3 cryptocurrencies to avoid trading in April

Although the cryptocurrency market has plenty of digital assets that have every reason to become a valuable investment for those ‘hodling’ it, sometimes it might be worthwhile to refrain from trading certain cryptocurrencies, at least for the time being.

Based on indicators such as ratings (such as the Weiss Crypto Ratings), historical performance, and recent developments (as well as their absence) in connection with certain crypto assets, Finbold has arrived at the list of three that crypto traders might want to avoid in April.

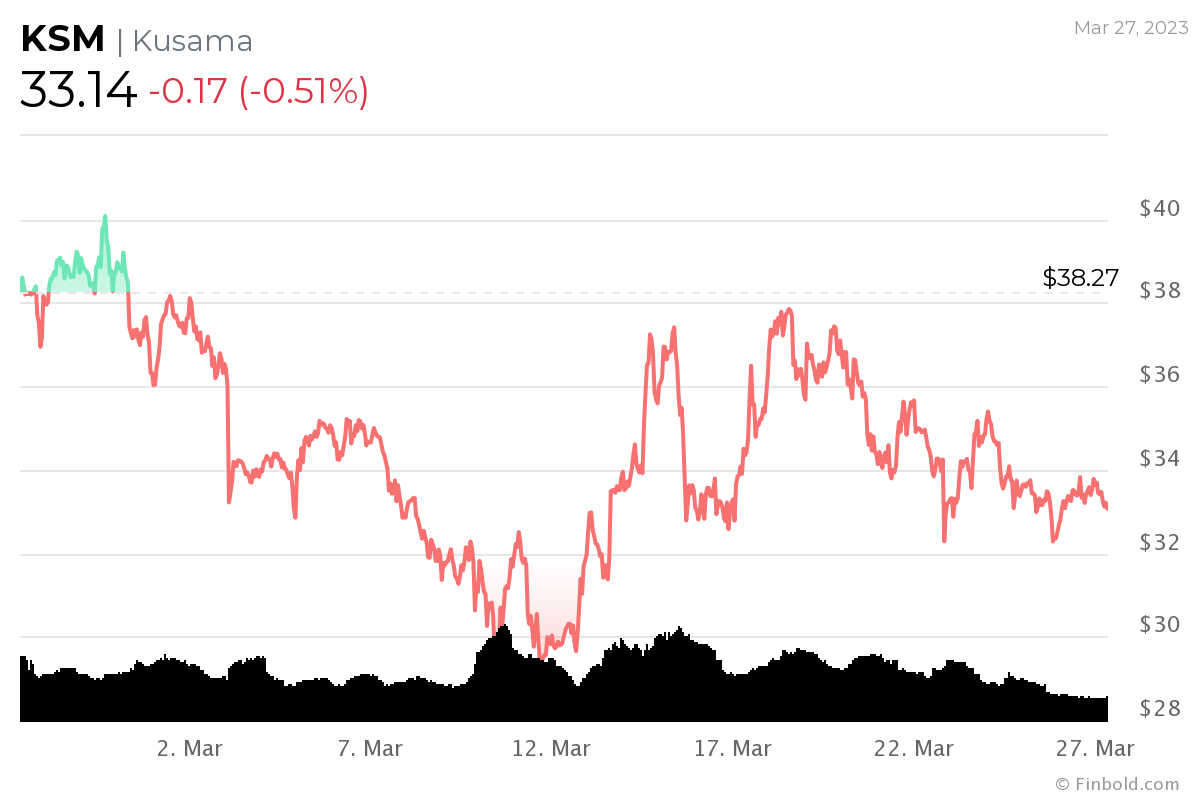

Kusama (KSM)

A pre-production blockchain version of the Polkadot (DOT) ecosystem using nearly the same codebase and branded its ‘canary network,’ Kusama (KSM) aims to be the experimental and developmental environment for new features that will eventually be deployed on Polkadot.

That said, KSM’s adoption and technology development have both been rated as ‘very weak’ (E-), with hardly any news in the past month, as well as receiving a ‘weak’ score (D+) for the coin’s market performance, which has seen declining trading volume, while its price lost 0.51% on the day, 9.91% in the last week, and 13.4% on its monthly chart, currently standing at $33.14.

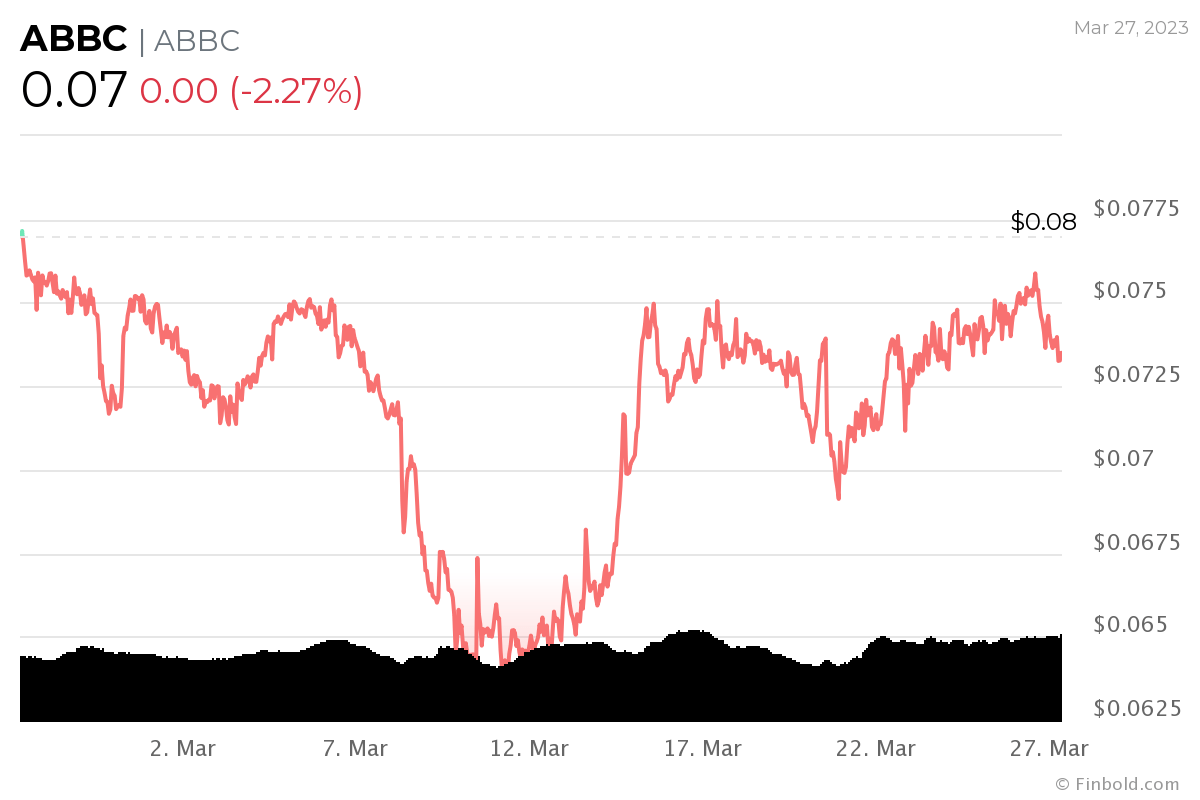

ABBC (ABBC)

Another coin with poor technology and adoption (E-), as well as the market score, is ABBC (ABBC), a blockchain platform that aims to allow secure transactions using integration with facial recognition, as well as offering crypto services like Aladdin Wallet and Aladdin Pro.

Despite these promises and the launch of a new staking portal on Aladdin Exchange, CoinMarketCapdata shows there are currently only 62 holders of the ABBC coin. Moreover, in spite of gaining 2.65% across the week, its price has declined 2.27% in the last 24 hours and 6.22% over the past 30 days, currently trading at $0.07.

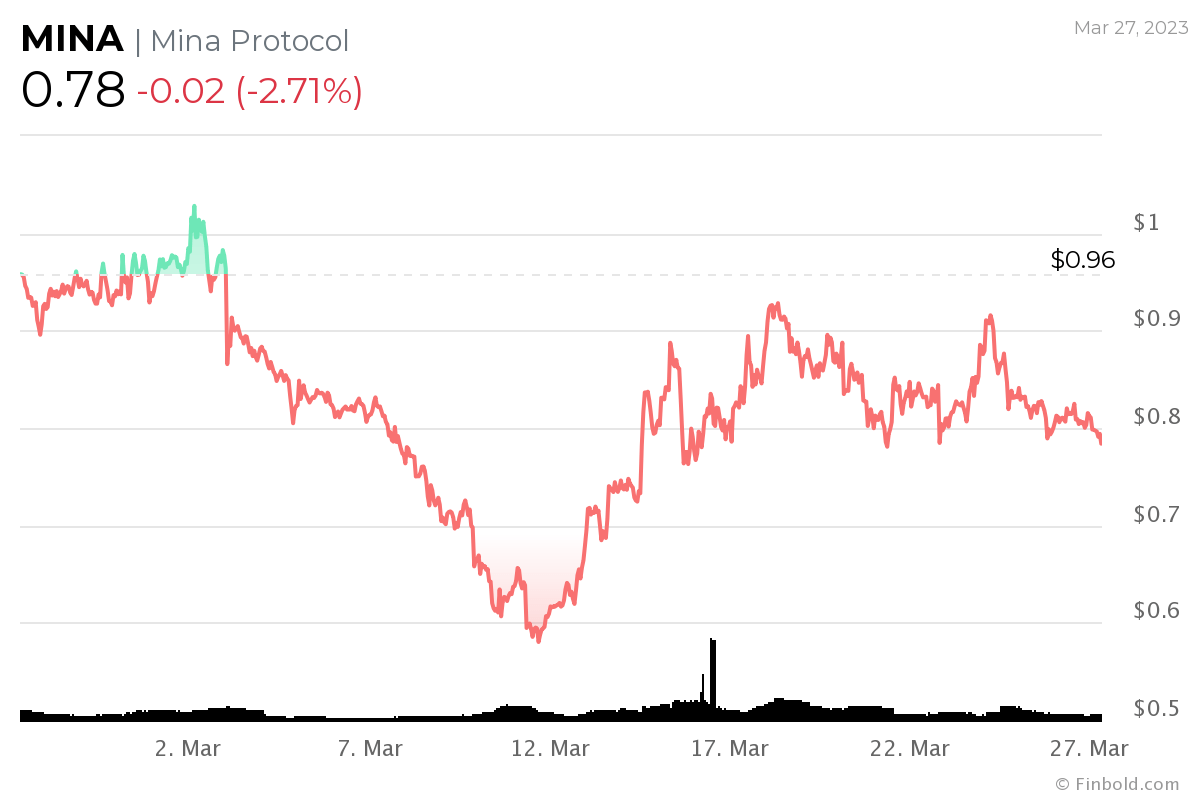

Mina Protocol (MINA)

Meanwhile, Mina Protocol (MINA), which is building a privacy-preserving gateway with an aim to become the world’s first zero-knowledge (ZK) blockchain, has received a better market performance grade than the two previous assets due to its fair market momentum.

On the other hand, its technology and adoption grade is only slightly better but still with a ‘very weak’ score of E+, despite the continuous chatter around ZK technology. At press time, MINA was trading at the price of $0.78, recording a daily decrease of 2.71%, in addition to falling 10.47% over the week and 17.63% in the last month.

Conclusion

Having said that, the crypto market often throws in some unexpected twists, such as losing tens of billions to its market capitalization in a matter of hours, so even the above-mentioned cryptocurrencies could show progress in the future, despite it seeming unlikely for the moment.

This is why it is important to have patience, observe the market movements, developments, and sentiment carefully, as well as do due diligence in studying each digital asset before investing any significant amount of money into it.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond