First Mover Asia: Active Crypto Developers Decreased Nearly 60% in 2022

Good morning. Here’s what’s happening:

Prices: Bitcoin and the CoinDesk Market Index turned lower, as traders started to rethink the takeaway from this week’s Federal Reserve meeting.

Insights: Ethereum had 192 active developers on Dec. 14, the highest number of developers among blockchain projects, data from Token Terminal suggests.

Prices

CoinDesk Market Index (CMI)

866.48

−15.4 ▼ 1.7%

Bitcoin (BTC)

$17,408

−394.2 ▼ 2.2%

Ethereum (ETH)

$1,270

−41.0 ▼ 3.1%

S&P 500 daily close

3,895.75

−99.6 ▼ 2.5%

Gold

$1,787

−20.6 ▼ 1.1%

Treasury Yield 10 Years

3.45%

▼ 0.1

BTC/ETH prices per CoinDesk Indices; gold is COMEX spot price. Prices as of about 4 p.m. ET

Crypto sentiment makes quick reversal

By Bradley Keoun

If Wednesday’s Federal Reserve meeting brought a buoyant mood to crypto markets, Thursday’s action brought a reality check.

Bitcoin (BTC), the largest cryptocurrency was down 2.6% over the past 24 hours, to about $17,400 – tracking a similar trajectory in U.S. stocks.

Ether (ETH), the native cryptocurrency of the Ethereum blockchain and the second-biggest overall, lost 3.6%, to $1,262. The CoinDesk Market Index (CMI) slid 2.4%. Optimism’s OP token ranked among the biggest losers with a 10% decline.

The take of CoinDesk markets analyst Glenn Williams Jr. was that the Federal Reserve, while slowing the pace of interest-rate increases, still has a long way to go before it can end its campaign to wring out inflation. Before price rises can moderate, the Fed will have to see a pretty significant increase in unemployment – to keep expectations of higher wages from becoming entrenched. Hopes of a quick reversal by the Fed Chair Jerome Powell and his colleagues might be premature. Funding rates – a key barometer of sentiment in crypto derivatives markets – are still pointing negative.

Insights

By Sage D. Young

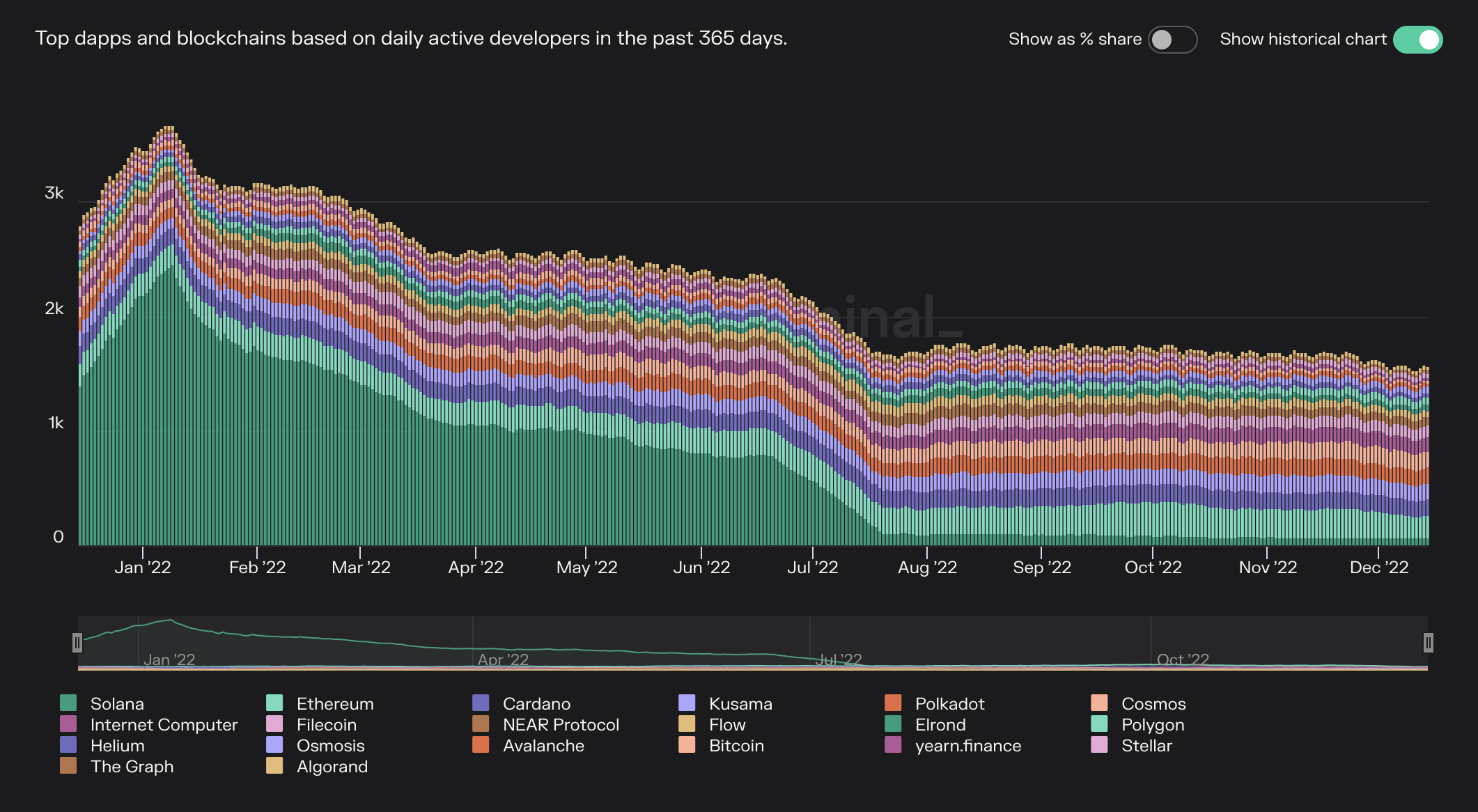

The number of daily active developers working on top blockchains and decentralized applications (dapps) has decreased roughly 57% this year, according to financial data platform Token Terminal.

In January, about 3,700 daily developers were active, compared to almost 1,600 on Dec. 14, data from Token Terminal suggests, which tracks daily totals.

(Token Terminal)

The decline has come as ether, the token of the Ethereum blockchains, and other cryptocurrencies have plummeted from record highs little more than a year ago. ETH was recently trading at about $1,300, down 64% from the start of the year when the second largest crypto by market capitalization was still hovering near $4,000. The number of projects built on the Ethereum platform over this period has plummeted as some projects have failed and increasingly risk averse investors have deployed their money at a slower rate than during 2021’s bull market.

“It’s not surprising to see an overall decline in daily active devs,” said Chris Eberle, angel investor and contributor at Coordinape and PleasrDAO who goes by DeFi Ginger on Twitter. “2022 has been punch after punch for crypto. The impact to the market and the overall brand of crypto is just brutal.”

Eberle noted that this year’s crypto debacles, including the recent collapse of crypto exchange giant FTX and failing of centralized lender Celsius, have created “one, big ball of pain” for the industry that has also contributed to the decline in active developers.

With 192 developers as of Dec. 14, Ethereum currently has the most daily developers among blockchain protocols and dapps. Cardano and Cosmos rank second and third with 144 and 143 active developers, respectively. Bitcoin, the largest cryptocurrency by market capitalization, currently has 18 active developers.

According to Token Terminal, Solana saw the largest reduction from roughly 2,500 devs in January to 75 developers at the time of publication, although the protocol insisted in a tweet last month that thousands of developers are working on the platform. “Something doesn’t add up, Eberle said. «Solana fell off a cliff before [the FTX collapse].”

He added: ”Others seem to have some dip but it could well be seasonal as we’re in the holiday zone now.”

Token Terminal’s methodology to determine an “active developer” is based on the “number of distinct GitHub users that made 1+ commits to the project’s GitHub repositories during the past 30 days.”

Overall, the number of the active developers in the crypto space has stabilized between 1,500 and 1,600 since mid summer, suggesting that a core of the determined, adequately funded people remain convinced of blockchain technology’s potential.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Stacks

Stacks  Algorand

Algorand  Cosmos Hub

Cosmos Hub  OKB

OKB  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Huobi

Huobi  Status

Status  Waves

Waves  Lisk

Lisk  Numeraire

Numeraire  Hive

Hive  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom