SHIB Could Breakout Downwards Despite a $10M Accumulation

Today, on-chain analyst Lookonchain reported that the largest holder of Shiba Inu (SHIB) accumulated another 1.5 trillion tokens. According to the smart money analyst, the operation occurred on two of the world’s largest exchanges— Coinbase and Binance.

The largest holder of $SHIB accumulated 1.5T $SHIB ($10M) from #Binance and #Coinbase again 4 hrs ago.

Address»0x40B3″ holds 5.3T $SHIB($35.5M), and transferred 20T $SHIB($134.4M) to address «0x73AF» on May 16.

The whale is the largest holder of $SHIB excluding exchanges. pic.twitter.com/irMR39mfwE

— Lookonchain (@lookonchain) June 13, 2023

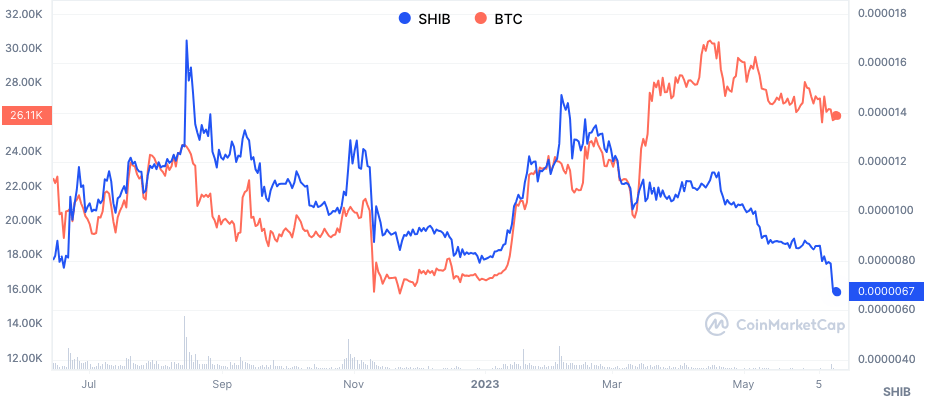

Usually, this sort of action implies that the whale was accounting for the long-term, especially as SHIB’s price action has been unimpressive of late. On a Year-To-Date (YTD) basis, SHIB has lost more than 45% of its value.

This reflects how the token has significantly decoupled from Bitcoin (BTC) which is on a 53% hike since the year began.

SHIB Historical Price Against Bitcoin |Source: CoinMarketCap

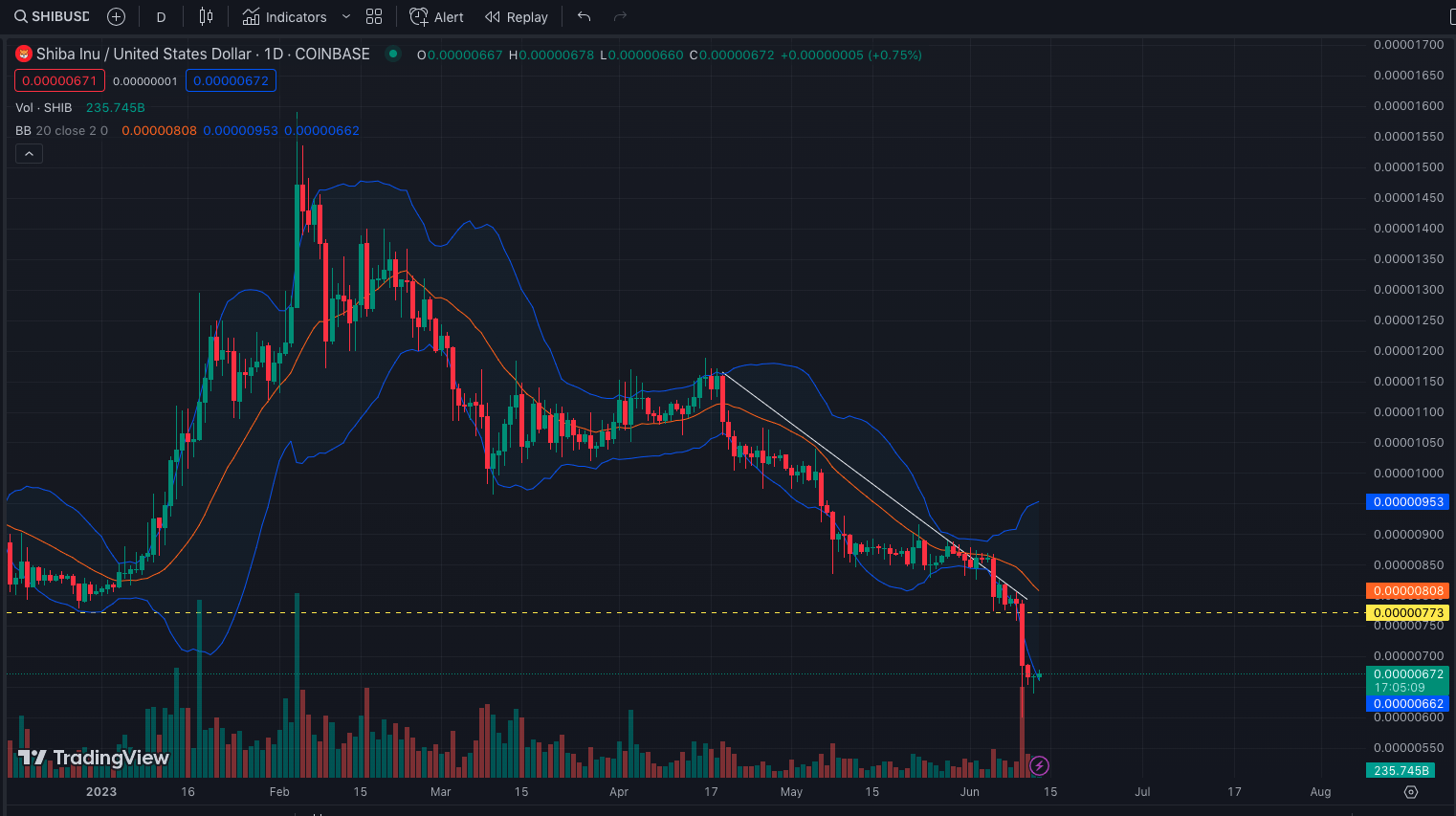

Bulls Need Buying Pressure at $0.00000662

Accoridng to the SHIB/USD daily chart, the token has not halted its nosedive. After a repeated test of the $0.0000077 support on June 5 and 8, SHIB succumb to bearish demand at $0.00000662.

However, at its press time price, SHIB exhibited extreme signs of volatility, the Bollinger Bands (BB) revealed. Also, the $0.00000673 price hit the lower band of the BB. This indicates that SHIB has been oversold.

Therefore, there could be an entry point around the region for a possible short-term recovery. Nonetheless, this would require buying pressure, and if bulls desire a reversal, they’d need to protect the $0.00000662 level from the dominance of bears.

SHIB/USD Daily Chart | Source: TradingView

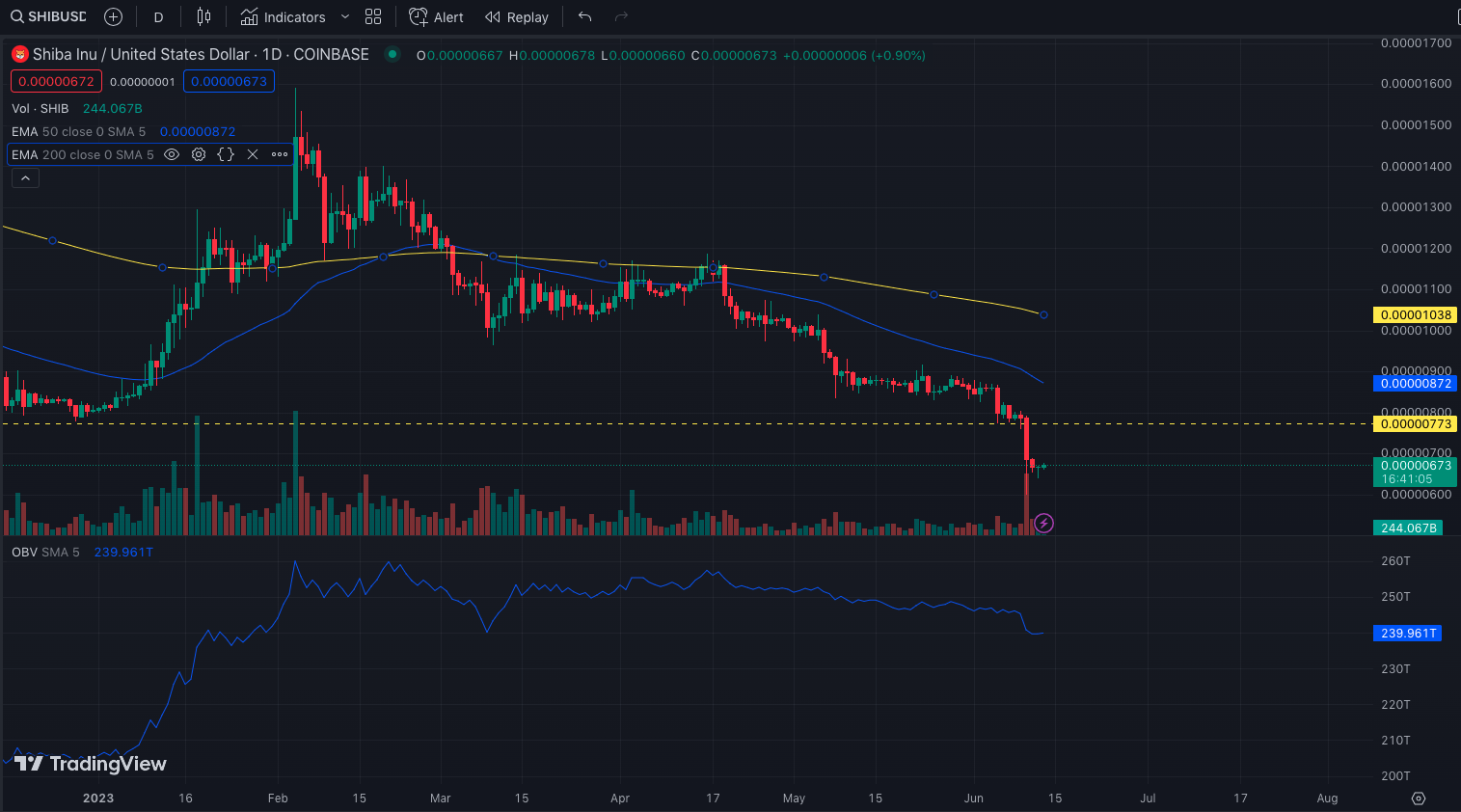

Furthermore, the 50-day EMA (blue) had crossed below the 200 EMA (yellow). When this occurs, it means that SHIB’s momentum could remain bearish.

A slide Down the charts Is on the Cards

Meanwhile, the On-Balance-Volume (OBV) had fallen to 239.96 trillion. The decline in the OBV suggests that distribution was taking place. This also reflects a negative volume pressure. Since SHIB’s price did not close higher, the OBV state signals a downward breakout warning.

SHIB/USD Daily Chart | Source: TradingView

In other developments, Shiba Inu was struggling to keep its burning mechanism alive. According to Shibburn, the burn rate had decreased by 81.82% in the last 24 hours.

The mechanism involved sending some SHIB tokens to dead wallets in order to reduce the total supply. In the long term, this is supposed to stabilize the Shiba Inu ecosystem while increasing the token price.

Despite burning a total of 410 trillion tokens, SHIB has failed to keep up with the hikes of the broader market. With its current condition, the toke might not provide respite anytime. So, holders might need to focus on long-term price action rather than short-term gains.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Holo

Holo  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  Ontology

Ontology  Decred

Decred  NEM

NEM  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur