Bitcoin, Ethereum Price Prediction- Reclaimed EMA Assists Market Leaders For Further recovery

Bitcoin, Ethereum price prediction: A minor consolidation in market leaders Bitcoin and Ethereum have created a sense of uncertainty in the crypto market. However, the sideways movement in these coins will also validate whether the market is sustaining higher grounds.

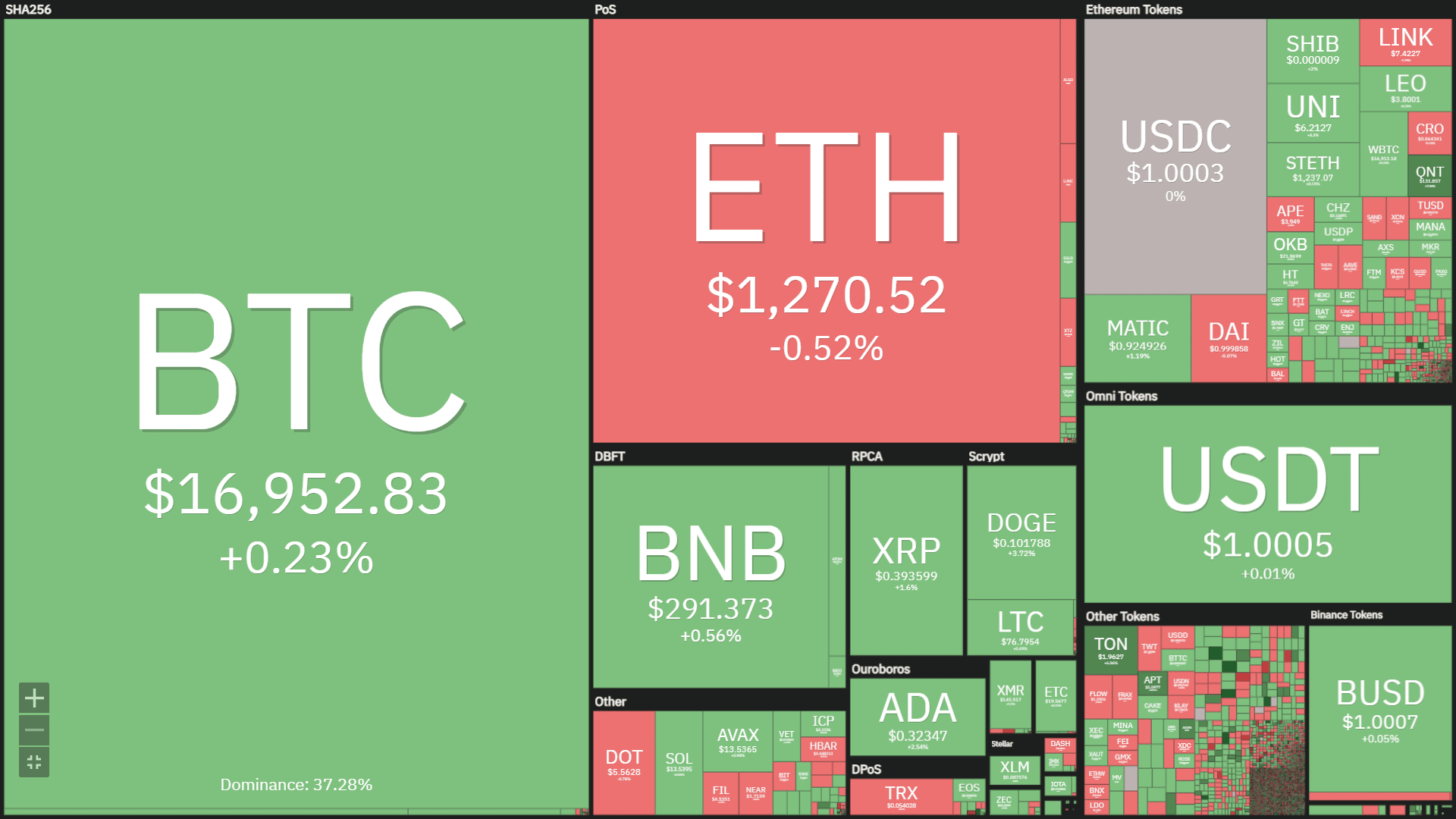

Moreover, by 9:17 am EST Saturday, the global crypto market stood at $855.12 Billion, showing a 0.53% rise over the last 24 hours. However, the total crypto market volume fell 21.3% to $32.24 Billion. The total volume in DeFi is currently at $2.49 Billion, making up 7.72% of the total crypto market 24-hour volume.

Top Gainers and Losers

Source- Coin360

Despite a sideway sentiment in the crypto market, the Aptos and Quant tokens showed gains among the top 100 listed cryptocurrencies. In the last 24 hours, the APT price rose 8.87% to reach the current price of $5.03; meanwhile, the QNT price appreciated 7.33% to reach the $131.67 mark. On a contrary note, the BinaryX and Filecoin tokens are experiencing the most loss. The BNX price at $125.81 shows a 2.66% fall, whereas the FIL price at $4.54 reflects a 2.34% drop.

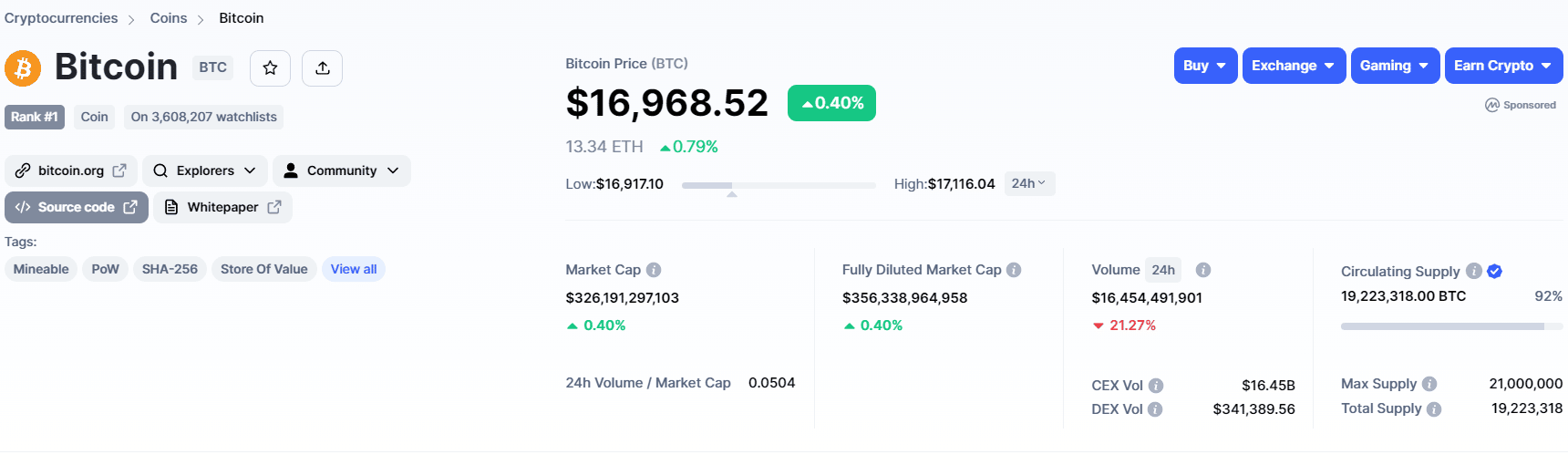

Bitcoin Price

Source- Coinmarketcap

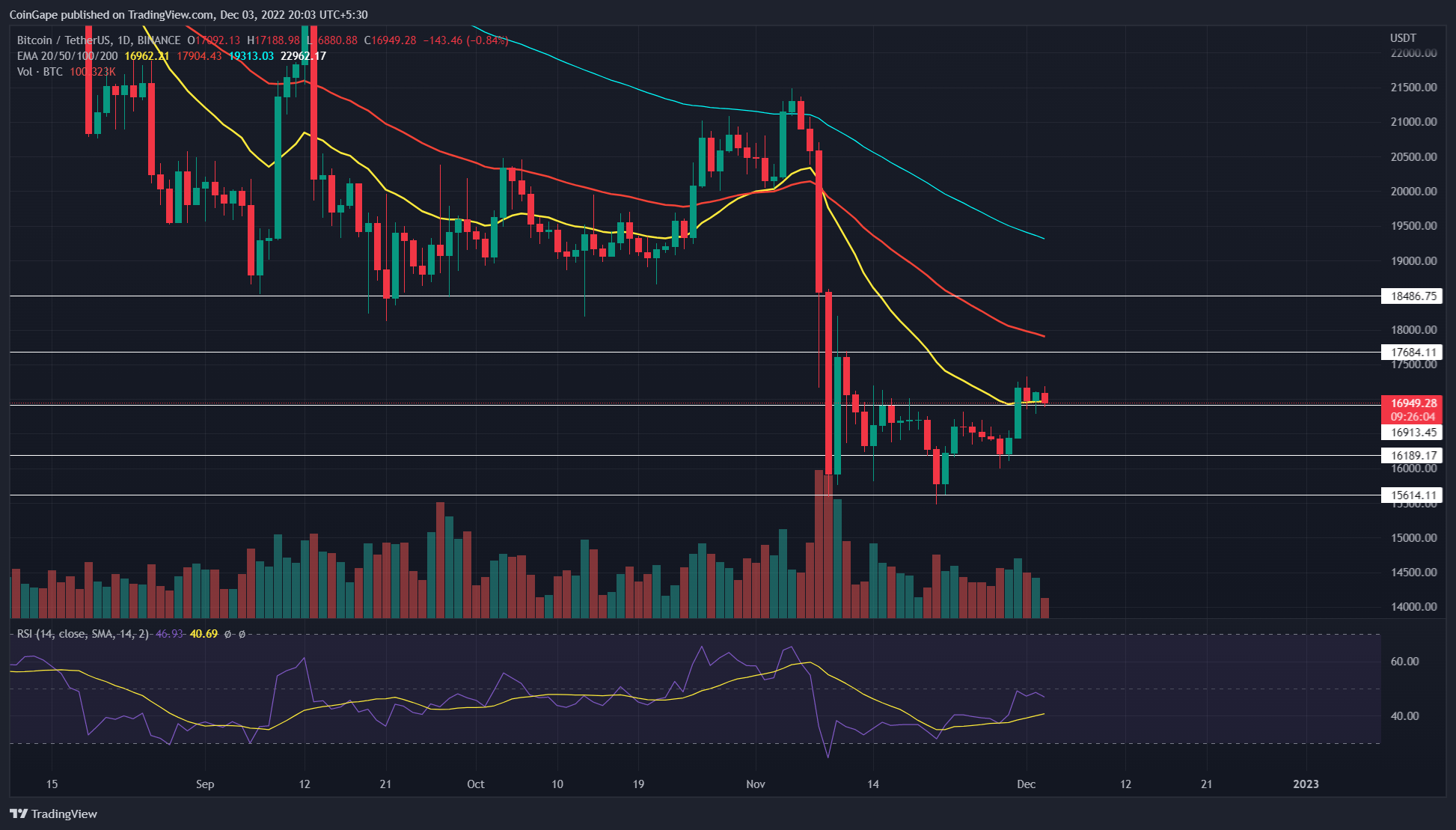

The ongoing recovery cycle in Bitcoin price has recently managed to breach the monthly resistance of $16900. On November 30th, the bullish breakout from the mentioned resistance and 20-day EMA with a substantial volume rise indicate the buyers are aiming to reach higher levels.

For the past three days, the prices have been trying to sustain above the reclaimed support, offering entry opportunities for sidelined buyers. Moreover, the lower price rejection at this combined support indicates the buyers are trying to sustain higher prices.

Source- Tradingview

Thus, the post-retest rally may drive the price 4.3% higher to $17700, followed by $18500.

Alternatively, a daily candle closing below $16900 during the retest phase will invalidate the selling pressure.

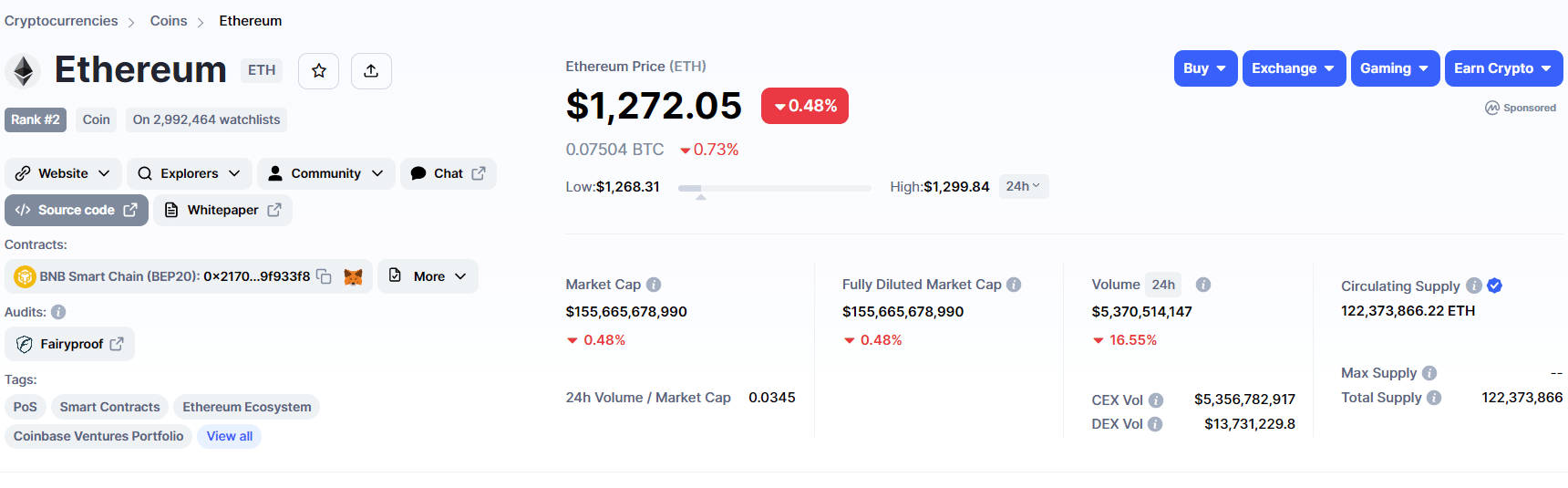

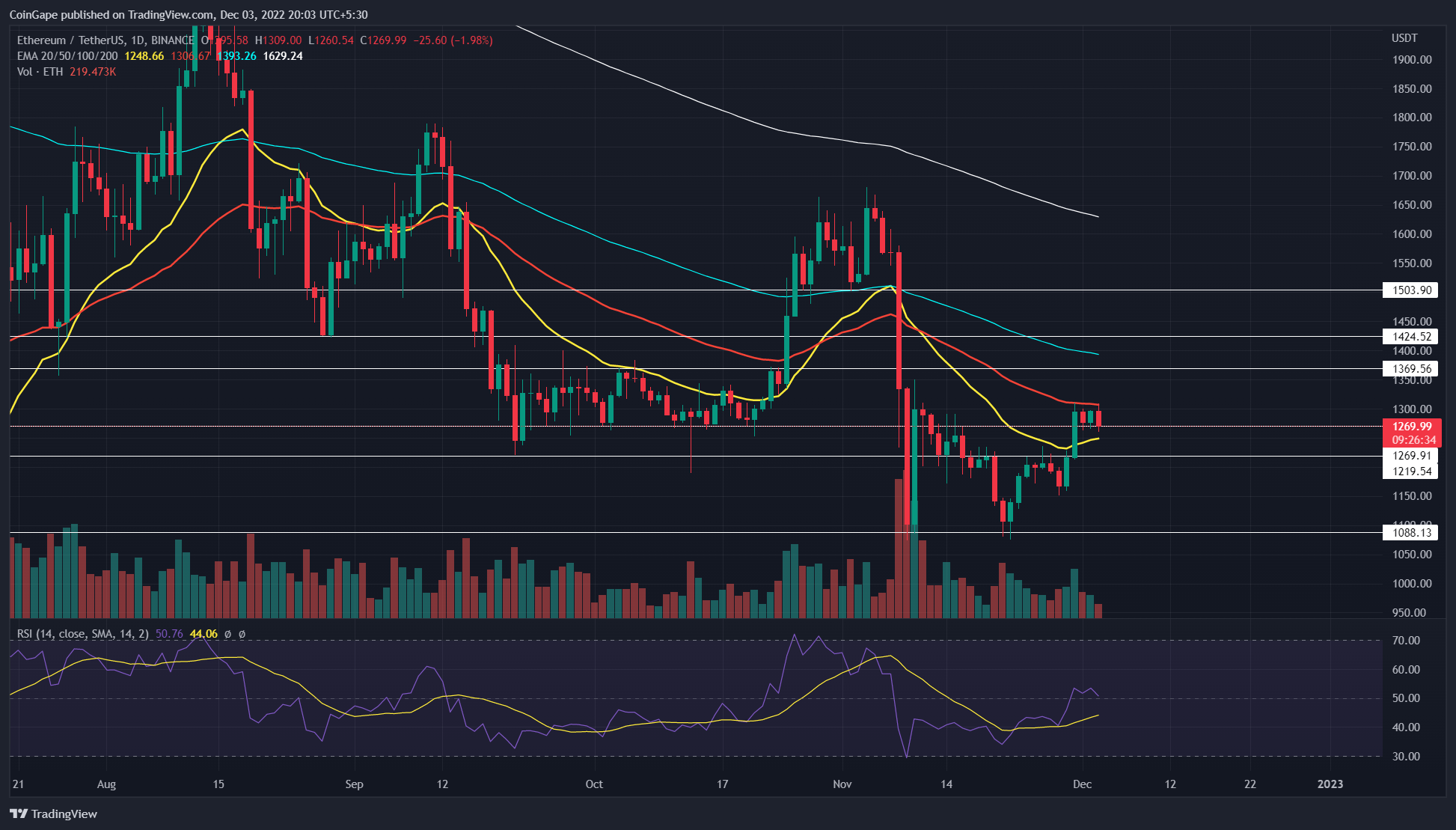

Ethereum Price

Source- Coinmarketcap

The Ethereum price experienced a V-shaped recovery when it bounced back from $1100-1080 support on November 22nd. The bullish recovery registered 19% growth and pushed the price above several resistances, such as $1220, $1270, and 20-day EMA.

Similar to Bitcoin, the ETH has been moving sideways over the past three days, trying to sustain above the $1270 and 20-day EMA flipped support. Thus, the new support should offer buyers a strong footing to lead the prices higher.

Source-Tradingview

Thus, with sustained buying, the altcoin could rise 12% higher by $1425.

Conversely, a breakdown below the $1220 support would offset the bullish thesis.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur