‘Rich Dad’ R. Kiyosaki shares his stance on current crypto market downturn

Robert Kiyosaki, the author of the personal finance book ‘Rich Dad, Poor Dad’ has delved into the current state of the cryptocurrency market as the effects of the FTX exchange saga continue to manifest. The crisis has resulted in assets like Bitcoin (BTC) failing to hold critical positions while facing a threat of further correction.

However, Kiyosaki believes that a possible Bitcoin drop to about $10,000 should be exciting while noting that he is ‘not worried’ with the current price trajectory, he said in a tweet on November 11.

At the same time, the author hailed gold and silver as stand-out assets to invest in while hitting out at the Federal Reserve and the Treasury policies.

“BITCOIN? WORRIED? No. I am a Bitcoin investor as I am an investor in physical gold, silver, & real estate. I am NOT A TRADER or flipper. When BITCOIN hits new bottom, $10 to $12 k? I will get EXCITED, not worried. I bet against the Fed, Treasury, Biden, & bet on G,S, & Bitcoin,” Kiyosaki said.

Kiyosaki’s support for Bitcoin

Notably, Kiyosaki has emerged as a long-term supporter of Bitcoin despite the asset operating in an extended bear market. The author has previously warned of an upcoming market crash while stressing that Bitcoin can be a cushion in such an environment.

As reported by Finbold, Kiyosaki asserted that Bitcoin could protect wealth but stressed that the asset does not guarantee safety for incomes.

According to Kiyosaki, a potential crash would result from the central bank’s policies to handle the skyrocketing inflation.

Bitcoin bears remain in control

Despite Kiyosaki’s bullish stand on Bitcoin, the asset’s possible price bottom took a hit following the FTX crypto exchange liquidity crunch. Notably, Bitcoin has breached the $20,000 level correcting to $16,000. By press time, the flagship cryptocurrency was trading at $16,800.

Bitcoin has continued to sustain a high selling pressure, as witnessed by the significant capital outflow. In particular, by press time on November 11, Bitcoin had a market cap of $323.38 billion, representing a loss of $85.32 billion from the $408.7 billion recorded on November 5.

Bitcoin technical analysis

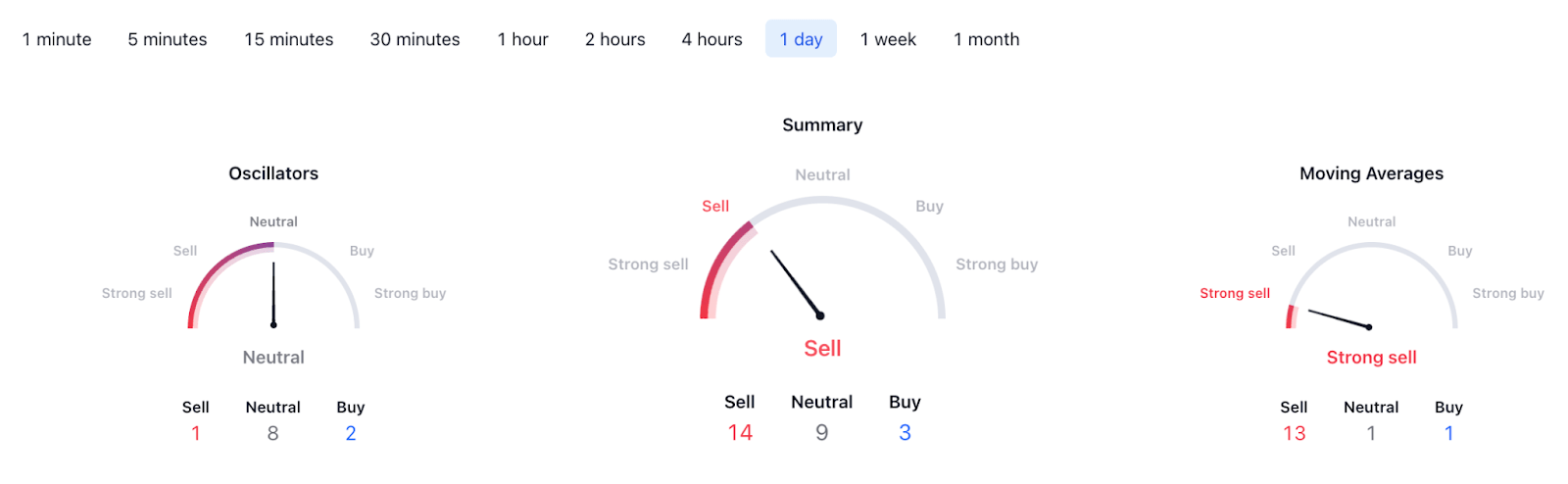

Elsewhere, Bitcoin technicals are predominantly negative, with a summary aligning with ‘sell’ at 14. For moving averages, they point to a ‘strong sell’ at 13, while oscillators are neutral at eight.

Although Bitcoin had found some relief following the slight drop in the U.S. inflation rate, the bears are still battling to take control. In this line, as per a Finbold report, Jeffrey Tucker, the founder of Brownstone Institute, suggested that Bitcoin could retest the $10,000 level while projecting the bear market might extend further.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Featured image via Ben Shapiro YouTube

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Decred

Decred  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Pax Dollar

Pax Dollar  Enjin Coin

Enjin Coin  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD