Dogecoin’s Profitability Spikes, Leaving Most of Market Behind: Crypto Market Review, Dec. 23

The last week before the New Year is not ending on a high note as the market ends the week with the majority of assets at a loss, showing the lack of any positivity among investors, which promises nothing but pain by the end of 2022.

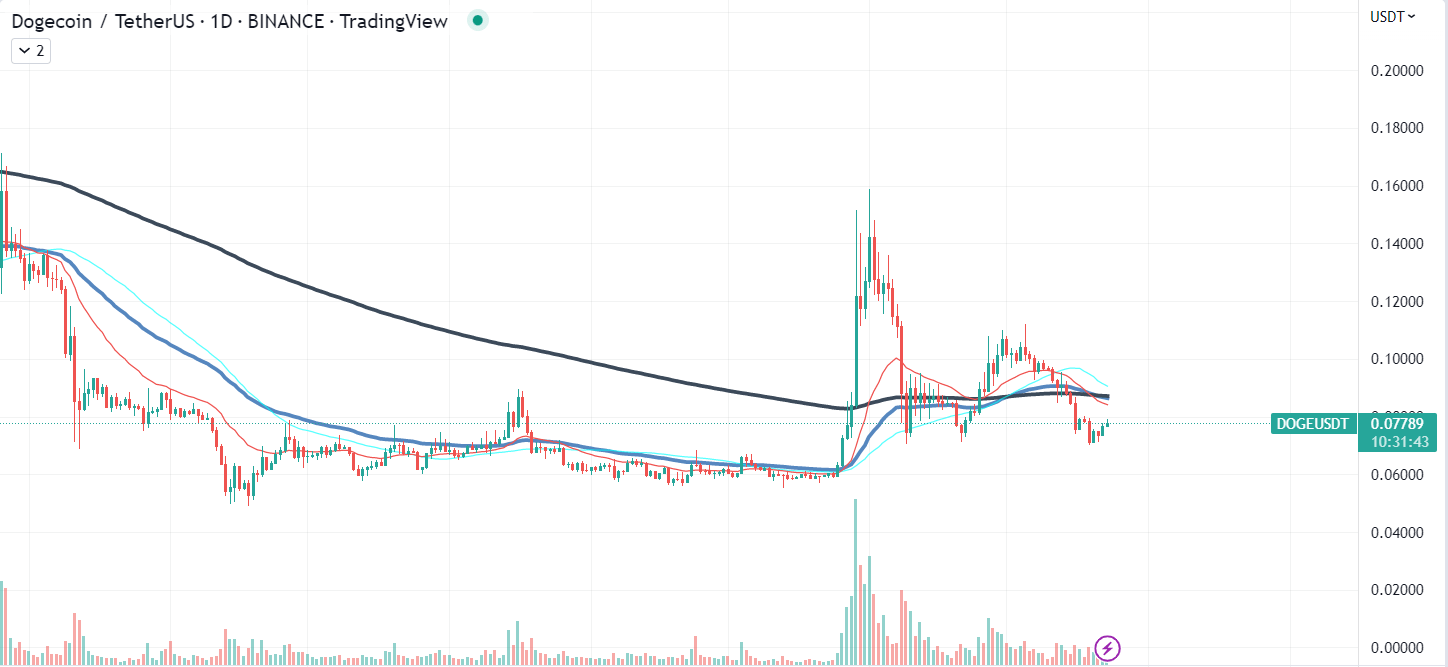

Dogecoin’s profit spike

Despite the grim end of 2022, Dogecoin had a relatively successful year as the meme asset went through numerous triple-digit rallies, broke numerous resistance levels and turned out to be far more resilient than some «serious» assets.

In October, Dogecoin gained more than 140% to its value in an explosive way thanks to Elon Musk’s Twitter drama. The price of the assets swung upward after investors assumed that Musk might add the support of Dogecoin as the native cryptocurrency of the social media platform. The assumption was based solely on Musk’s continuous support of DOGE throughout the years.

Unfortunately, by the end of the year, DOGE lost most of its gains but has recently entered a short-term uptrend, bringing more profit to investors than the majority of other «serious assets» like Ethereum or Bitcoin.

Solana tests bottom again

Despite a relatively stable performance in the last few weeks, Solana has not been getting a helping hand from the market and is still struggling to get out of the bottom zone. Recently, Solana dropped to it once again, losing what it had gained in December.

As we mentioned previously, Solana’s performance will not stabilize until the cryptocurrency finally gains any kind of trust among institutional investors. Due to its being the go-to holding off Bankman-Fried’s empire, Solana took the hit first, dropping to multi-year lows.

After the imposition, millions of SOL have been withdrawn from various staking contracts and trading platforms, which means that at any given time, the market might get hit with an enormous selling pressure that would kill any kind of recovery rally for Solana.

Until then, Solana’s ecosystem is still actively utilized by NFT and DeFi enthusiasts, which might become the only source of funding for the network in the foreseeable future.

Polygon’s massive record

As covered by U.Today previously, Polygon has recently celebrated a new achievement, the number of unique entities on the network passed the 200 million mark this week, setting a new all-time high.

Such drastic growth of the network is a strong fundamental signal: Polygon is growing despite all the issues the cryptocurrency market has. With the rapid growth and development, the market value of the underlying token should recover eventually.

At press time, MATIC is trading at $0.8, gaining a modest 0.77% in the last 24 hours. The asset has been moving in a continuous rangebound, with only one breakout attempt. The lack of action and steady volume suggest that the token is in the accumulation stage but, at the same time, remains in a prolonged downtrend.

As for now, MATIC trades at a support level it has not broken for the last 70 days.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Stacks

Stacks  Algorand

Algorand  Cosmos Hub

Cosmos Hub  OKB

OKB  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Huobi

Huobi  Status

Status  Waves

Waves  Lisk

Lisk  Numeraire

Numeraire  Hive

Hive  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom