These Four Key Charts Shed Light on the FTX Exchange’s Spectacular Collapse

Speculation surrounding Sam Bankman Fried’s crypto exchange FTX grew so intense that the firm agreed to sell itself to bigger rival Binance. Blockchain data offers a fresh perspective on FTX’s liquidity crunch, illustrating how the drama escalated so quickly.

Top 10 FTX withdrawers for all wallets

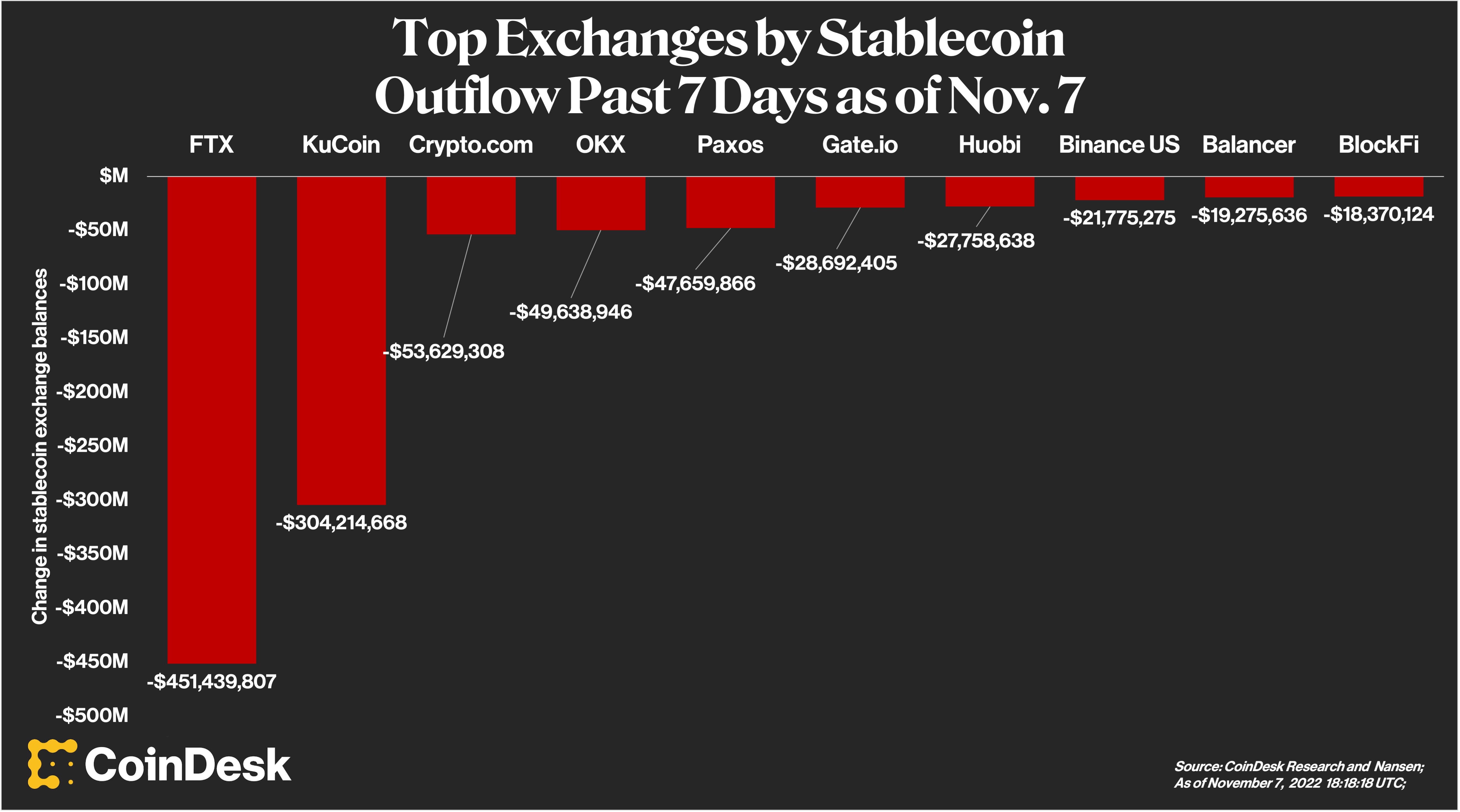

Understanding the volatility stemming from the FTX drama continues with stablecoin outflows. According to Nansen data, in the past seven days starting on Monday Nov. 7, FTX led all exchanges in stablecoin outflows. Some $451 million worth of stablecoins have left FTX, more than the combined outflows of KuCoin, Crypto.com and OKX.

Specifically, FTX’s holdings of USDC and USDT have nosedived dramatically. Between Friday, Nov. 4 and Tuesday, Nov. 8, Nansen data states that FTX’s USDC holdings dropped about $137 million, roughly 84%, while its USDT holdings dropped from $198 million to $68 million.

According to CryptoQuant, FTX’s stablecoin reserve stands at roughly $156 million currently, down more than 78% since Oct. 24.

FTX’s stablecoin reserve is at its lowest levels in a year. Some market participants have been concerned because one of the initial signs that foreshadowed the collapse of Terra Luna was when UST deposits on the Anchor lending protocol started dropping rapidly.

Top 10 “smart money” FTX withdrawers

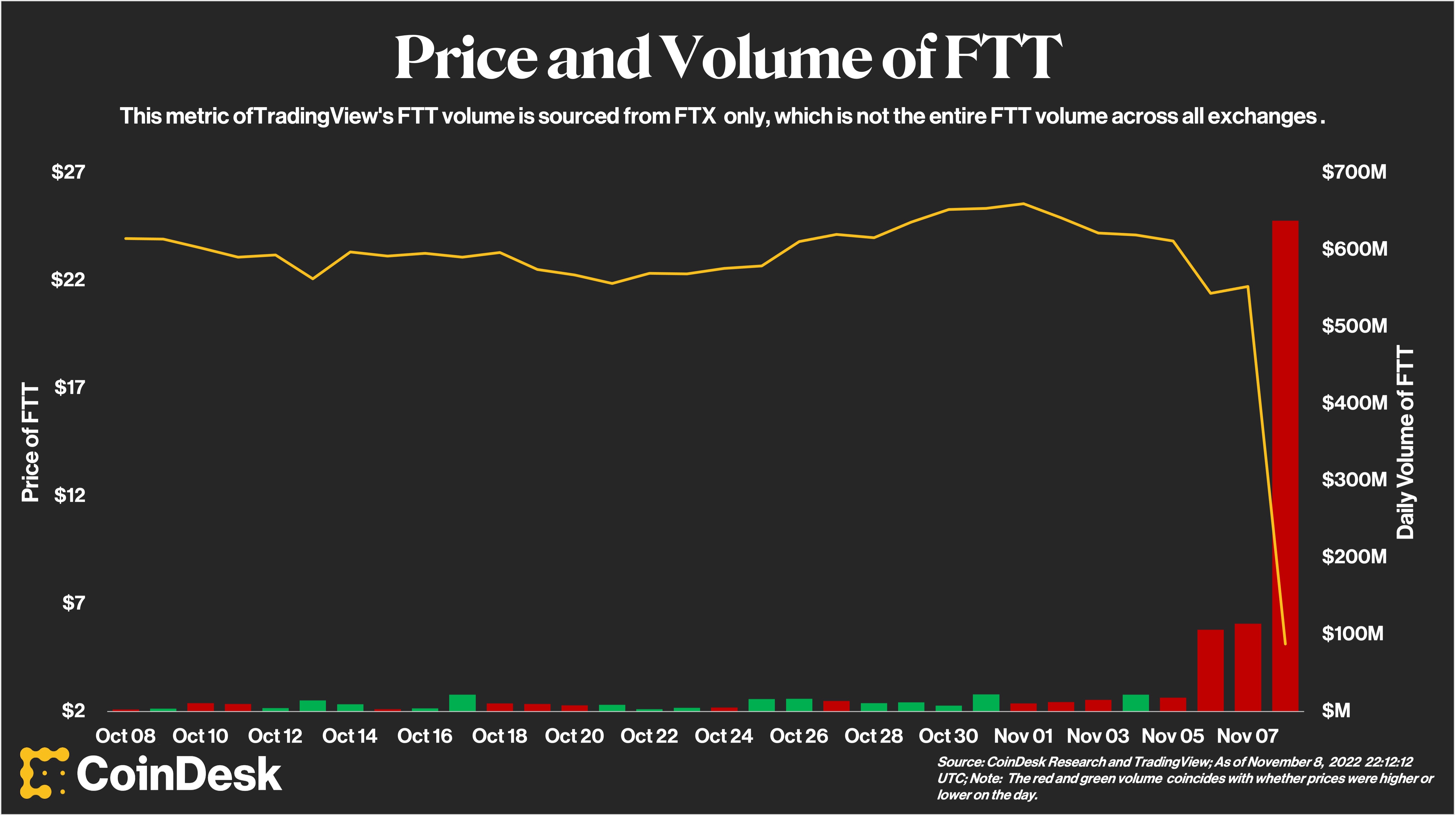

The chart above shows the daily price and volume of the FTX exchange’s FTT token, which grants holders a discount on trading fees on the FTX marketplace. Following CoinDesk’s disclosure on Nov. 2, FTT recently slid roughly 79%, with its volume jumping dramatically.

The data in the chart only cover volume on the FTX exchange, so it may not cover the entire FTT trading volume across all exchanges. The chart shows that the recent revelations triggered a flurry of interest in the token and that the drop in FTT was accompanied by significant price discovery.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  Ontology

Ontology  NEM

NEM  Decred

Decred  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur