Two Technical Bitcoin Indicators Diverge; Each Has Value Depending on Investors’ Timelines

An often-used measure of value in technical analysis and a more recent valuation metric specific to on-chain analysis are at odds at the moment. Each is relevant, depending on how fast an investor is looking to generate gains.

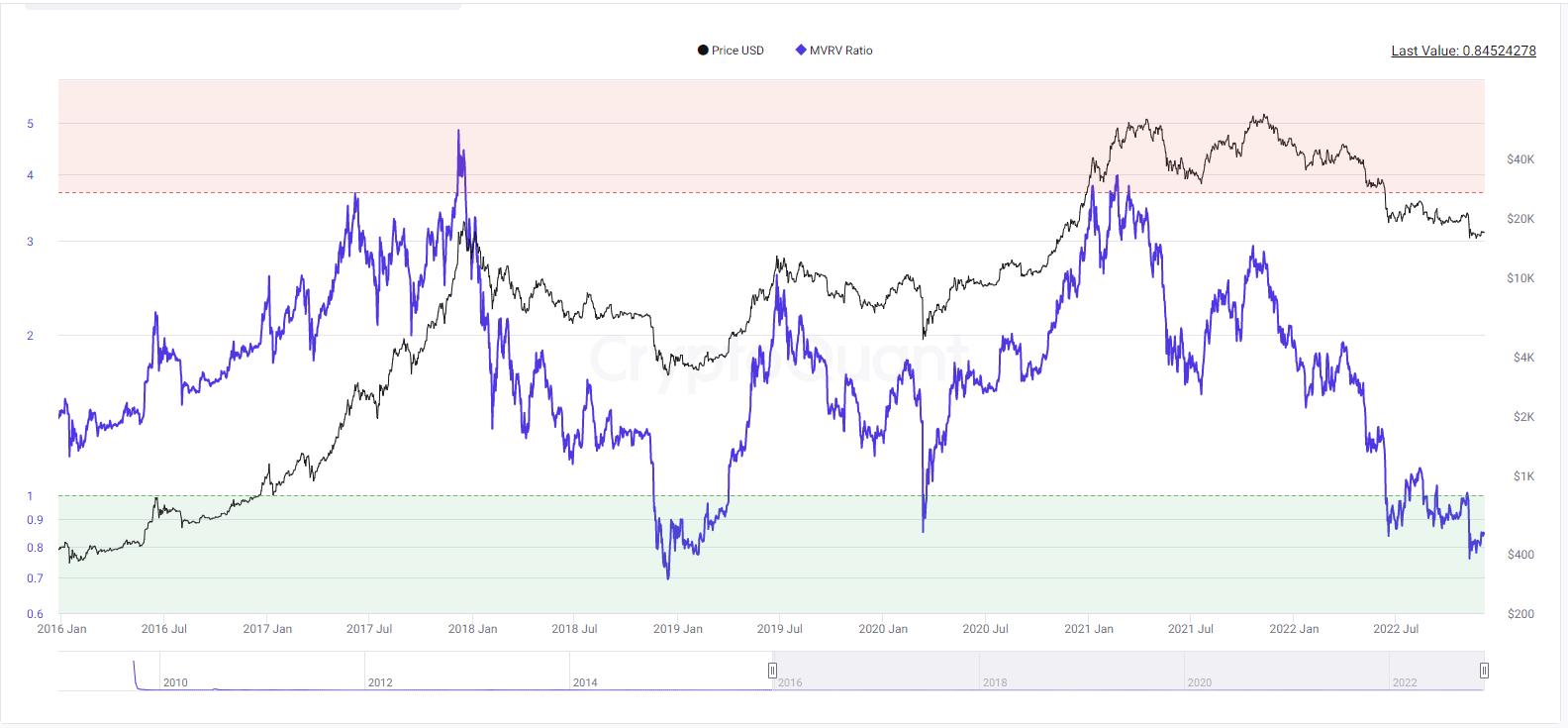

The more recent, bitcoin’s MVRV (market-value-to-realized-value) ratio, measures the ratio of BTC’s market capitalization to its realized capitalization. It implies BTC is trading cheaply on a relative basis and foreshadows likely future trends.

MVRV readings above 3.7 indicate that an asset is overvalued, while readings below 1 indicate that an asset is undervalued.

With a current reading of 0.85, bitcoin’s MVRV ratio has fallen to levels last seen in 2019, implying that current prices present a compelling entry point for long biased investors. For context, BTC prices were trading sub $5,000 during that time period.

Bitcoin’s MVRV ratio 12/6/22 (CryptoQuant)

Bitcoin’s current relative strength index (RSI), however, implies that BTC’s price is fairly valued, given its current reading of 48. RSI ranges from 0-100, with readings above 70 implying that prices are overvalued and those below 30 indicating the opposite. RSI’s reflect likely, immediate price movement.

Despite the neutral reading, a look at historical pricing when BTC’s RSI trades at or around 48 shows a hint of promise. In over 120 occurrences since 2015, following a reading between 47 and 49,BTC has increased on average 6% after 90 days and 2% after seven days.

A look at BTC’s Bollinger Bands shows a series of six consecutive narrow-range trading days, with prices briefly touching the upper range of its bands and now trending in the direction of the 20-day moving average.

The narrow trading range implies a lack of conviction among traders. The reversion to the 20-day average suggests that BTC is trading relatively close to where it should be.

To be sure, the discrepancy between the indicators is small.

MVRV holds primary relevance for investors, who tend to look longer term for payoffs. RSI and Bollinger Bands are most relevant for traders, who seek to accumulate gains more quickly.

Ultimately, the MVRV ratio appears to be a valid indication of BTC’s current intrinsic value. Technical indicators such as the RSI and Bollinger Band indicate the length of time in which BTC will remain undervalued.

Investors who are long bitcoin have an opportunity to acquire bitcoin as it trades near three-year lows relative to its realized value, but only if they can tolerate current price levels, which are unlikely to move much for the foreseeable future.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  NEM

NEM  Zcash

Zcash  Dash

Dash  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Nano

Nano  Numeraire

Numeraire  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur