Hidden XRP Signal Shows Important Reversal Ahead: Crypto Market Review, Dec. 5

The recovery of cryptocurrency markets continues as most digital assets are facing a recovery after weeks or even months of unstoppably rising selling pressure. However, the overwhelming positivity is a dangerous trend that could bring more harm than good to the market.

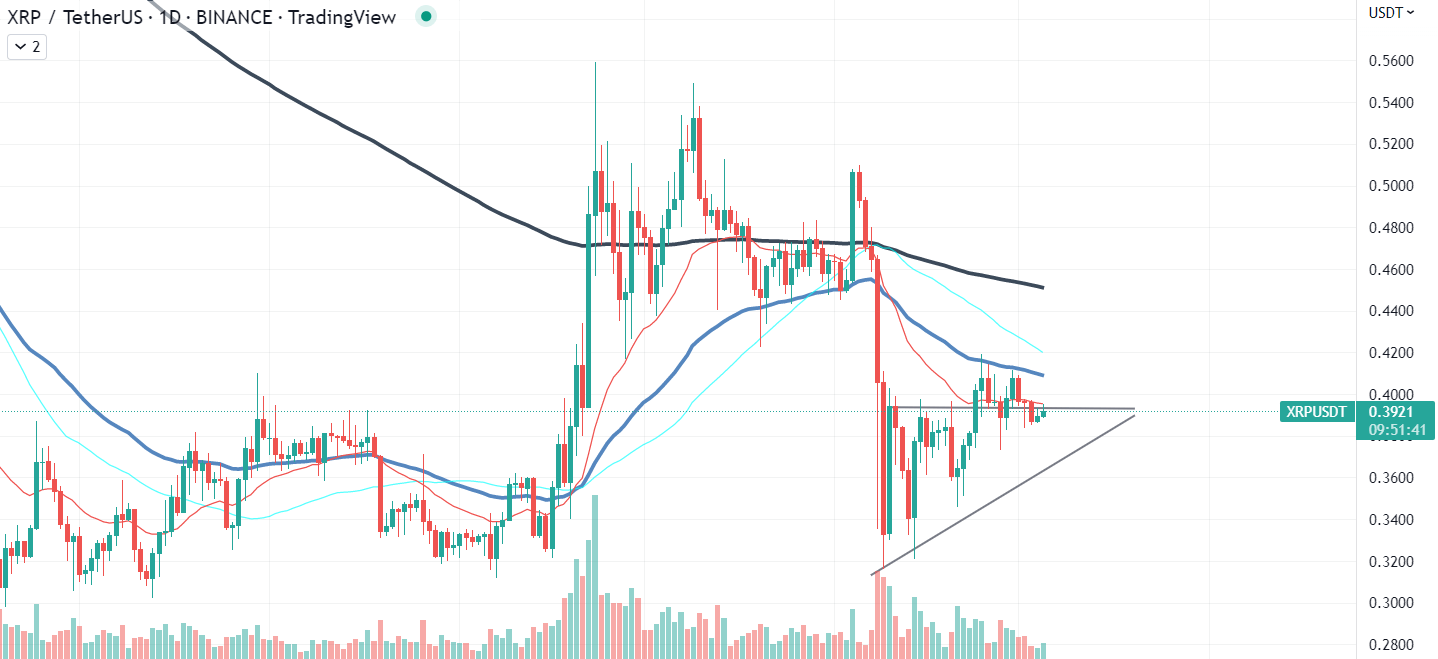

XRP’s descending volume profile

Trading volume is one of the most accurate indicators that is often overlooked due to its indirect nature and unclear utilization. However, its movement can undoubtedly show investors if it is a good time to enter the assets, when to expect a reversal and when to test the current trend’s strength.

In the case of XRP, the volume indicator is moving downward, creating a descending trend that signals an upcoming trend reversal which, in this case, would be a move downward. Unfortunately, yet another breakout that we labeled invalid in our previous review, did not bring any fuel back to the market, hence, it led to nothing but a few days of consolidation and a further reversal.

As for now, XRP remains in a complicated position market-wise. The recovery of Bitcoin did not cause a relief rally for XRP holders, making XRP even more unattractive for the majority of market participants.

The descending volume, invalidated reversal pattern and lack of fundamental factors that would push XRP’s value upward pushes us to unpleasant conclusions: in these times, XRP cannot yet find buyers who would provide enough buying volume to break the pressure of the market-wide downtrend.

Potentially premature recovery

The dovish talk of Fed chairman Jerome Powell has been the catalyst of the current cryptocurrency market rally, but it is not as obvious as you might think. Powell’s speech indeed shows the regulator’s intention to ease up the tightening of monetary policy in the U.S.; however, no signals about the pivot have been delivered by the Fed.

The desire to pause or calm down the rate hiking cycle reflects only one thing: traditional and digital assets markets need to have a break in order to remain afloat. An outflow of funds from both markets has been crucial since the beginning of 2022.

Obviously, the only thing an investor would like to hear after a full year of pain on the markets is a reversal of the monetary policy, the end of the rate hiking cycle and the beginning of the uptrend. The only thing Powell highlighted in his last conference was a regulator’s desire to ease up the pressure on the financial market; no signs of upcoming monetary easing were noticed in his speech.

In the last seven days, the cryptocurrency market has gained more than $60 billion to its total capitalization as assets like Bitcoin broke through important thresholds, gaining up to 20% to their value in a matter of days.

At press time, Bitcoin is trading at $17,257, with XRP changing hands at $0.39 and Ethereum being exchanged for $1,290.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur