Have Crypto Markets Reached Bottom?

While the recent spike in price volatility is subsiding, don’t expect institutions to re-enter crypto markets with any force just yet.

These large-scale investors have been spooked by recent volatility that is difficult to predict and may send their investments spiraling downward. Bitcoin’s support has already fallen about 13% over the past 10 days amid the unraveling of crypto exchange FTX. Its recent price at about $16,500 is less than a quarter of what it was just a year ago.

But this latest twist is odd given investors previous concerns about a lack of volatility that has plagued markets for months.

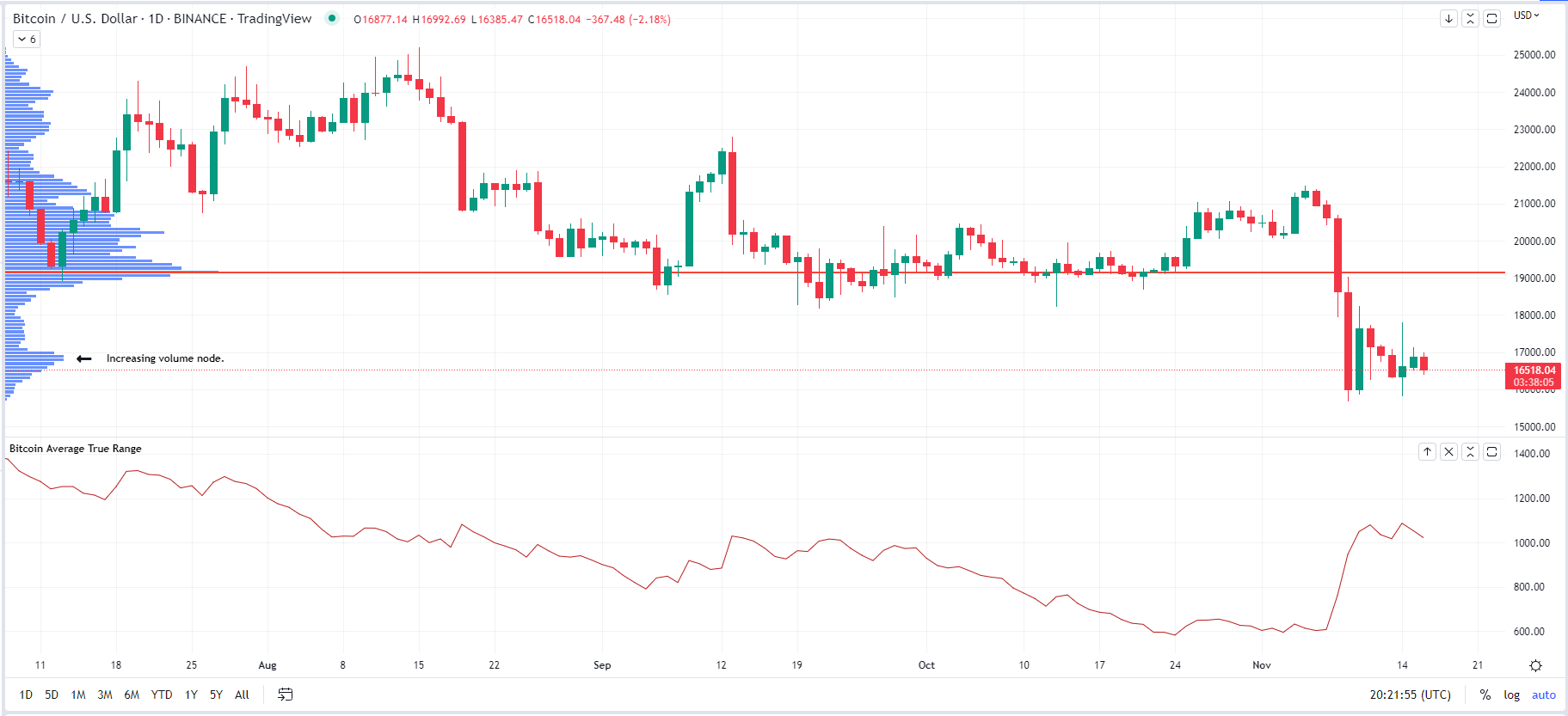

For both BTC and ETH, the magnitude of price movement since January 2022 has been declining, when using the Average True Range of daily price movement as a proxy.

A lack of price movement, gives investors less opportunity to generate gains.

Now as investors focus more on avoiding calamity than producing alpha, a new trading range appears to be forming at the $16,500 level for BTC.

Where previously we saw significant price agreement between the $19,000 to $20,000 range, the recent turmoil has pushed that level of agreement down.

BTC 11/16/22 (TradingView)

For ETH, the spikes in price agreement are appearing at both the $1,200 and $1,100 level.

Institutional investors appear to still have confidence about digital assets, but also find little reason to add exposure.

“Right now, most of the institutional investors we talk to are content to sit on the sidelines and just wait…they haven’t sworn off the space, but they’re not doing anything in crypto right now especially against this macro backdrop,” Ben McMillan, CIO of digital currency index provider IDX Digital Assets said

McMillan said that investors are anxious about future developments that could send crypto markets further spiraling.

“I think there’s no question investors are waiting for the next shoe to drop…the million dollar question is «how big is that shoe?» he said.

He added: “I’ve had several calls already today about Genesis halting withdrawals. That’s not to say there’s anywhere near the risk there that existed with FTX but investors are very skittish about ANY counterparty risk in crypto right now and the bias is to «get out first and re-assess later.»

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Hive

Hive  BUSD

BUSD  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond