We asked Google Bard what factors can drive Bitcoin to $100k; Here’s what it said

Following Bitcoin’s (BTC) impressive rally to nearly $69,000 in late 2021, the maiden cryptocurrency has experienced several price fluctuations, leaving the market anticipating its next potential record-breaking milestone.

Many experts agree that the $100,000 level is Bitcoin’s next possible record target, fueling further speculation on when this milestone might be reached. In terms of predicting the next Bitcoin price action, generative artificial intelligence (AI) platforms like ChatGPT are increasingly being utilized to offer insights.

In light of this, Finbold sought insights from the latest generative AI offering, Google’s Bard. We posed the question to Bard: What can propel Bitcoin to $100,000?

Bard acknowledged the possibility of Bitcoin reaching $100,000 and identified four key drivers that could propel BTC to the level. However, the tool cautioned that it is not guaranteed that Bitcoin will hit the $100,000 mark.

Bitcoin’s drivers to $100k

Firstly, Bard recognized the role of mass adoption in driving the asset to new record highs. The tool noted that demand for the asset would likely increase as more individuals invest in Bitcoin, pushing the price up.

Secondly, Bard highlighted that institutional investors are a major catalyst for a Bitcoin rally. It is worth noting that Bitcoin’s previous record high was partly fueled by institutions like PayPal (NASDAQ: PYPL) and electric vehicle manufacturer Tesla (NASDAQ: TSLA) entering the cryptocurrency space. According to Bard:

“If institutional investors, such as pension funds and hedge funds, were to invest in Bitcoin, it would likely lead to a rise in the price. This is because institutional investors have a lot of money to invest, and their investments can significantly impact the price of assets.”

Furthermore, the AI platform suggested that increased government adoption of Bitcoin as a legal tender can boost investor confidence. In this case, the tool highlighted that government involvement in Bitcoin can legitimize the asset while getting a boost from its influence and control over the economy.

Lastly, Bard emphasized the importance of positive news in driving Bitcoin’s value. It noted that positive news could lead to excitement around digital assets.

Bitcoin price analysis

It is essential to consider that Bitcoin is currently in the process of recovering from the bear market experienced last year, which was influenced by concerns surrounding regulations and macroeconomic factors such as inflation. Currently, Bitcoin is trading within a consolidation phase, and its rally beyond $30,000 has been impeded by recent regulatory scrutiny.

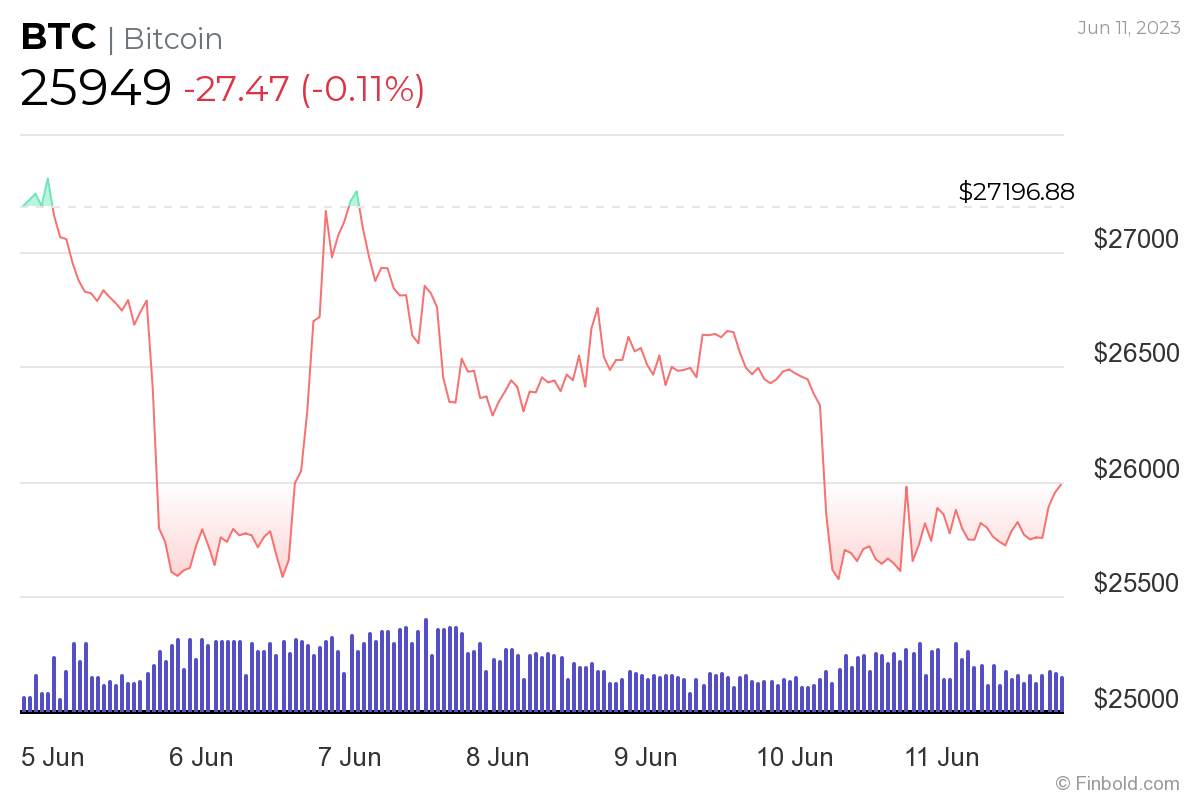

By press time, Bitcoin was trading at $25,949, reflecting a weekly loss of approximately 5%.

Moreover, Bitcoin’s technical analysis indicates a bearish outlook. According to TradingView’s one-day gauges, the sentiment suggests a ‘sell’ with a score of 14. The moving averages indicate a ‘strong sell’ sentiment at 12, while the oscillators remain neutral with a score of 7.

Currently, the short-term price movement of Bitcoin is heavily influenced by the regulatory actions taken by the United States Securities and Exchange Commission (SEC).

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  Gate

Gate  NEO

NEO  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Siacoin

Siacoin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Lisk

Lisk  Ontology

Ontology  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Nano

Nano  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD