Why traders should keep their eyes on dYdX price for the rest of November

- dYdX price rose by 130% in less than a week.

- The Volume Profile Indicator shows the largest influx of bullish volume this year.

- Invalidation of the uptrend scenario requires a breach below the $1.45 support for confirmation.

dYdX price should be on every trader’s watchlist. After outperforming nearly all cryptos this month, the technicals suggest more gains could occur. Key levels have been defined to gauge DYDX’s next potential move.

dYdX price is one to watch

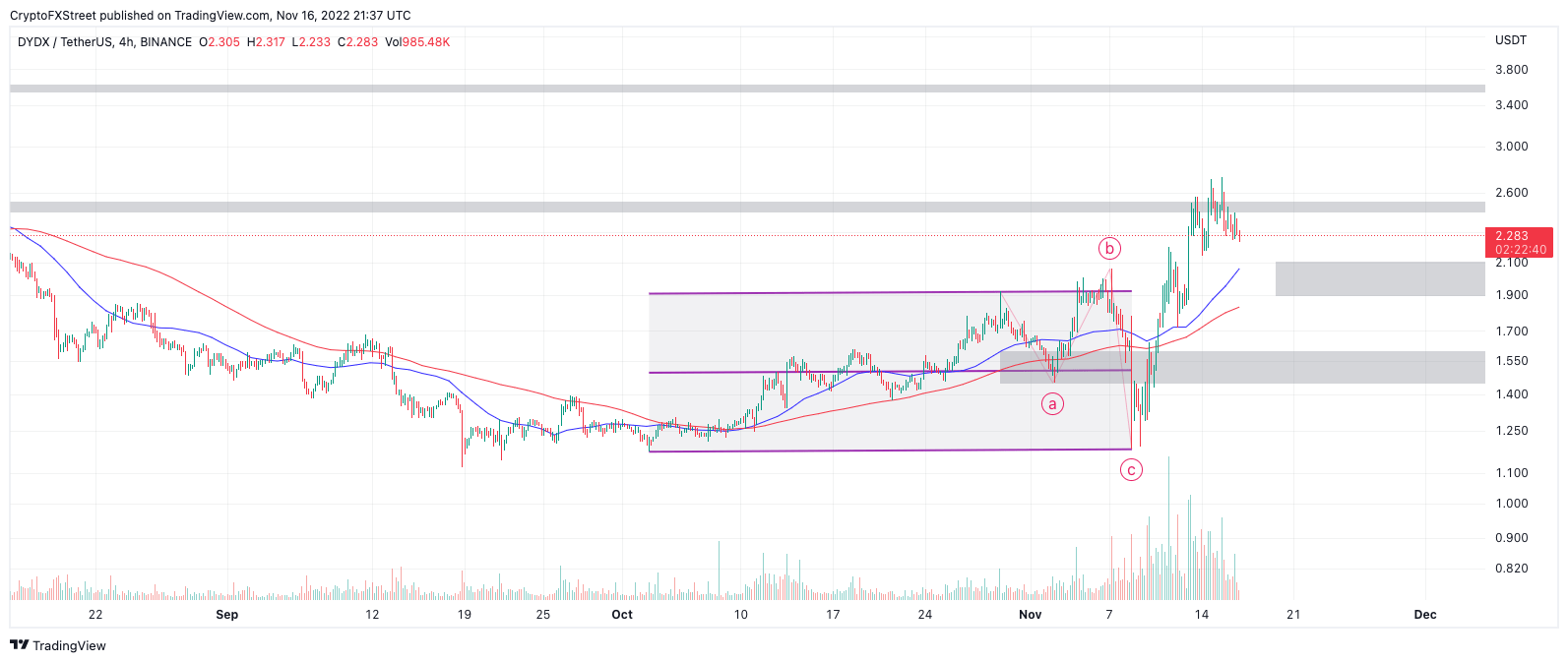

dYdX price has portrayed applaudable strength in the crypto market. While most altcoins have succumbed to Bitcoins’ demise, DYDX has diverged from the pact. During November’s third trading week, the bulls produced a jaw-dropping 130% rally. As the price cools off, there are subtle signs embroidered in the technicals suggesting the uptrend rally is far from over.

dYdX price currently auctions at $2.20 as a profit-taking consolidation occurs near the top of the newly established rally. During the ascension, the Volume Profile Indicator showed the largest uptick in transactions this year while producing a classic ramping pattern. The 8-day exponential moving average (EMA) and 21-day simple variant were dually breached during the uptrend move.

DYDXUSDT 8-hour chart

From a technical standpoint, the DYDX price rally looks genuine enough to aim for higher targets. If market conditions persist, the $3.55 and $4.00 liquidity zone stands a fair chance of being breached. Still, after such an impressive rally, traders should expect a deeper pullback as the recently breached 8-day EMA has yet to be retested. A plummet toward $1.90 could provide an excellent entry for the next swingtrade aiming for $3.55.

Still, every uptrend rally can halt no matter how promising the technicals seem. Invalidation of the bullish thesis could occur if the $1.45 support zone is breached. If the bears tag the invalidation level, a sweep-the-lows event could occur, targeting the recent double bottom near $1.12. Such a move would result in a 50% decrease from the current DYDX price.

In the following video, our analysts deep dive into the price action of Bitcoin, analyzing key levels of interest in the market.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  TrueUSD

TrueUSD  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD  Ren

Ren