Dogecoin price crashes over 8% in 24 hours; Is DOGE still bullish?

Meme cryptocurrency Dogecoin (DOGE) emerged as a stand-out digital asset over the last week, gaining momentum in reaction to Elon Musk’s acquisition of Twitter (NYSE: TWTR). However, the token’s sustainability of the rally is now a focal point after recording minor losses.

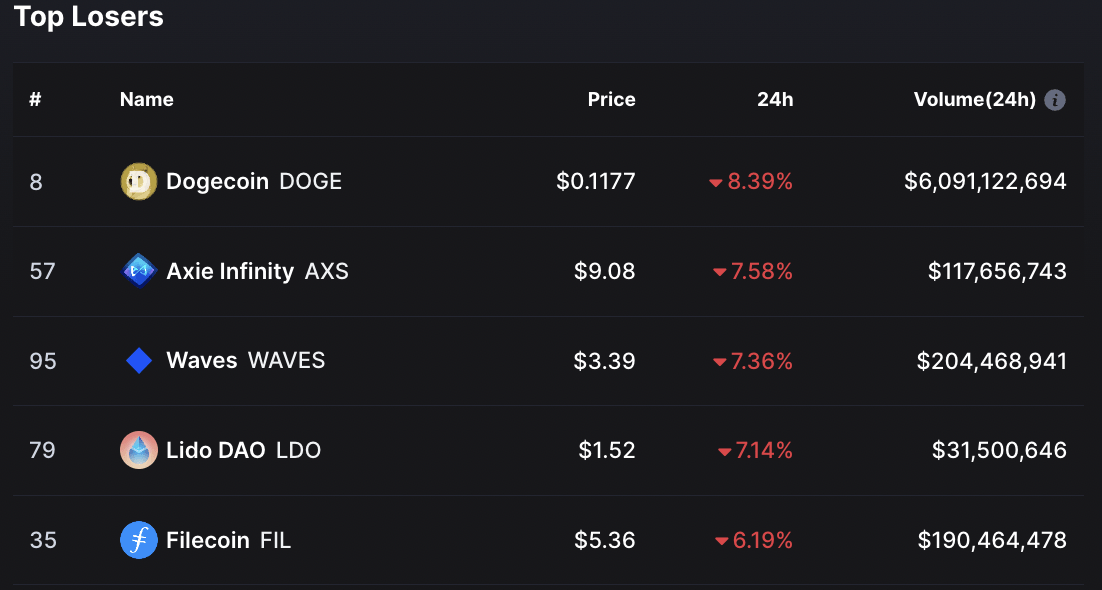

In particular, by press time, Dogecoin was trading at $0.11 with losses of over 8% in the last 24 hours. The token’s weekly chart indicates that the price peaked at $0.14 on October 29.

At the same time, following DOGE’s recent correction, the asset has emerged as the biggest daily loser among the top 100 cryptocurrencies by market cap tracked by CoinMarketCap.

Triggers for DOGE’s correction

Although DOGE’s price correction can be attributed to the general crypto market movement, it can also be argued that investors are likely taking the profit out of the eighth-ranked cryptocurrency by market capitalization. The latest downturn follows DOGE’s weekly gains of over 100%.

It is worth noting that most investors appeared to rediscover their interest in DOGE after the Twitter deal emerged. Notably, before the deal’s announcement, the token wasn’t performing well after being weighed down by the ongoing crypto winter.

Furthermore, besides the apparent profit taking, a section of investors probably believe that after Musk’s Twitter deal was finalized, there is likely no other possible trigger to push the price up.

Impact of Musk on DOGE

Indeed, there is a projection that DOGE might find use cases under Twitter, considering that Musk has been an avid supporter of the token. At the same time, Musk’s electric vehicle company Tesla (NASDAQ: TSLA), already allows the use of Dogecoin to purchase merchandise.

Interestingly, there is anticipation that DOGE might be used as a tipping mechanism on social media. Already, Bitcoin (BTC) and Ethereum (ETH) are the two tipping assets on Twitter.

With the question of sustainability of the recent rally, it can be assumed that the asset’s existing few use cases might be the main inhibitor. Additionally, DOGE is far from being considered a formidable store of wealth. Due to these limitations, the asset’s rally is purely speculative at this point.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD  Bitcoin Diamond

Bitcoin Diamond