DYDX and TWT Prices Soar as Decentralized Services Become New Safe Havens

Over the past couple of weeks, the events that played out have led people to consider decentralized wallets and exchanges over their centralized counterparts.

The coins behind decentralized wallets and exchanges are rallying this week. Trust Wallet (TWT) is up by 129%, GMX by 55%, and DYDX by 70% from the candle opening of Nov. 10, according to data from TradingView.

The tweets from Changpeng Zhao, the CEO of Binance, about Trust Wallet acted as a catalyst for the rally of TWT.

The collapse of centralized exchanges.

The events related to FTX unfurled one after the other, eventually resulting in the FTX group declaring bankruptcy. Just when the crypto community believed it could not get worse, the FTX exchange suffered a $400 million hack. The community speculates that it was an inside job.

After the collapse of FTX, centralized exchanges were releasing their Proof of Reserves to promote transparency. During such releases, it was found that Crypto.com has Shiba Inu as 20% of its reserves. Before publishing their Proof of Reserves, the exchange withdrew 210 million USDT from Binance and 50 million USDC from Circle. Apart from that, various other discoveries led to a 50% tank in the price of CRO, the native token of Crypto.com.

Crypto.com is also one of the sponsors for the upcoming FIFA World Cup 2022, just like FTX, who spent millions of dollars sponsoring sports events.

Transition from centralization to decentralized services

During bull markets, users preferred centralized exchanges over decentralized ones because of the easy User Interface (UI) and convenience. They found DEX unusable due to various complexity present.

The collapse of various centralized exchanges over 2022 has now led users to transition to their decentralized counterparts. There is a realization of the importance of self-custody, and the popular crypto phrase, “Not your keys, not your crypto,” says it all. Notable crypto influencers are urging to get the cryptos off the exchanges.

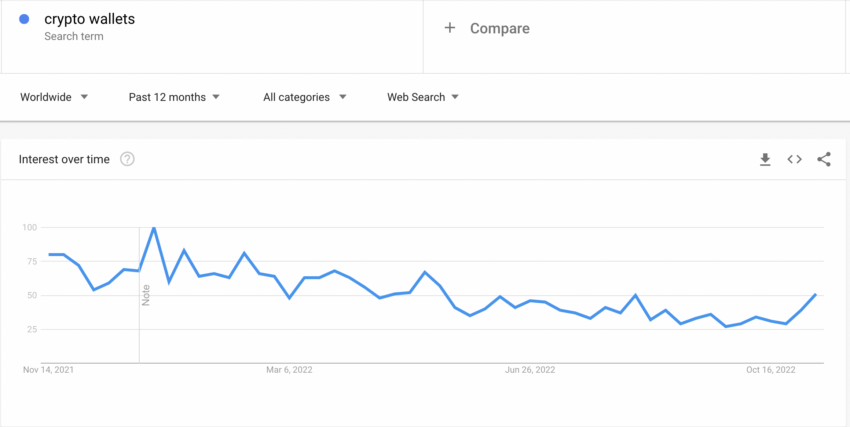

There is also a recent spike in the search term ‘crypto wallets’ according to data from Google Trends.

Source: Google Trends

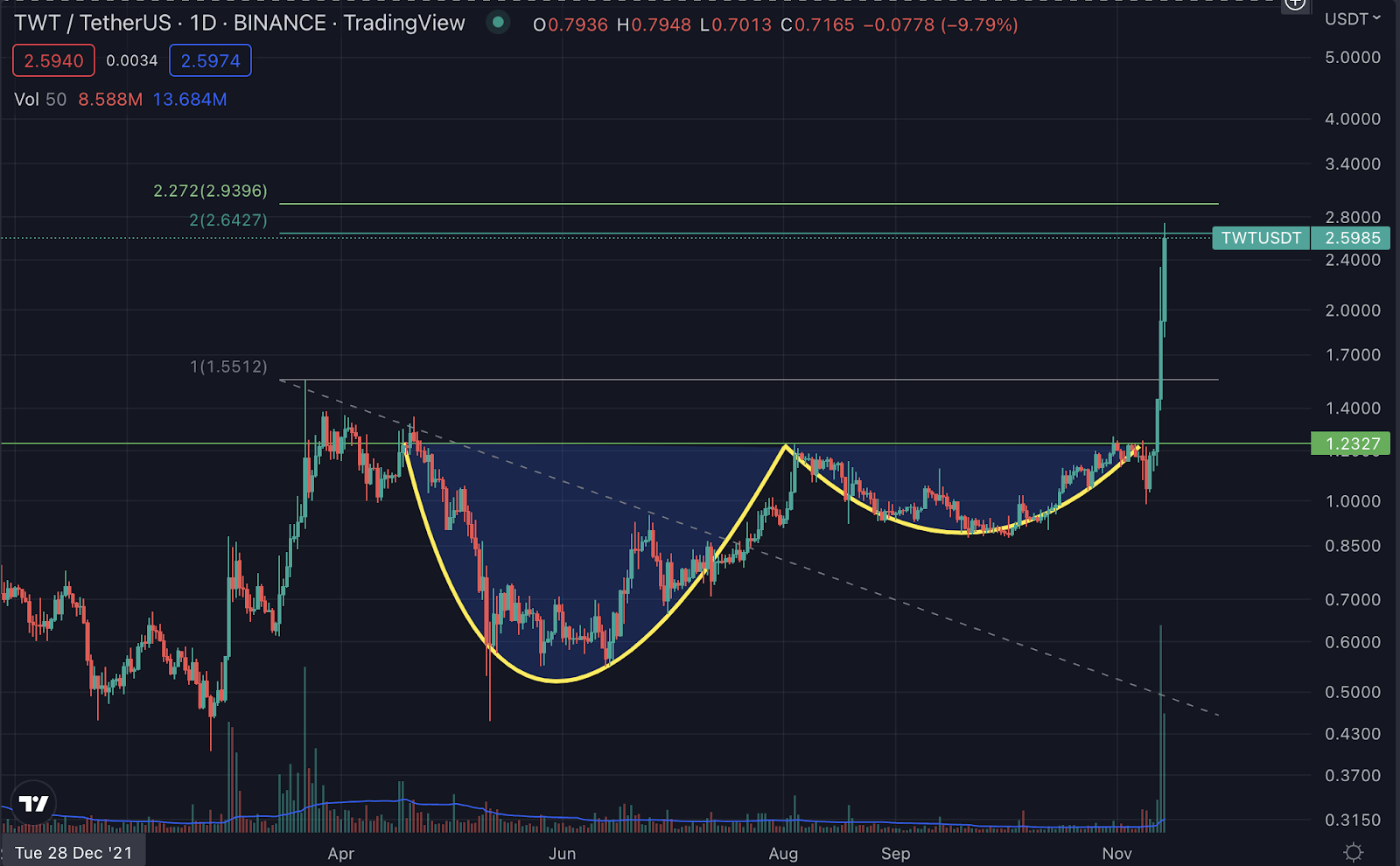

TWT price-action

TWT formed a clear cup and handle pattern in the weekly timeframe before the breakout. The coin that has been pumping from Nov 10, when Binance announced not to pursue the FTX breakdown, finally breached the neckline at $1.2327 on Nov 12. It is trading at an all-time high now.

TWT will face immediate resistance at $2.6427, which is 2 Fibonacci retracement levels drawn from March 2022 highs to May 2022 lows. The next resistance will be between $2.9396 to $3 because the area has 2.272 Fibonacci retracements and a psychological resistance of $3.

Source: TradingView, TWT/USDT

DYDX price prediction

DYDX seems to form a solid double-bottom base. With the support of volume, a close above the neckline at $2.578 can send the price over the $5 level. However, the same neckline is a strong resistance as of now.

Source: TradingView, DYDX/USDT

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  LEO Token

LEO Token  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Pax Dollar

Pax Dollar  Ontology

Ontology  Enjin Coin

Enjin Coin  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD