CPI Reduces Interest Rates Announcement Comes to Rescue Crypto

The U.S. Bureau of Labor Statistics reported that the Consumer Price Index for all urban consumers (CPI-U) rose by 0.4 percent in October on a seasonally adjusted basis, which is the same increase as in September. This mere 0.4 increase seems to give a little breathing space for the crypto market.

The crypto market came tumbling down with the leaked FTX balance sheets that revealed a void of $10 million. Followed by this revelation, the CEO of Binance sold all the FFT tokens to the free market which made the prices of the tokens tumble.

Following that Changpeng Zhao decided to acquire FTX exchange but finally withdrew from the acquisition citing many reasons. Due to the occurrence of this incident, the crypto industry took a big hit.

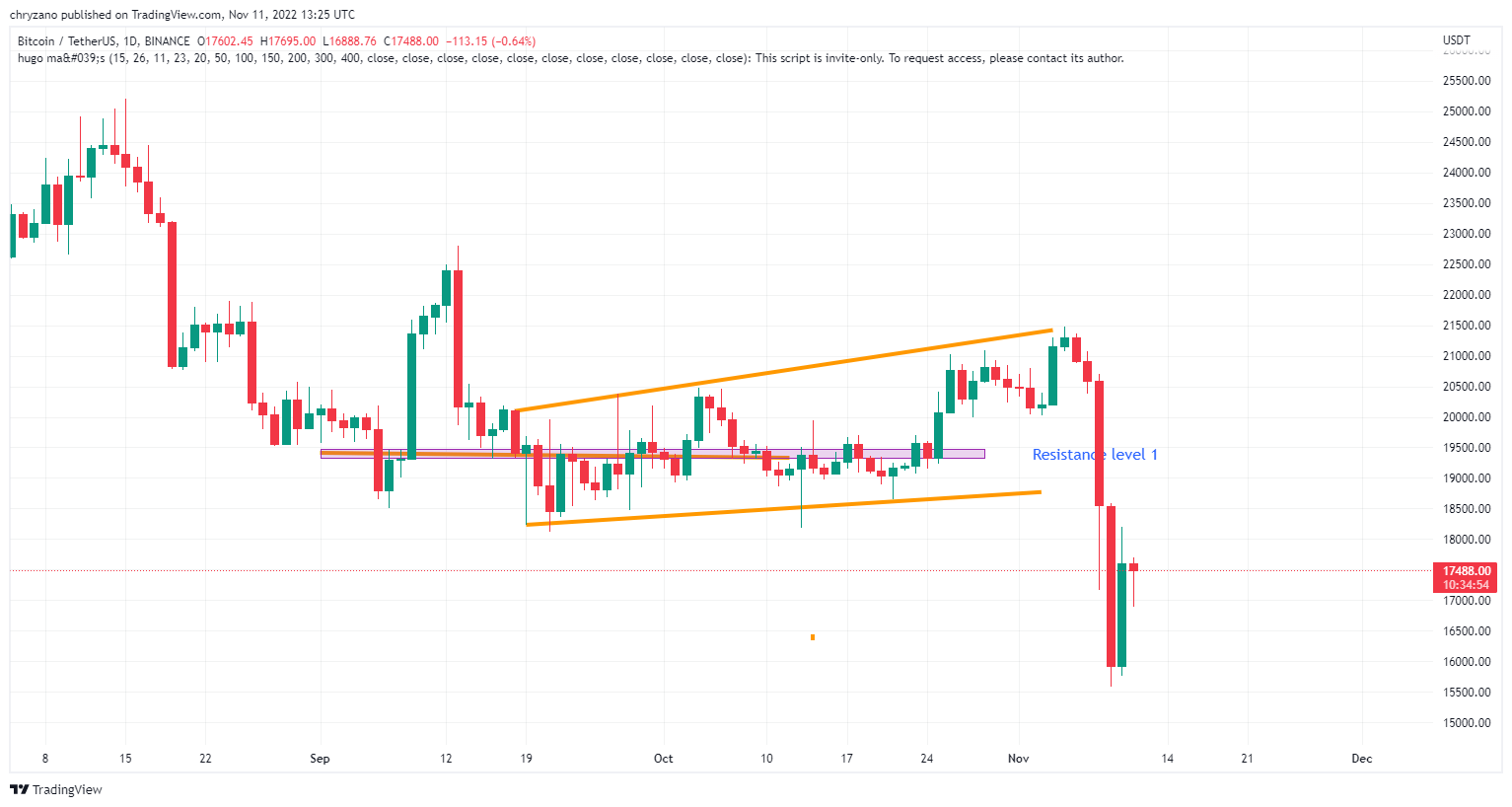

Notably, Bitcoin was moving sideways in the month of October fluctuating within a thin frame of prices. But with the crash of FTX, BTC which was trading at $21,300 on Monday fell down to $17,570 during the course of five days.

As of press time BTC is trading at $17,561. However, if the bulls could keep BTC pushing, it could take BTC to Resistance Level One which lies near $19, 400. Notably if not for the FTX crash, BTC would have been fluctuating in the normal region as mentioned above.

Bitcoin/Tether USD 1D Binance on TradingView

Ethereum which also was moving sideways took a deep fall with the FTX crash. Although the price of Ethereum fell from $1,642 to $1,100 in quick succession with the fall of FTX, there seems to be some momentum in Ethereum as the prices are trying to rise.

Additionally, Ethereum which is priced at $1,300 could reach Resistance Level One if the bulls keep pushing the price up. Viceversa, if the bears take control of the situation then Ethereum may land on Support Level One, as shown in the graph.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur