Vertex Review: Outstanding And Fully Featured DEX On Arbitrum

Decentralized cryptocurrency exchanges have always been one of the more exciting concepts in the crypto space. To this day, they are often shrouded in mystery, especially for those new to the field. Vertex is valued as a DEX (decentralized exchange) that is exceptional in its design – it’s a new DEX created to bridge the gap between the usability of a centralized exchange and the transparency and self-monitoring of the decentralized platform. In this Vertex review, we’re going to talk about a project that aims to remove some of that mystery.

What is Vertex?

Vertex positions itself as a Defi Hub platform on the Arbitrum ecosystem to provide users with various services such as spot trading, derivatives, and Crypto borrowing & lending on a single application.

Vertex is powered by a combined unified central limit order book (CLOB) and integrated automated market maker (AMM), whose liquidity is enhanced as positions from LP market pairs are entered into the order book. Gas and MEV fees are minimized on Vertex thanks to batch trading and the optimistic aggregation model of the underlying Arbitrum layer two (L2), where Vertex smart contracts control the risk instrument and products.

With the collapse of the UST stablecoin earlier this year, the Vertex team was forced to abandon their original plan and rethink their next steps. Their new mission is to build a decentralized, vertically integrated, cross-margin order book for spot, specialty, and profit products. In other words, building a decentralized exchange can match the product offering and user experience of centralized exchanges like Binance and FTX.

Highlights of Vertex

Centralized trading platforms like FTX have a permanent track record of proving how wrongful custody platforms are to users. Decentralized exchanges (DEXes) were created as an alternative to these platforms, providing the ability to trade cryptocurrencies without creating an account (no licensing required) and without using a signed wallet (no trust required).

By comparison, this is a huge innovation, so why do most DEXs still lag behind their centralized counterparts? At this moment, Vertex believes that current DEX exchanges need to meet the convenience and UI/UX standards that most centralized platforms provide. This is supposed to be the combined result of the following:

The initial Web3 trading experience can be so overwhelming for some Web2 users that they immediately want to give it up. Using Metamask, new UI concepts/interfaces (e.g., swaps), and using more protocols just for hedging or leverage can be tiring for new learners to respond to their needs quickly on their favorite CEX.

Most DEXs these days only meet the basic needs of an advanced trader. At the same time, CEX offers tools for leverage and hedging, catering to a wide variety of markets (trading now/perps), yielding idle assets, bridging, and, most importantly, enabling fast and convenient fiat currency trading anytime, anywhere.

Therefore, Vertex overhauls the DEX more efficiently so that users can enjoy the advantages of both a centralized exchange and a decentralized one. This protocol will offer leading flexibility with multiple user interfaces, money markets for lending and borrowing, cross-margin and perps trading, and deep liquidity from the AMM+ order book dual integration.

Users inherit the benefits of self-monitoring, permissionless protocol, and completely trustless transaction UX on the decentralized side. The protocol is product agnostic, even implementing fiat on/off and bridging interfaces.

Vertex emulates the CEX model without permission or detention. Instead, its uptime depends on a decentralized network, and it combats fragmentation with an integrated approach on the same Vertex exchange. And finally, it allows traders to enjoy the best of both CEX and DEX exchanges.

Besides, Vertex DEX is a combination of two models: CLOB (central limit order book) and AMM (Automated Market Maker). In which accounts on Vertex will be defaulted to using cross margin. With Cross margin, the assets in the user account will be used as collateral once the margin falls below the standard.

Transaction fees and MEVs will be minimized by working on Arbitrum, layer 2, applying the Optimistic Rollup model, in which Vertex smart contracts will control risks and operate critical products.

Products of Vertex

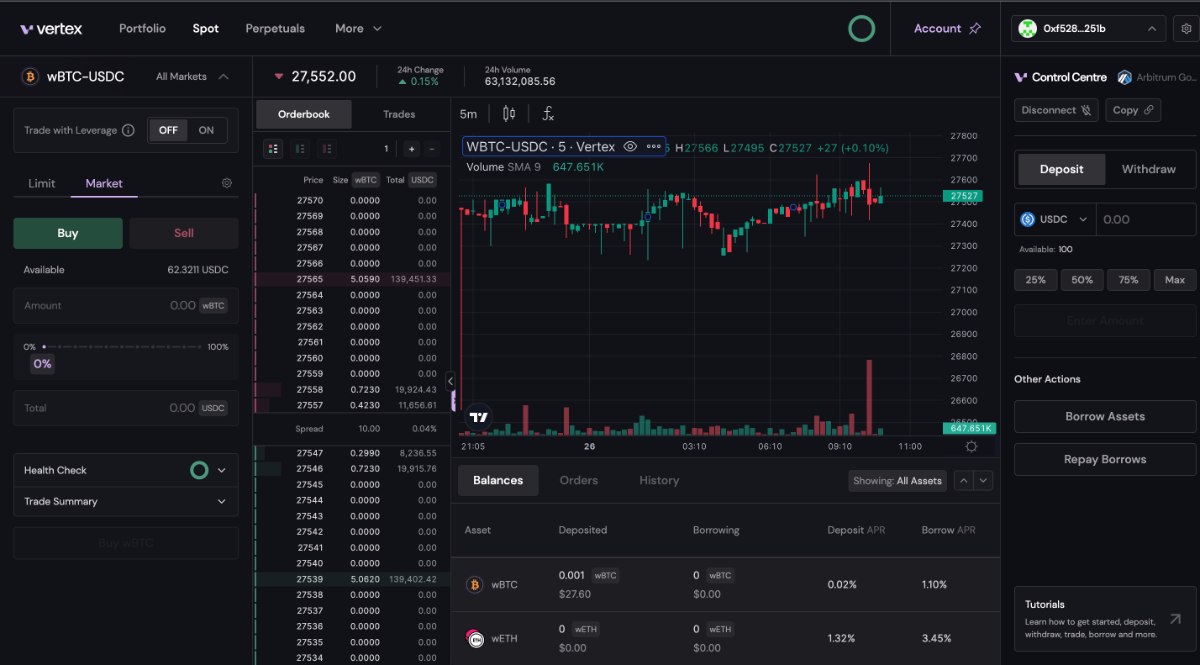

Spot Market

A place to buy, sell and swap pairs of assets with each other. At Vertex, this DEX platform integrates Orderbook DEX and AMM DEX mechanisms to serve traders.

This is in contrast to other financial markets, where you may buy and sell assets for delivery at a future date – referred to as derivatives (e.g., perpetual and futures) since their price is derived from the underlying asset. Its spot markets allow you to buy or sell listed crypto assets paired with USD-denominated stablecoins.

Launch spot markets on Vertex include:

- wBTC/USDC

- wETH/USDC

- Others will be added over time

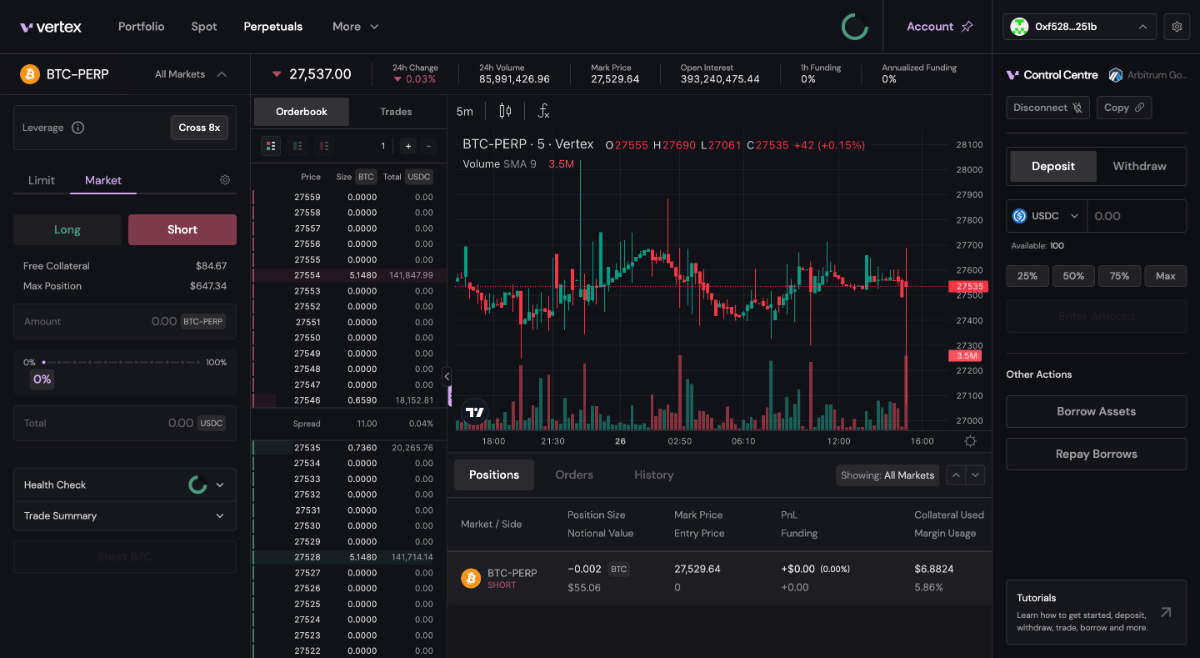

Perpetuals Market

The derivatives market at Vertex allows up to 10X leverage for professional traders. Perpetual markets on Vertex trade 24/7 – meaning you can buy or sell assets anytime of day or night while retaining custody of your spot assets on-chain.

Launch perpetual markets on Vertex will include:

- BTC/USDC

- ETH/USDC

- More markets will be enabled soon after the launch.

Integrated Money Market

Vertex integrates capital markets (borrowing and lending) directly into the DEX, whereby users can borrow assets in the underlying market for margin and increase leverage according to user needs. These operations will also be entirely on-chain on Arbitrum. Supported currencies for lending include USDC, wBTC, and wETH.

Revenue of Vertex Protocol

Vertex’s revenue source will come from the fees users need to pay for participating in the following activities:

- Transaction fee on DEX: Fluctuating 0.01 – 0.03%

- Loan interest rate to borrowers: The loan interest rate is not fixed

- Sequencer Fees: Default fee when users use Vertex Sequencer service, including activities

- Order Liquidation: 0.25 USDC/order

- Withdrawal of collateral: Direct deduction on that asset (USDC, BTC, ETH)

- Mint LP Token: 0.1 USDC

- Burn LP Token: 0.1 USDC

- Market order execution; 0.025 USDC.

Tokenomics

$VRTX is the token of the Vertex protocol. With $VRTX, you can hold and stake into the xVRTX derivative to provide liquidity, transferable (similar to xSUSHI) or locked to the non-transferable voVRTX enhanced token.

Users enjoy lower transaction fees when paying with $VRTX. $VRTX can also be used to participate in “basket auctions,” in which Vertex auctions off a portion of its revenue in installments (USDC/BTC/ETH transaction fees).

Unlike CEX, Vertex users retain distributed governance on the platform. xVRTX holders will be able to create new proposals or vote on changes to the protocol. However, official protocol documents suggest this will materialize later. A gradual transition to fully decentralized governance is expected as Vertex’s minimum viable product (MVP) matures from its infancy.

The voVRTX token will serve as the foundational mechanism for the governance and arrangement of incentives. In addition to basket trading and auction fees, it can be obtained from locking xVRTX, and voVRTX increases fees earned emissions earned, and voting rights.

Users holding xVRTX have two options to earn additional profits: pledge or insurance staking.

Pledgers lock their stake for 2 weeks or more (up to 6 months for up to 2.5x increase) and receive the boost from their accumulated voVRTX balance.

Stake insurance participants will lock up for 3 weeks or more, where up to 50% of their stake serves as collateral in the insurance fund. These lockers instantly receive a maximum gain of 2.5x and also have the exclusive ability to liquidate under-mortgaged positions for additional profit.

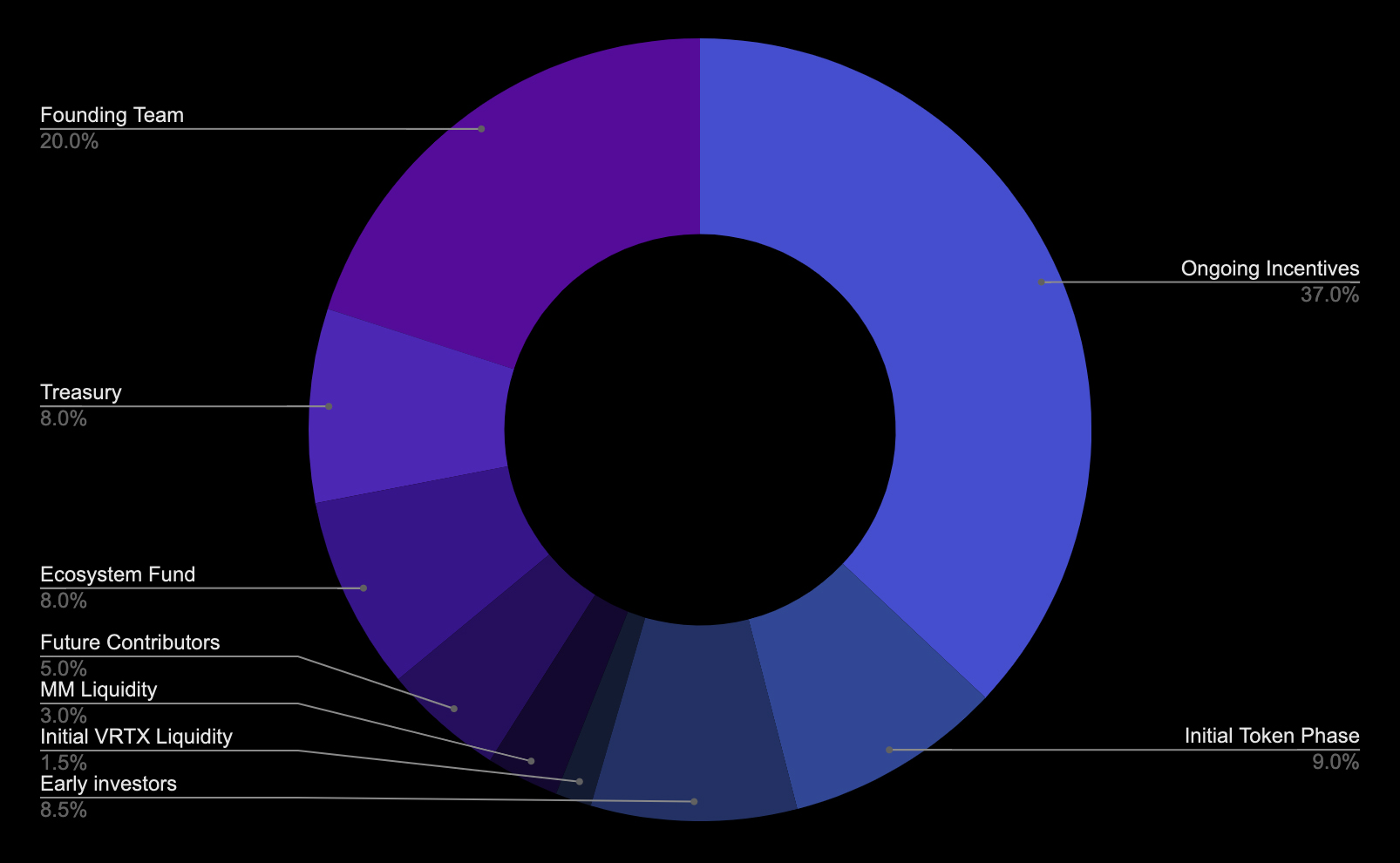

VRTX is distributed according to the following ratio:

- Ongoing Incentives: 37%

- Founding: 20%

- Initial Token Phase: 9%

- Early Investors: 8.5%

- Treasury: 8%

- Ecosystem Fund: 8%

- Future Contributors: 5%

- MM Liquidity: 3%

- Initial VRTX Liquidity: 1.5%

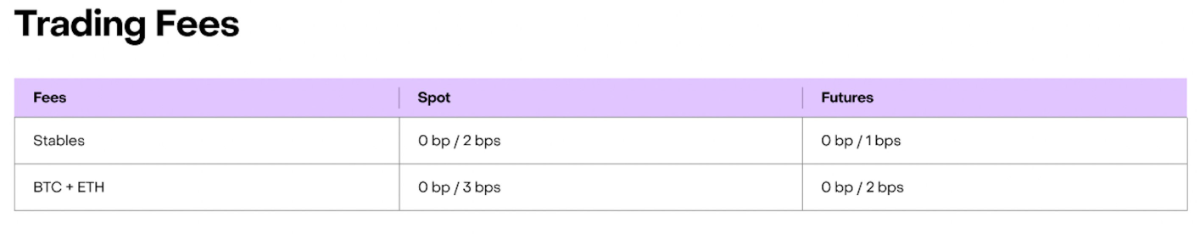

Very low transaction fees

At Vertex, the team is completely free of trading fees for the makers, while the fees for takers are also relatively cheap, ranging from 0.01 to 0.03% (compared to outside exchanges, it is about 0.1%), meaning Vertex is 10 times cheaper.

Why choose Vertex?

- Trade Spot & Perpetuals – Buy and sell your favorite assets. Trade spot on margin or utilize leverage on perpetual to amplify exposure or hedge risk.

- Universal Cross-Margin – Take advantage of portfolio margining. Manage one universal margin account includes all of your balances and positions to maximize capital efficiency — no more switching between accounts.

- Lightning-Fast Speed – Vertex is as fast as your favorite CEX with order-matching latency of 10 – 30 milliseconds. Execute trades seamlessly.

- Earn & Borrow – Vertex’s integrated money market lets you earn a yield on deposits automatically. Borrow assets against your margin with multiple collateral types.

- Self-Custody – Vertex is non-custodial. Only you have control over your assets. Take back control from CEXs.

- Intuitive & Streamlined App – Tap into a sophisticated yet simple UI. Integrated on/off-ramps and bridging, so you don’t need to leave the app.

Conclusion

Vertex is bringing a modern version of its decentralized exchange on Arbitrum. The platform will have all the usual features of a CEX that most DEXs lack, including lending, borrowing markets, bridging interfaces, fiat on/off, and trading tools advanced such as cross margin, limit order, and leverage.

Vertex has a lot to offer its users, and this potential only grows with time. All in all, Vertex will take DEX to the next level and, with it could inspire a new boom of “modernized” decentralized exchanges in DeFi.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Enjin Coin

Enjin Coin  Holo

Holo  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD