Chainlink (LINK) Declines 80% in 2022, Here’s Why It Could See a Further 25% Drop

The Chainlink (LINK) price is at risk of breaking down from the $6 horizontal support area, something which could trigger a 25% fall.

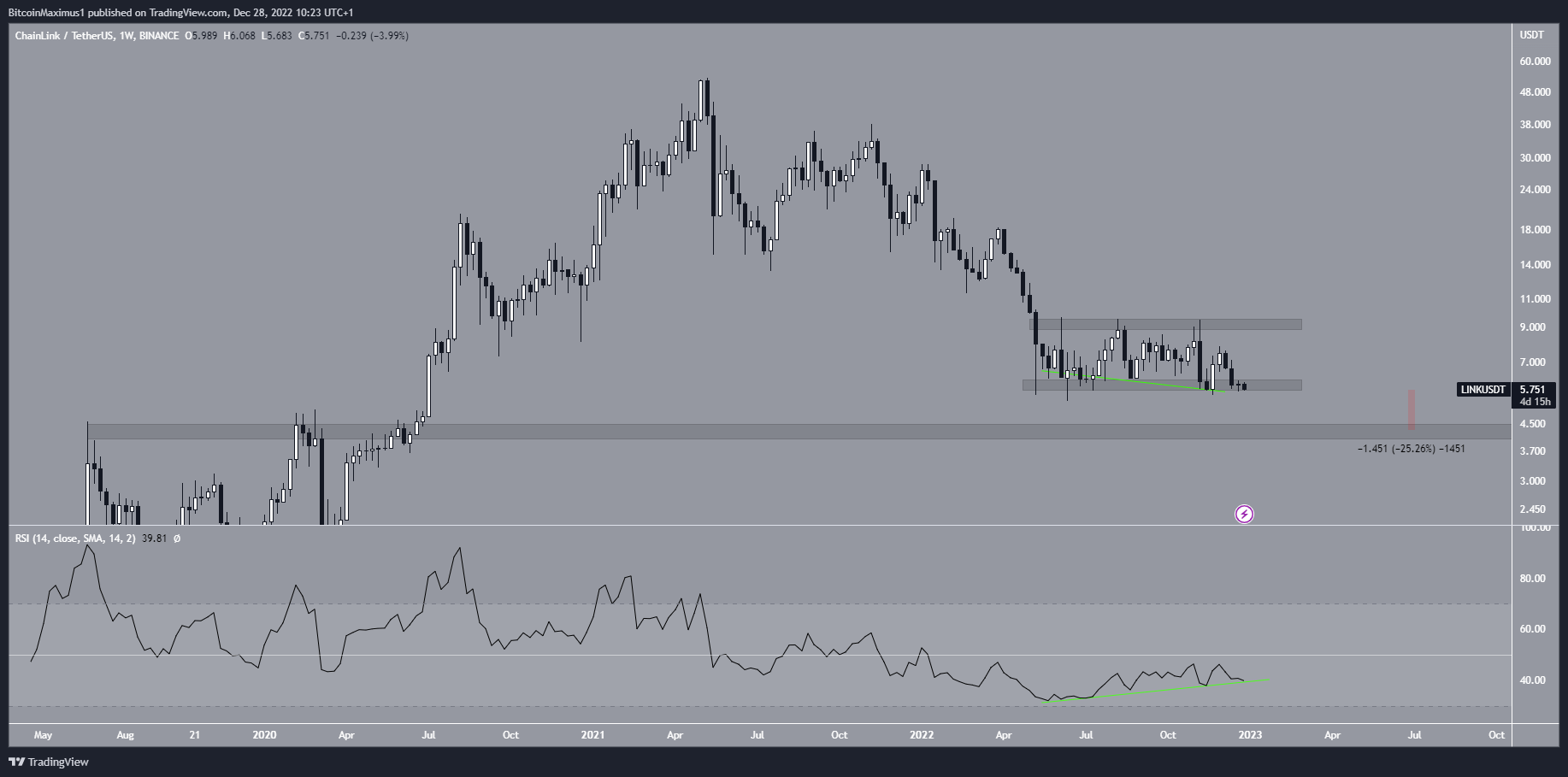

The LINK price has fallen since reaching a maximum price of $53 in May 2021. The downward movement led to a low of $5.30 in June 2022.

Since then, the LINK price has hovered above the $5.80 horizontal support area. During this time, the weekly RSI generated a bullish divergence (green line), something that often precedes upward movements. However, both the trendline of the divergence and the $6 horizontal support area are at risk of breaking down.

If this occurs, the LINK price could fall toward the next support at $4.30. This would amount to a drop of 25%. Currently, this seems to be the most likely Chainlink price prediction for January. Conversely, a bounce at the $6 support area would likely lead to a bounce toward the $9.20 resistance area.

LINK/USDT Weekly Chart. Source: TradingView

Chainlink Price Prediction For January

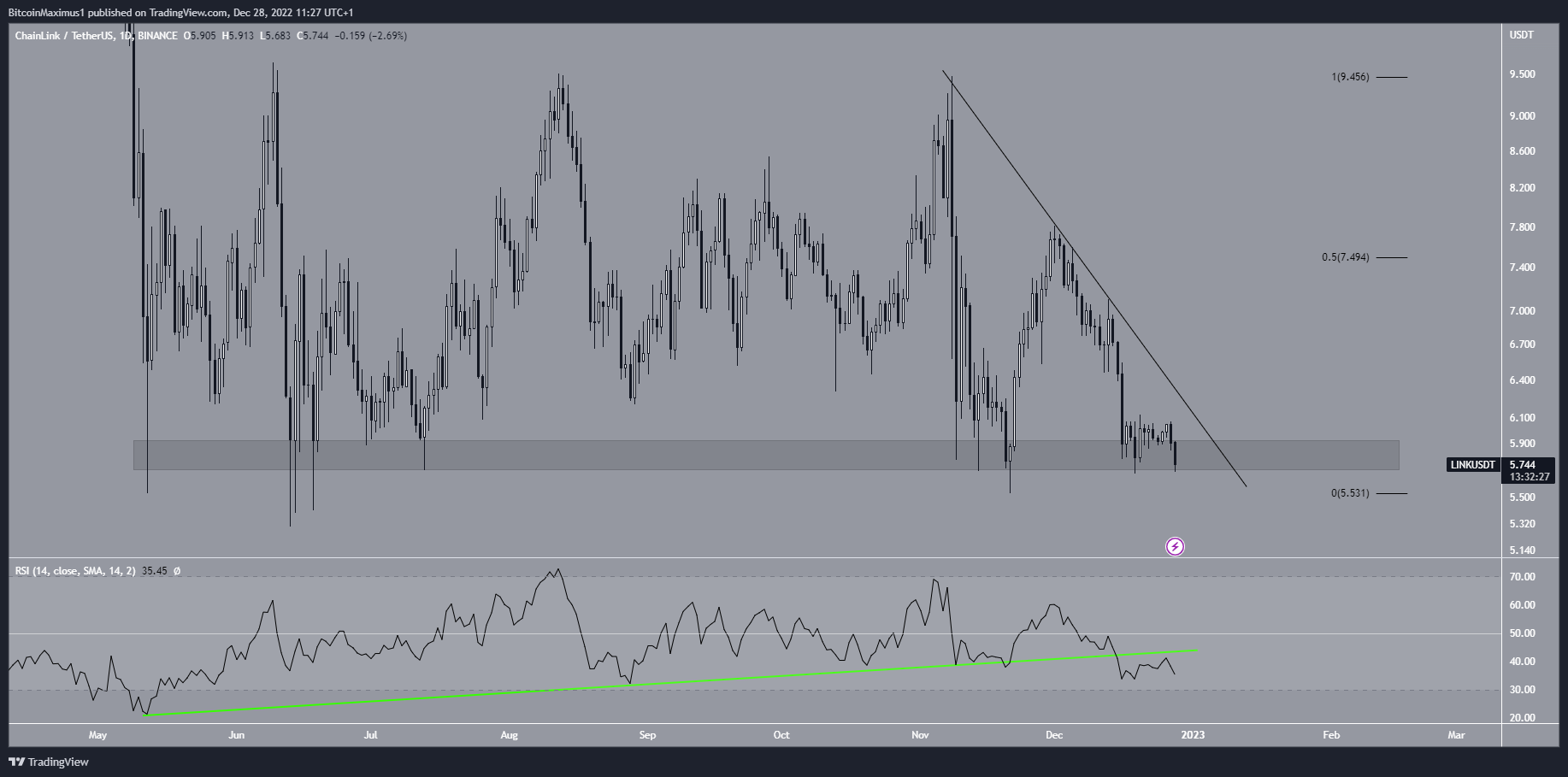

The daily chart supports the possibility that the LINK price will break down from the $5.80 support area. The main reason for this is that the daily RSI broke its bearish divergence trendline. This is a sign that the direction of the future price movement is bearish. The decrease has also accelerated over the past 24 hours.

Moreover, the LINK price is following a descending resistance line that has been in place since the beginning of November. The line could reject the price if a bounce occurs. In case of a breakout, it is possible that LINK will reach $7.50, the 0.5 Fib retracement resistance level, and a horizontal resistance area.

LINK/USDT Daily Chart. Source: TradingView

As a result, the daily and weekly time-frames combine to provide a bearish LINK price analysis. A breakdown from the $5.80 support area and a drop toward the $4.30 support is the most likely scenario. A reclaim of the $7.45 resistance area would be required for the Chainlink price forecast to be considered bullish.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  BUSD

BUSD  Pax Dollar

Pax Dollar  Enjin Coin

Enjin Coin  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD