Bulls and Bears Wrestle for Control of Polkadot Price

The Polkadot (DOT) price has generated bullish divergences in multiple time frames. While such divergences often precede upward movements, one has yet to occur.

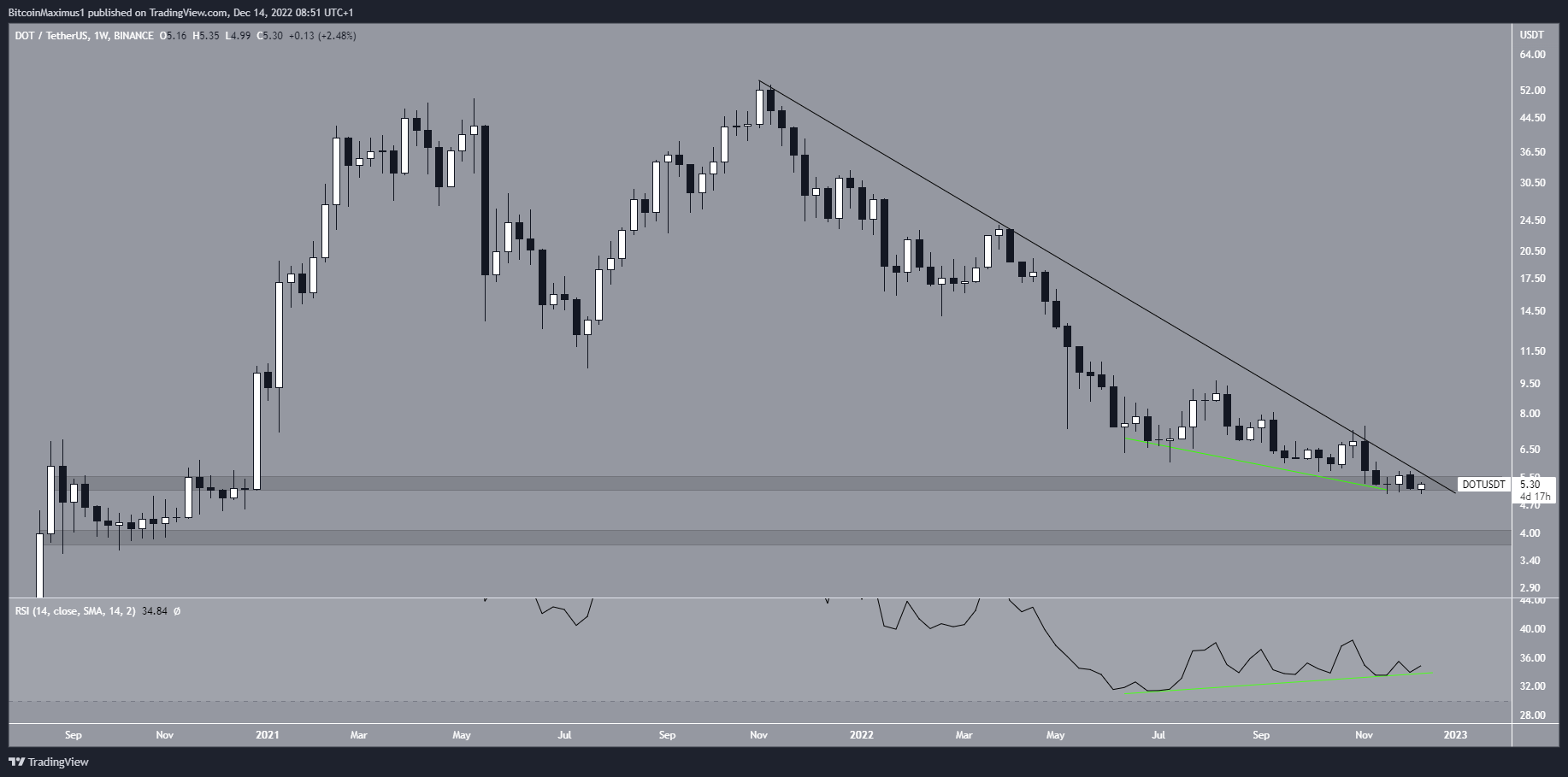

The Polkadot price has fallen below a descending resistance line since its all-time high of $55.09 in Nov. 2021. So far, the DOT token price fell to a low of $5 in Nov. 2022.

The Polkadot price has bounced slightly since, but it has yet to initiate a significant upward movement. Currently, it is trading inside the long-term $5.40 horizontal support area, which had previously acted as resistance.

The most bullish development in the price action is the bullish divergence in the weekly RSI (green line). The divergence is very significant and occurs in a long-term time frame. If it is sufficient to initiate a bullish trend reversal, the DOT price could break out from the resistance line and accelerate its rate of increase.

Conversely, a weekly close below the $5.40 area could cause an immediate drop toward the next support at $3.90.

DOT/USDT Weekly Chart. Source: TradingView

Bullish Pattern Aligns With Polkadot Price Rally

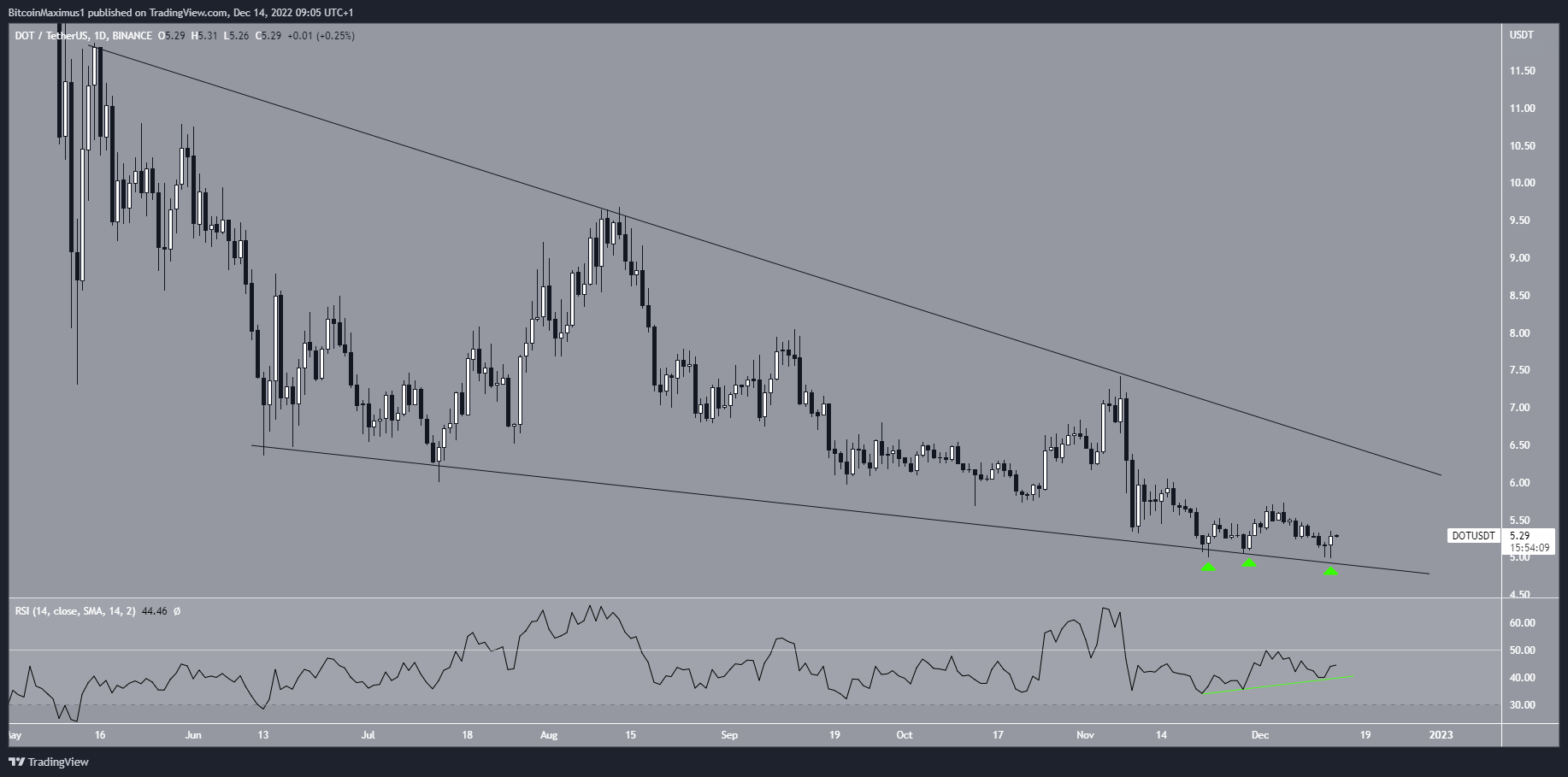

The daily chart shows that the Polkadot price has been trading inside a descending wedge since May. Since the descending wedge is considered a bullish pattern, an eventual breakout from it would be likely.

Since Nov. 22, the DOT price has traded close to the support line of the wedge, creating a triple bottom pattern (green icons) in the process. This is also considered a bullish pattern. Moreover, the daily RSI has generated a bullish divergence (green line). This aligns with the readings from the weekly timeframe, supporting the initiation of an upward movement.

As a result, a movement toward the resistance line of the wedge is the most likely scenario. This would also take the Polkadot price to the long-term resistance line. Such a movement seems to have already begun over the past 24 hours.

Conversely, a breakdown from the wedge would invalidate this bullish DOT price projection.

DOT/USDT Daily Chart. Source: TradingView

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  Cosmos Hub

Cosmos Hub  Stacks

Stacks  OKB

OKB  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Synthetix Network

Synthetix Network  Zcash

Zcash  Tether Gold

Tether Gold  Dash

Dash  Holo

Holo  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Ravencoin

Ravencoin  Siacoin

Siacoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Huobi

Huobi  Status

Status  Waves

Waves  Lisk

Lisk  Numeraire

Numeraire  Hive

Hive  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom