Total Crypto Market Triggers Golden Cross, Despite “Deadly” Bitcoin Counterpart

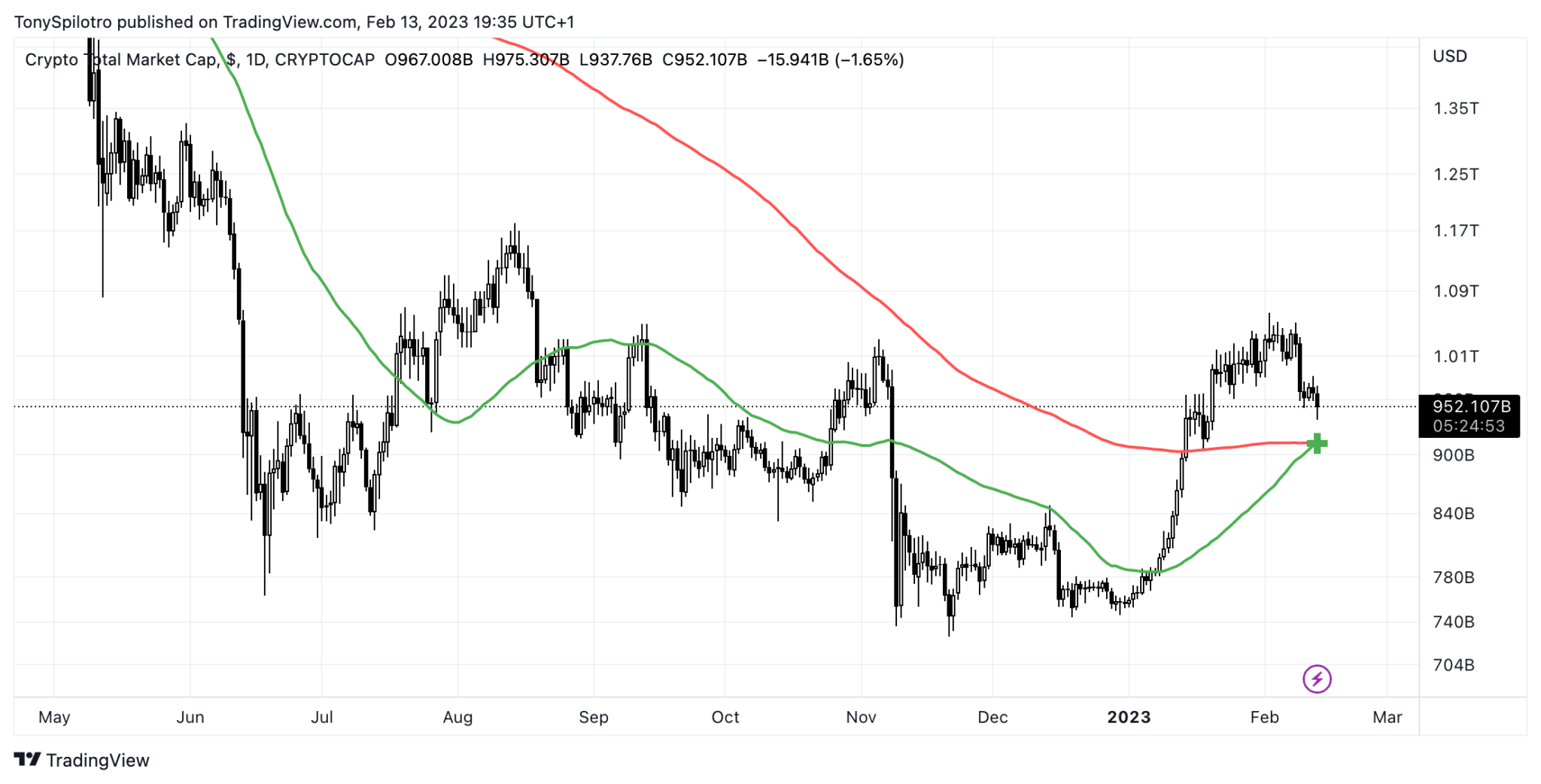

The chart representing the total crypto market cap in aggregate has triggered a golden cross on daily timeframes.

While the crossover of two important moving averages is typically a buy signal, Bitcoin, is close to confirming the opposite signal — a death cross — on a higher, more dominant timeframe. Will Bitcoin bears take back control over crypto, or will the golden cross help to pull the entire market — including BTC — higher?

Total Crypto Chart To Golden Cross Just Below $1 Trillion

The total cryptocurrency chart is calculated by TradingView and sums up all the different crypto assets out there into one price index. It helps tell the world exactly how much crypto as a whole is valued.

Currently, the total crypto market cap is below a critical line in the sand: $1 trillion. After reaching above the level for the first time in months, the index pulled back and is trying to find support and is consolidating just below resistance.

A golden cross will confirm at the end of the day | TOTAL on TradingView.com

Despite the pullback across the crypto market, today’s price action will trigger a golden cross following tonight’s daily close. A golden cross occurs when a short-term moving average crosses above a long-term moving average from below.

Related Reading: Bitcoin Golden Cross Versus Death Cross: Why The Outcome Is Critical

In this case, the crossover is of the 50-day and the 200-day moving averages. A golden cross signals to the market that the trend is potentially changing and could lead to sustainable upside.

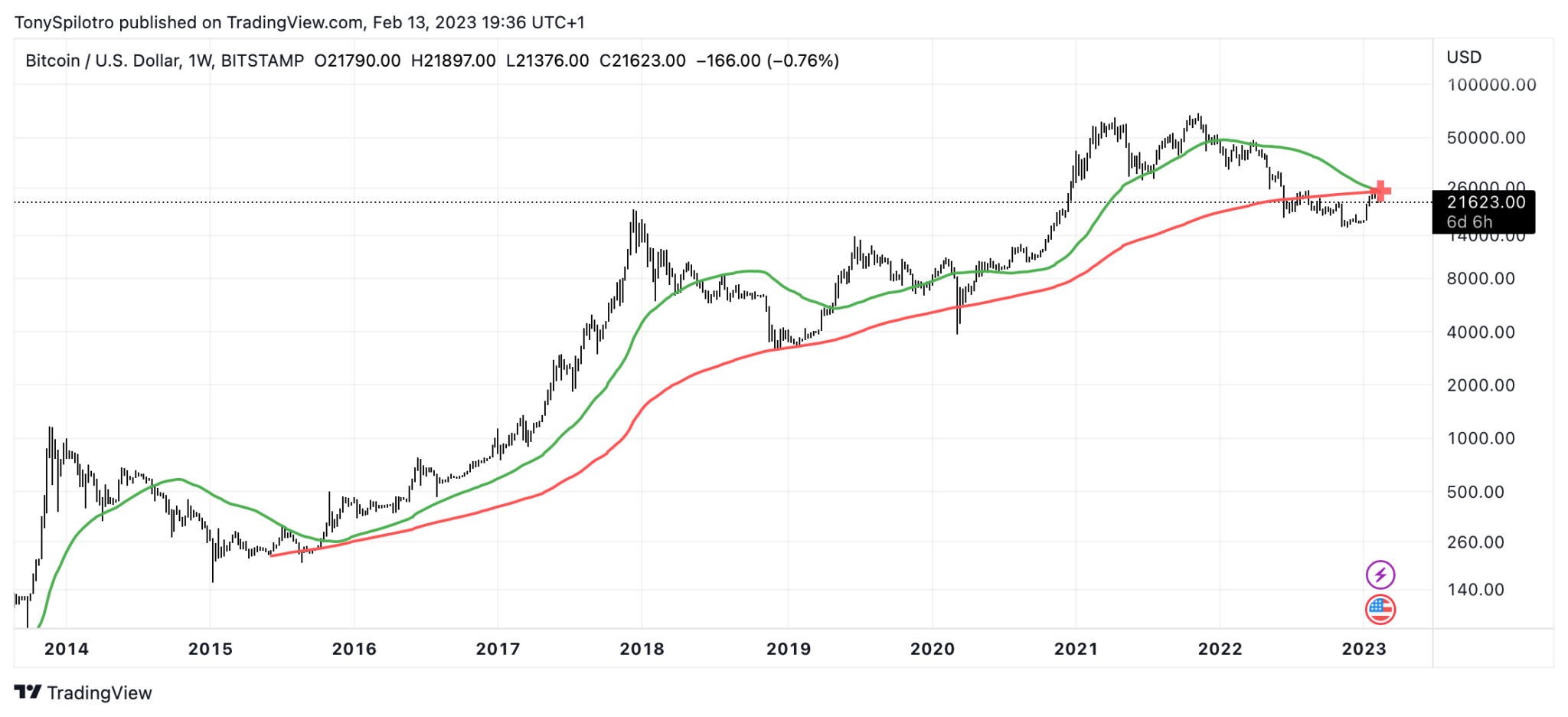

But The Bitcoin Death Cross Could Put Bears Back In Control

The ominous-sounding opposite of a golden cross is a death cross. Bitcoin, the most significant weight in the total market cap chart, could confirm a death cross on the weekly timeframe.

If Bitcoin doesn’t rally by Sunday, the weekly could confirm a death cross | BTCUSD on TradingView.com

Weekly timeframe signals tend to be more dominant than daily signals, which could mean bears take back control over crypto. But if crypto rallies hard enough it could uncross the weekly bearish crossover in BTC and drag the rest of the market higher — Bitcoin included.

Related Reading: Bitcoin Weekly RSI Reaches Line Between Bear & Bull Market

Notably, if BTCUSD closes at these levels by week’s end, it would mark the first time in Bitcoin history that the weekly signal confirmed.

Regardless of Bitcoin’s weekly outcome, the total crypto market cap should golden cross today after the daily close, making the rest of the week a nail biter until the very end.

While everyone is talking about the #Bitcoin death cross, the $TOTAL crypto market cap has golden crossed on the daily. Weekly > Daily, but bulls have six days left to uncross the death cross. Going to be an interesting week. pic.twitter.com/Oz4UMlXPfZ

— Tony «The Bull» (@tonythebullBTC) February 13, 2023

Follow @TonyTheBullBTC on Twitter or join the TonyTradesBTC Telegram for exclusive daily market insights and technical analysis education. Please note: Content is educational and should not be considered investment advice. Featured image from iStockPhoto, Charts from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  EOS

EOS  KuCoin

KuCoin  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  Hive

Hive  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur