CHZ, ALGO, LDO, ETHW and NEAR Lead Crypto Market Rout

BeInCrypto takes a look at five projects that decreased the most from the entire crypto market last week, more specifically, from Nov. 18 to Nov. 25

These digital assets have taken the crypto news and crypto market spotlight:

- Chiliz (CHZ) price is down 28.28%

- Algorand (ALGO) price is down 12.66%

- Lido DAO (LDO) price is down 12.22%

- EthereumPoW (ETHW) price is down 11.32%

- Near Protocol (NEAR) price is down 11.29%

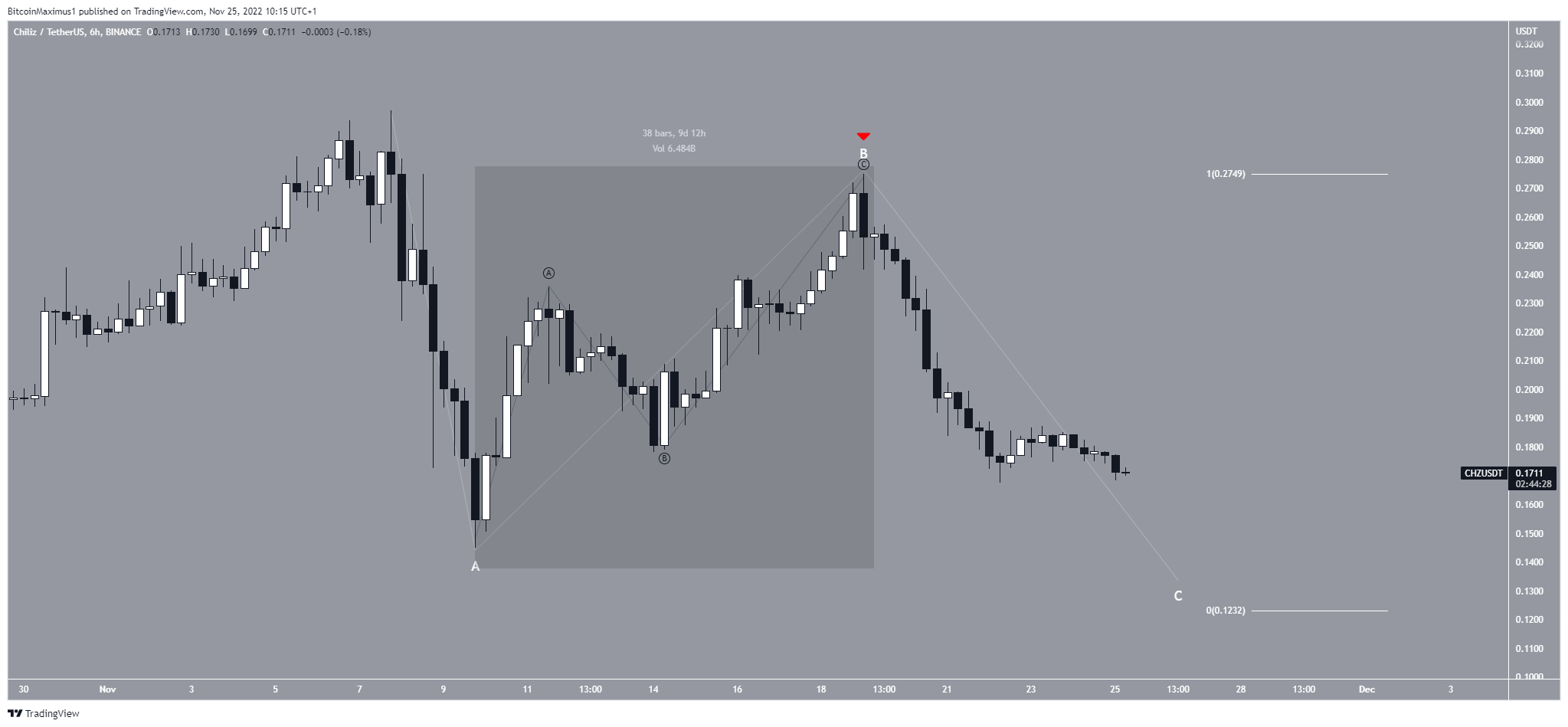

CHZ Leads Crypto Market Drop

The CHZ price has fallen since Nov. 7. On Nov. 19, it created a slightly lower high (red icon) and resumed its downward movement.

The movement Nov. 9 – 19 (highlighted) resembles an A-B-C corrective structure (black). Therefore, the decrease from Nov. 7 may also be an A-B-C correction (white). In this possibility, the CHZ price is in wave C of this correction.

Giving waves A:C a 1:1 ratio (white) would lead to a low of $0.123. Afterward, an upward movement would be likely.

CHZ/USDT Chart By TradingView

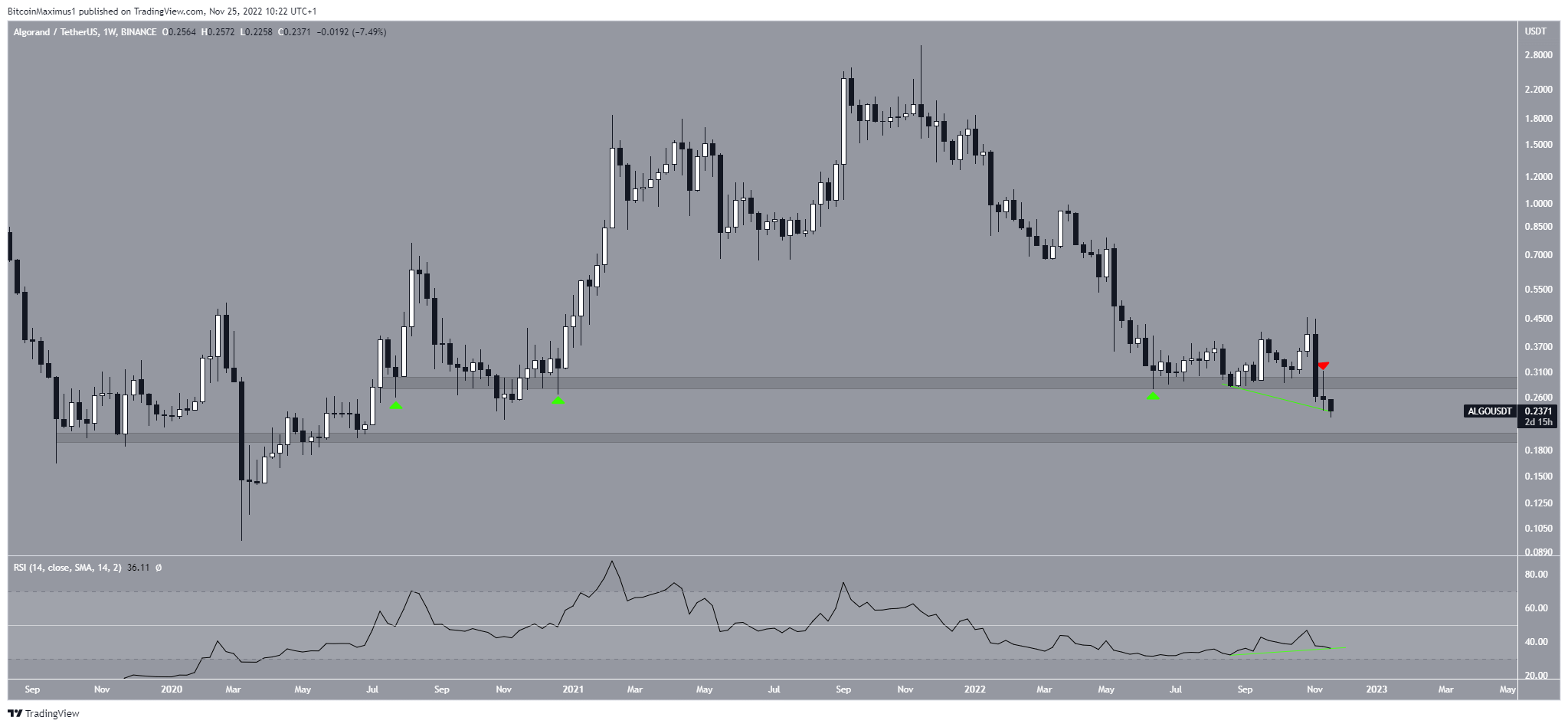

ALGO Falls Below Crucial Horizontal Area

The ALGO price had been trading above the $0.29 horizontal support area since the beginning of 2021. However, it finally broke down on Nov. 9. The breakdown and ensuing downward movement led to a low of $0.22. The next closest support area is at $0.20.

While the weekly RSI has generated bullish divergence (green line), the trend is considered bearish until the ALGO price reclaims the $0.29 resistance area. If it is not successful in doing so, a drop towards $0.20 is the most likely scenario.

ALGO/USDT Chart By TradingView

LDO Re-Tests Previous Resistance

On Oct. 17, the LDO price broke out from a descending resistance line that had been in place since Aug. 14. While it decreased afterward, the downward movement validated the resistance line as support (green circle).

Now, the LDO price is trading in a short-term range between $0.93 and $1.29. Whether the price breaks out above the latter or breaks down below the former will likely determine the direction of the future trend.

LDO/USDT Chart By TradingView

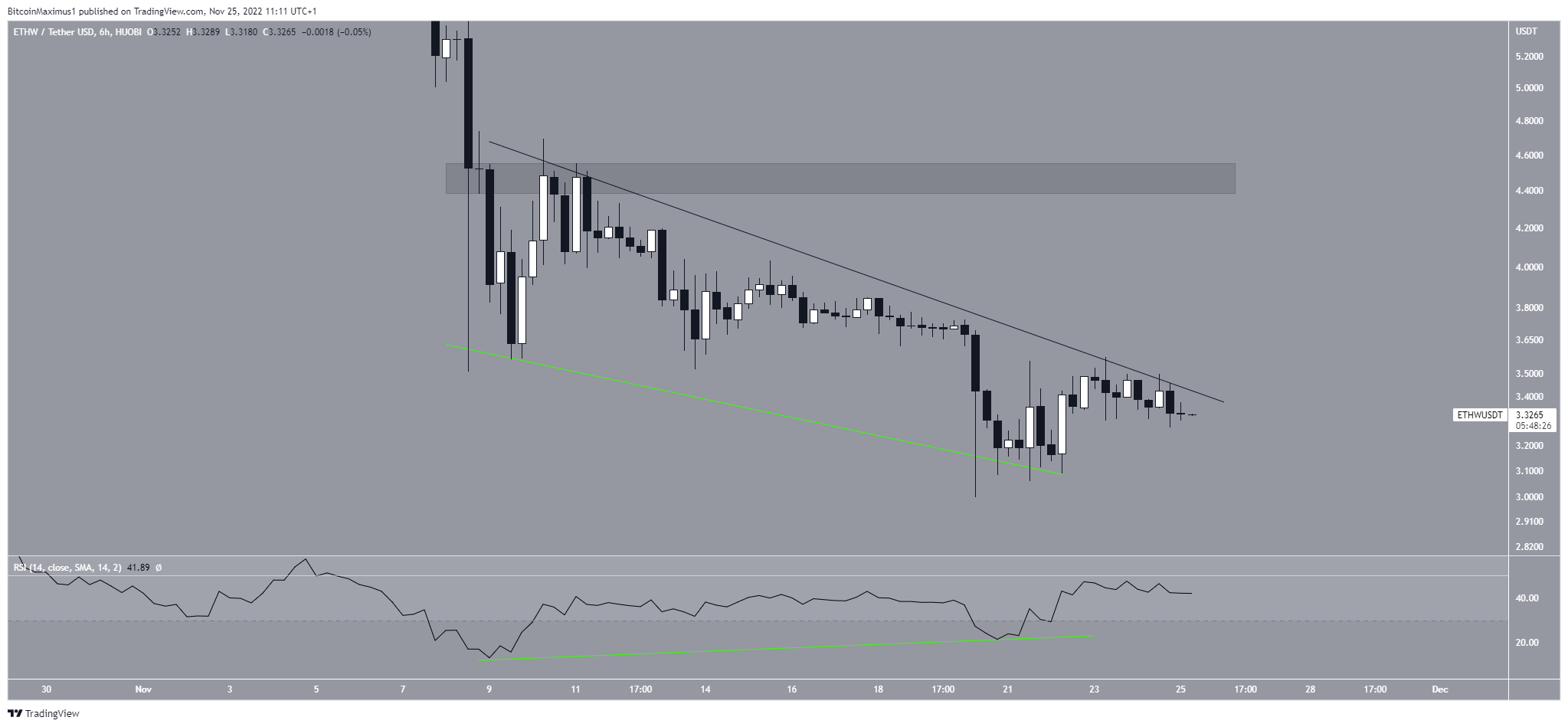

ETHW Generates Bullish Divergence

The ETHW price had fallen below a descending resistance line since Nov. 8. The downward movement led to a low of $3 on Nov. 20.

Afterward, the price began a bounce which was preceded by bullish divergence (green line) in the RSI. Currently, ETHW is making another attempt at breaking out from the line.

Since lines get weaker each time they are touched, a breakout from it is expected. If one occurs, the next closest resistance area would be at $4.50.

Conversely, decreasing below the $3 lows would invalidate this bullish prediction.

ETHW/USDT Chart By TradingView

NEAR Could Begin Rally Soon

NEAR had decreased below a descending resistance line since Nov. 10. This downward movement led to a low of $1.43 on Nov. 21.

Afterward, the RSI generated bullish divergence (green line) and catalyzed an upward movement. On Nov. 23, the price broke out from the descending resistance line. It is currently in the process of validating it as support.

If successful, this could initiate an upward movement towards $2.20.

On the other hand, a decrease below the descending resistance line would invalidate this bullish price forecast.

NEAR/USDT Chart By TradingView

Disclaimer: BeInCrypto strives to provide accurate and up-to-date news and information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  TrueUSD

TrueUSD  Dash

Dash  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Lisk

Lisk  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD