Why A Bitcoin Monthly Close Above $23,000 Hints At More Momentum For The Bulls

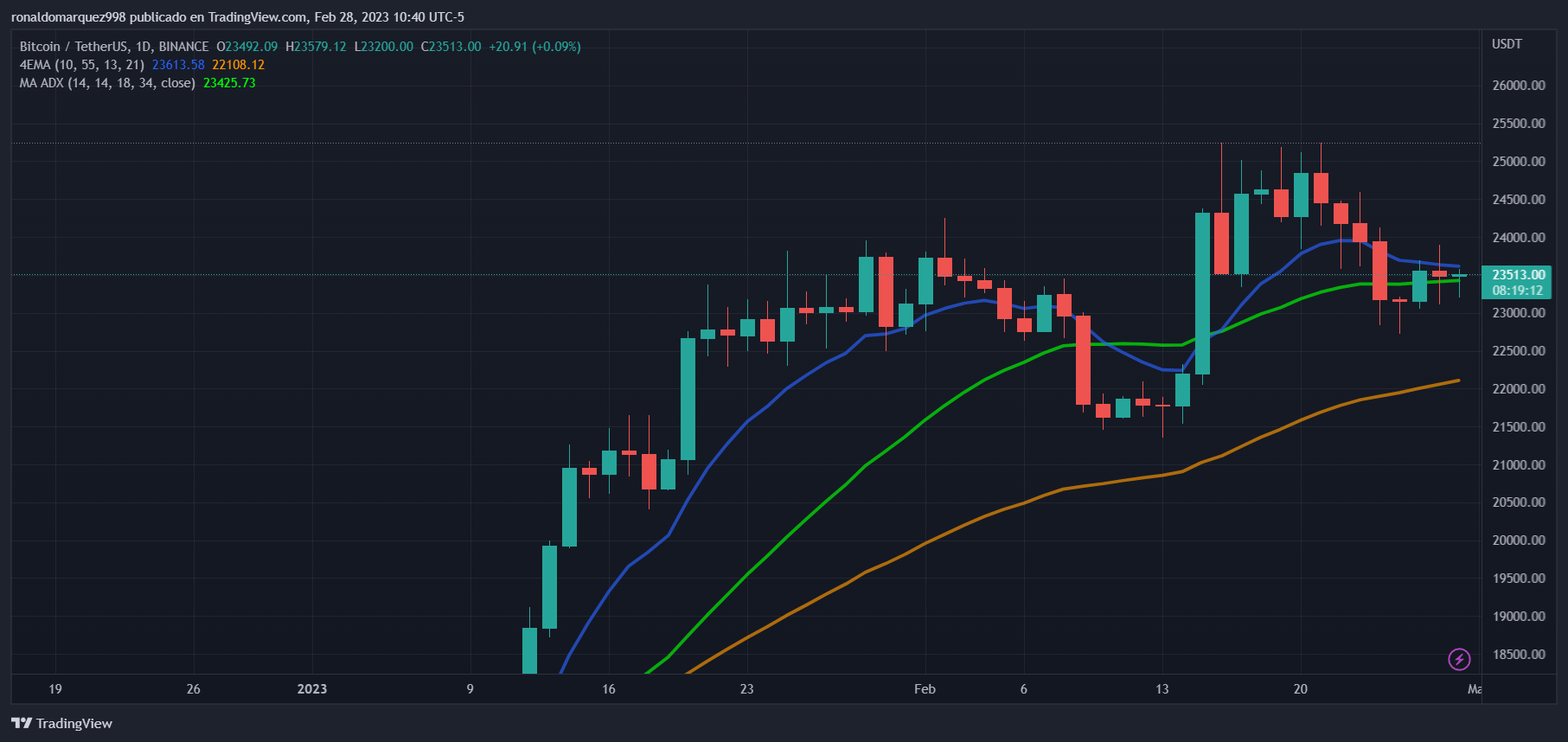

Bitcoin continues to hold above the $23,000 psychological level for bulls as it nears the end of the month. The industry’s largest cryptocurrency by market cap may have another continuation signal to conquer new annual highs in its 50-month moving average indicator.

This is a key threshold for Bitcoin if bulls expect an uptrend above the $25,000 resistance level. For the data and research analysis firm Material Indicators, a monthly close above the 50-month moving average (MA) could signal a medium-term win for the bulls.

Related Reading: Lido DAO (LDO) Holds 10% Gains On Weekly Chart While Majority Of Coins Shrink

What’s Ahead For Bitcoin In March?

According to a recent post on Twitter by an analyst from Material Indicators, the battle for the directional bias of BTC is currently being fought between bulls and bears at the 50-day moving average (MA). A close between the 50-month MA could lead to a green monthly close and a continuation of the range that Bitcoin has experienced in recent weeks.

In addition, a close above the 50-month MA will provide the bulls with the momentum they need to continue the uptrend BTC has been in since January and a further test of the nearest resistance walls holding the price action in the current range.

On the other hand, a close below $23,128 for Bitcoin could result in a red month for the largest crypto asset in the market, invalidating the uptrend and a possible retest of the lows and support levels that are key to prevent further declines in BTC’s price. Material Indicators said:

Would like to see more BTC bid liquidity enter the active trading range to increase the chances of closing the Monthly candle above the 50-Month Moving Average. Volume has been weak, so at this stage doesn’t feel bullish.

Bull Market Signal For BTC

Another bullish signal has been spotted on the Bitcoin charts, indicating the crypto-winter thaw and spring’s bloom in the BTC price.

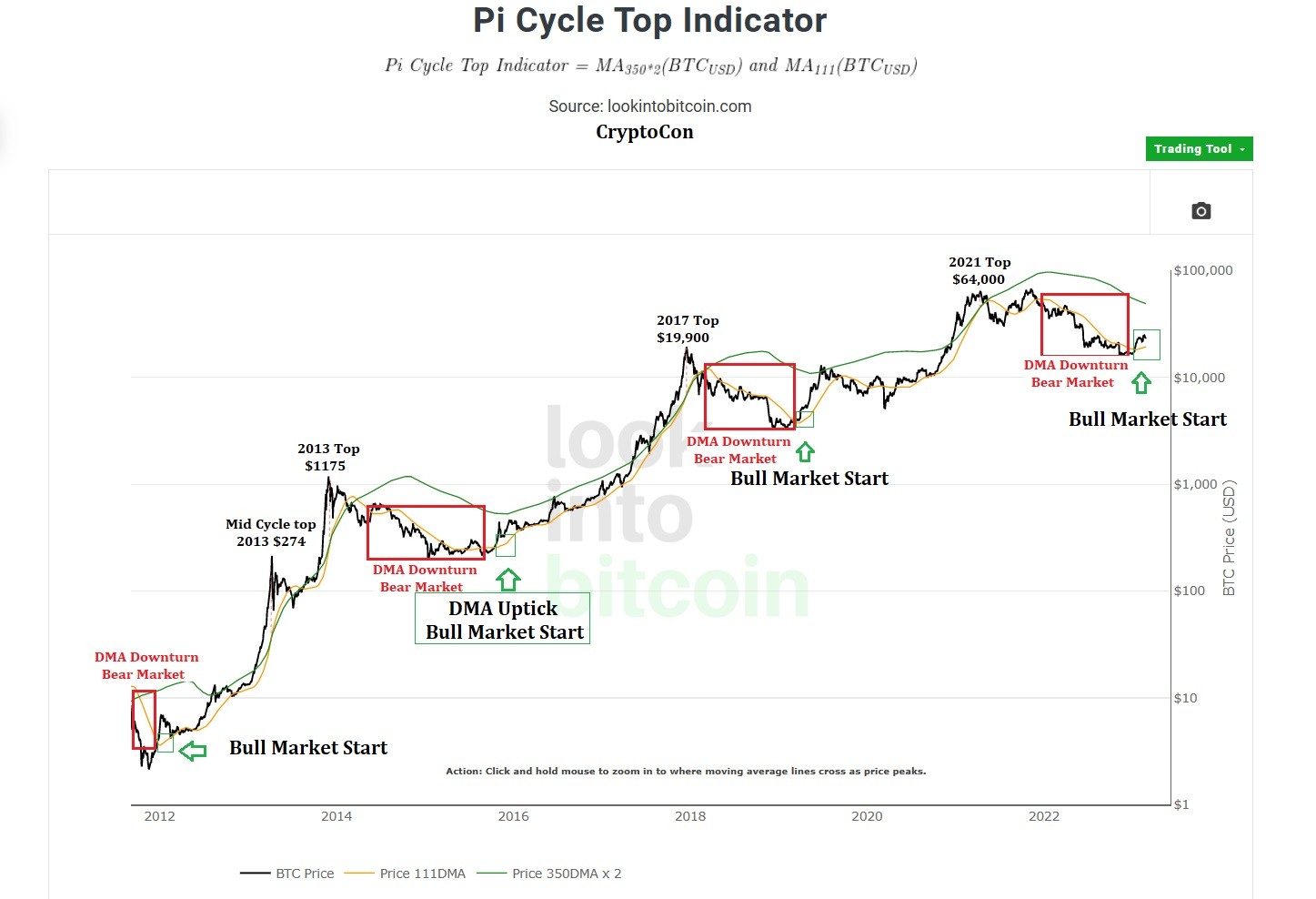

The Pi Cycle Top/Bottom Indicator predicts the cycle top and bottom of the Bitcoin market cycles. It attempts to predict the point at which the price of BTC will peak before falling and vice-versa. This indicator has historically been effective at predicting the market cycle timing tops within 3 days. It demonstrates the cyclical nature of Bitcoin’s price over longer time frames.

According to a Twitter post by CryptoCon, a technical analyst and long-term data researcher, the Pi Cycle top/bottom indicator has signaled the beginning of a new bull market.

CryptoCon noted that after a year of decline, the yellow 111-day MA has begun to ascend, as seen in the chart above.

This indicator uses the 111-day moving average (111-MA) and a newly created multiple of the 350-day moving average, the 350DMAx2 (the multiple is calculated from the values of the 350-MA, not the number of days). Whenever the 111 DMA has turned and peaked to the upside, it has marked the beginning of a bull market, as in the previous cycles of 2012, 2015, and 2020.

Related Reading: Dormant Bitcoin Now 16% Higher Than BTC In Exchange Reserves

BTC is approaching the monthly close well above $23,000, which could lead to a green close and a short-term win for the bulls. If not, the bears will test the supports at $22,500 for a possible further test of the $21,000 level.

Bitcoin is trading at $23,500, down -1.1% for the past 24 hours. BTC has seen a significant profit decrease in the broader time frame, with a drop of -5.2% over the past seven days. In the fourteen and 30-day time frames, it has managed to maintain gains of 7.8% and 2.1%, respectively.

Featured image from Unsplash, chart from TradingView.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Synthetix Network

Synthetix Network  Tezos

Tezos  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  NEM

NEM  Decred

Decred  Zcash

Zcash  Dash

Dash  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  HUSD

HUSD  Augur

Augur