Crypto Markets Analysis: Bitcoin and Ether’s Flat Trajectory to Continue, Technical Indicators Suggest

Bitcoin and ether continue to trade flat, as volatility for the two assets wanes.

Bitcoin (BTC) prices stabilized following the FTX fallout, now off a mere 2% from Nov. 11. The ether price (ETH) is down a more pronounced 6% from the same date.

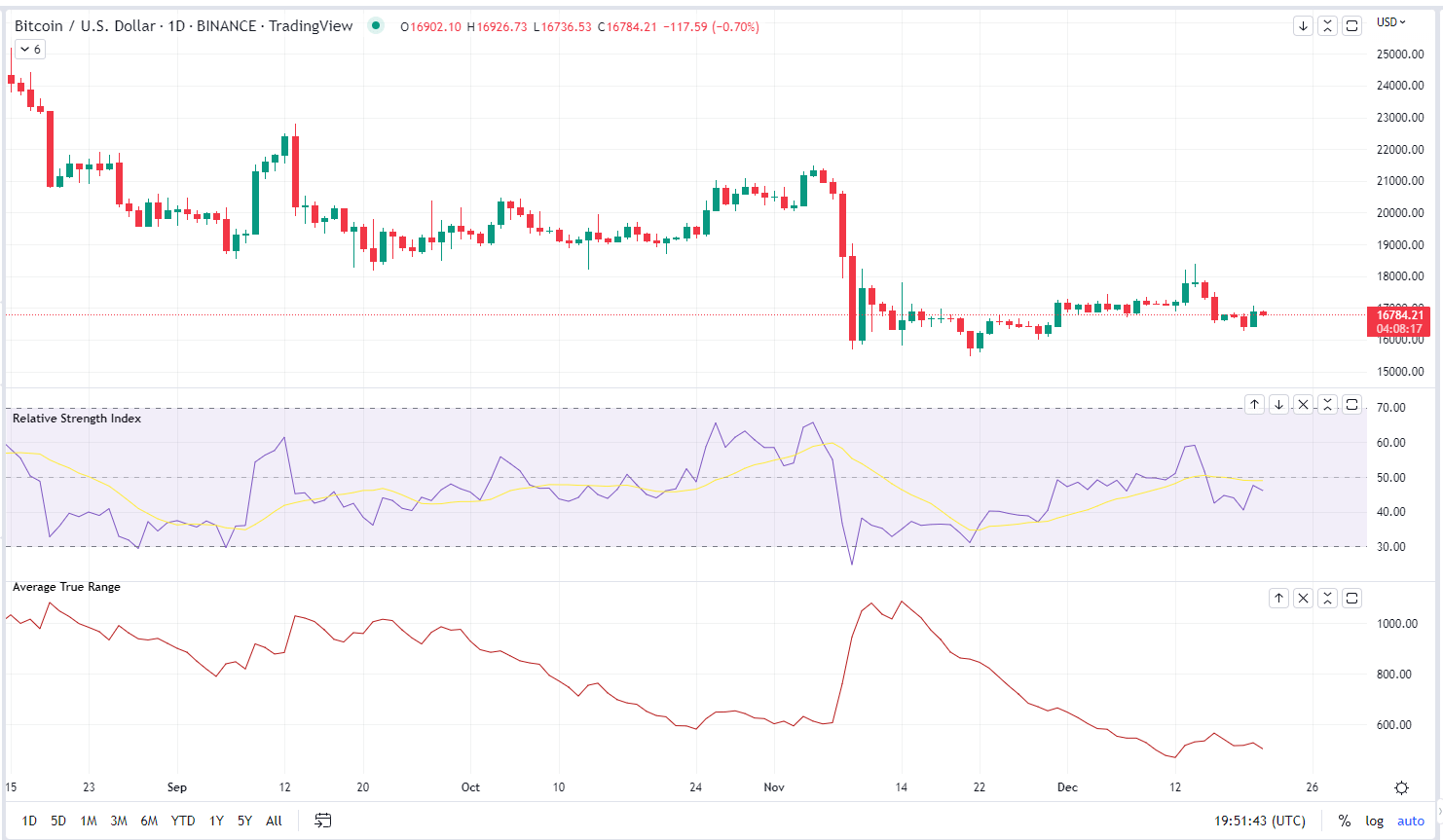

The most recent six months of trading activity for BTC has followed a familiar, if not exhausting pattern.

- Trade flat for a period of time.

- Decline in price following turmoil within a centralized crypto entity.

- Trade flat for a period of time at that new lower level.

Number 3 is where we are now.

Predicting the length of time that crypto assets will remain range bound is challenging, if not foolhardy. There are some cues to pay attention to, however.

Momentum for both BTC and ETH remains in neutral territory, using the Relative Strength Indicator (RSI) as a proxy for momentum. BTC’s current RSI is approximately 49.06 – a very middling level. RSI is a technical indicator that ranges from 1-100. Readings over 70 imply that an asset is potentially overbought, while readings under 30 imply that an asset is possibly oversold.

Searching BTC data back to 2015, and filtering for RSI levels between 49 and 50 shows 61 occurrences with an average gain of 2.2%, 30 days after the fact.

For ETH, filtering for RSI levels between 47 and 49, showed 43 occurrences since 2017, with an average 30-day gain of 6.7%.

Applying those performance figures to current prices, results in prices of $17,144 for bitcoin and $1,291 for ether. This is far from earth shattering, given where both have traded in the past.

The results should not be viewed as predictive but can provide context as to where investors think prices may wind up.

Bitcoin Bollinger Bands

If using the historic data for guidance, it’s difficult to find a bullish scenario in the short term. Both price points fall within areas of significant price agreement, decreasing the likelihood of prices pushing higher without an external catalyst.

Current data doesn’t offer much either. Both BTC and ETH are both showing declines in volatility, as the Average True Range of their price movements has fallen 47% and 46% since November.

Their respective Bollinger Bands lend additional credence, as BTC and ETH have stayed closely tethered to their 20 day moving averages, straying from the mean only briefly, before reverting back.

As a counterpoint, there isn’t much of a bearish case to be made either.

The appetite of asset managers has picked up, adding to their long positions in bitcoin for three consecutive weeks.

The Commodity Futures Trading Commission’s (CFTC) Commitment of Traders report, is a weekly listing the open interest for futures and options.

The most recent release shows that asset managers now account for 40% of long open interest on the Chicago Mercantile Exchange. and are reportedly 83% long as a group.

Derivatives markets show a decline in the ratio of bitcoin put options to call options. One interpretation is that investors see declining opportunities to be profitable by betting against crypto.

Ultimately, it likely boils down to investor time horizon.

If long term biased, the current market structure likely provides you with a solid entry point. Shorter term traders however may be turned off by the lack of price movement.

Bitcoin 12/21/22 (TradingView)

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD