Solana (SOL) Could Recoup Losses In Last 7 Days – Here’s How

Solana continues to paint its charts in red, registering declines on its intraday, weekly, biweekly, monthly and year-to-date price metrics.

- Solana loses over 7% of its value over the last seven days

- SOL’s extended bearish movement will likely pull the asset below $25

- Solana’s current TVL is less than a billion

The crypto has already lost 89.3% of its November 6, 2021 all-time high (ATH) of $259.96 and is currently trading at $27.81 according to tracking from Coingecko at the time of this writing.

Over the last seven days, the altcoin dropped by 7.4%. On a 14-day period, Solana declined by over 15% as it failed to make any kind of recovery for quite some time now.

As if the cryptocurrency hasn’t suffered enough already, its analysis points indicate it is due for a bearish pull in this extended crypto winter.

Solana Seen Dropping Before Bouncing Back

After Solana fell below the crucial $30 marker, its chart had red candlesticks for three straight days, putting its trajectory into a further decline.

The digital asset’s problems became bigger when it dropped below $28 as its 20 and 50 Exponential Moving Average (EMA) indicated sellers having a huge advantage this time.

Related Reading: AVAX Sheds 50% Over The Last 60 Days – More Losses Ahead?

Source: TradingView

A piece of good news, however, is that despite having another bearish run, Solana managed to keep its hopes of making a bounce back intact.

A massive downward pull will likely put the altcoin in $26.3 support which will give sellers the opportunity to do their work and deflate SOL’s price further, all the way to $24.

After this, the digital coin is seen to have some breathing room and prepare for an upward price rally which will target the $27 to $29 range.

If Solana manages this, it will recover some of its losses over the last week. Analysts, however, are seeing a slow moving phase for the crypto asset.

Solana’s DeFi Locked Value Plummets To Under A Billion

Solana used to rival some of the more prominent blockchains in terms of its Decentralized Finance (DeFi) total value lock (TVL).

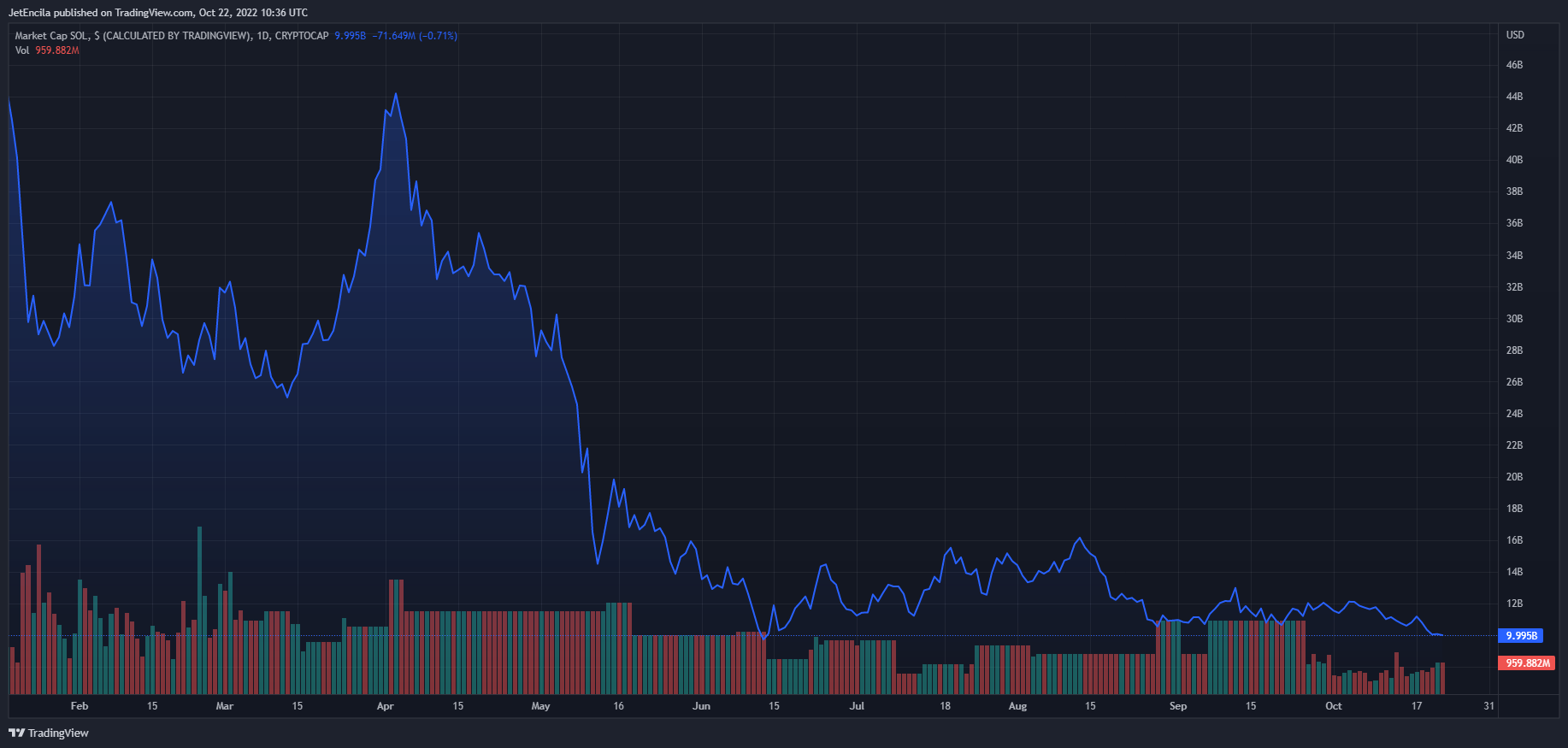

Just last year, the network’s TVL recorded a massive surge as it reached over $10 billion. However, at press time, that value significantly dropped and is at just above $860 million.

Not only did Solana’s TVL dried up, it is in danger of going down even more as the DeFi industry has lost a lot of its momentum.

It would appear not many people are willing to gamble and take risks in a market that is under a bearish streak.

If this continues, SOL will likely end-up falling below the $25 marker and will lose any chance of triggering a bullish rally on the way to hitting another all-time high.

Related Reading: Uniswap Coin’s Bullish Trajectory Sets UNI To Breach $7 Level – Time To Buy?

SOL total market cap at $9.9 billion on the weekend chart | Featured image from Analytics Insight, Chart: TradingView.com Disclaimer: The analysis represents the author’s personal views and should not be construed as investment advice.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  Stacks

Stacks  Cosmos Hub

Cosmos Hub  OKB

OKB  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Synthetix Network

Synthetix Network  Zcash

Zcash  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Ravencoin

Ravencoin  Siacoin

Siacoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Huobi

Huobi  Status

Status  Waves

Waves  Lisk

Lisk  Numeraire

Numeraire  Hive

Hive  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom