expiration date. In comparison, calls are the right to buy a contract at a particular price by an expiration date.

The Bitcoin OI chart below shows strong puts at $10,000, $15,000, and $16,000. While traders have signaled an overwhelming amount of calls, amounting to over $1 billion in value, for BTC above 30,000.

The ratio of puts to calls suggests traders expect Bitcoin to move higher, with $30,000 being the mode price target.

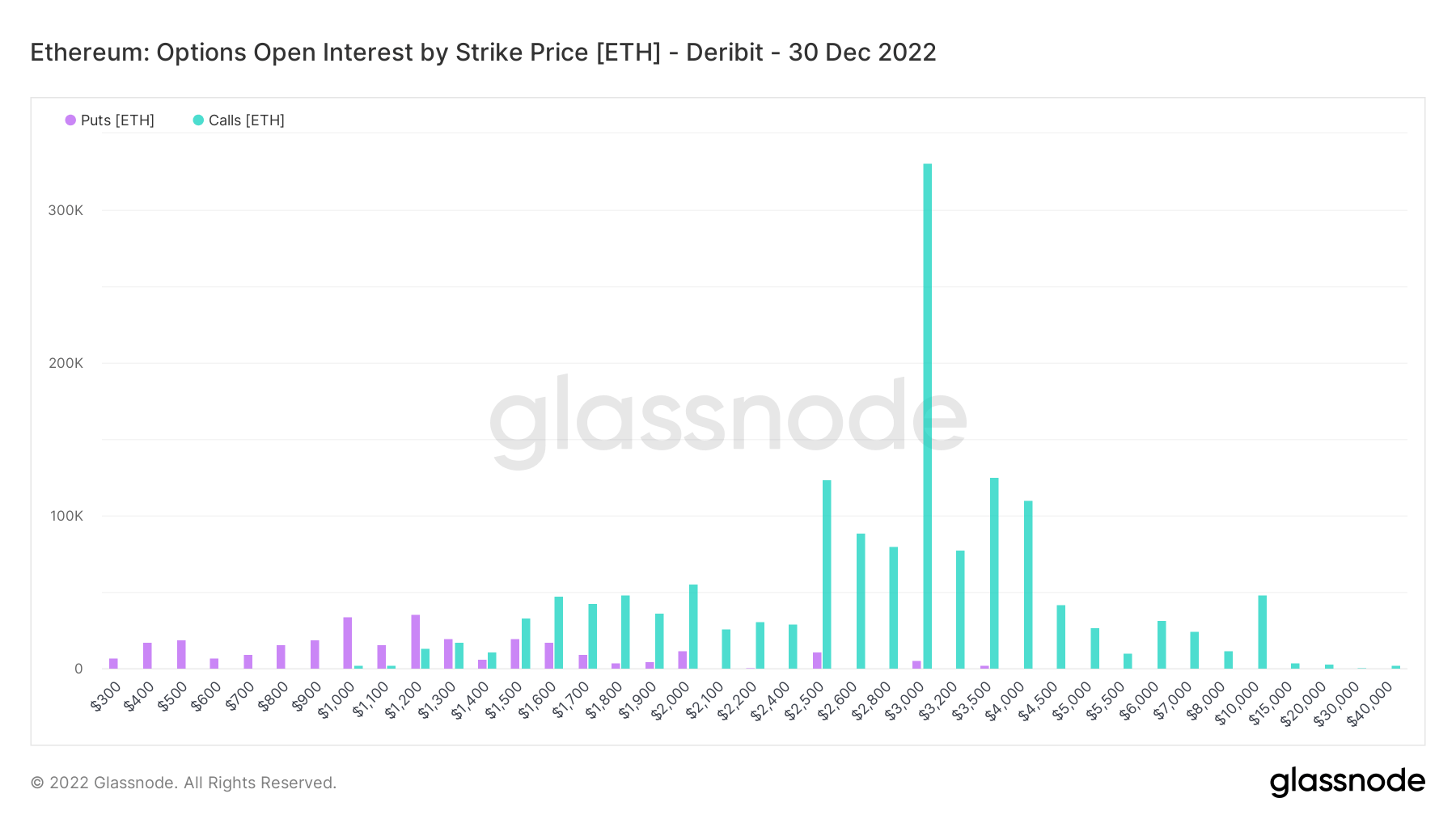

Meanwhile, Ethereum OI shows a similar pattern to Bitcoin as calls dominate. Calls at $3,000 dwarf all other prices, both puts and calls.

»

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Stacks

Stacks  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Decred

Decred  Zcash

Zcash  NEM

NEM  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Nano

Nano  Status

Status  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur