Crypto Market Tides Forecast Profits, Report Shows

After the unreeled crypto winter, the market continues to show signs of revival after the debacle of institutions and exchanges filing for bankruptcy in late 2022. Following a month of upward price action fueled by investors betting on crypto in January, the market sentiment may turn its tide and move into the green land.

Related Reading: This Bitcoin On-Chain Metric Is At A Historical Resistance, Will BTC Decline?

According to a report from on-chain analytics firm Glassnode, Bitcoin (BTC) is consolidating above the on-chain cost basis of several cohorts. This puts the average BTC holder into a regime of unrealized gains and suggests a potential turning of the macro market tides, the firm believes.

The Shift Of Crypto Market Tides Is Underway

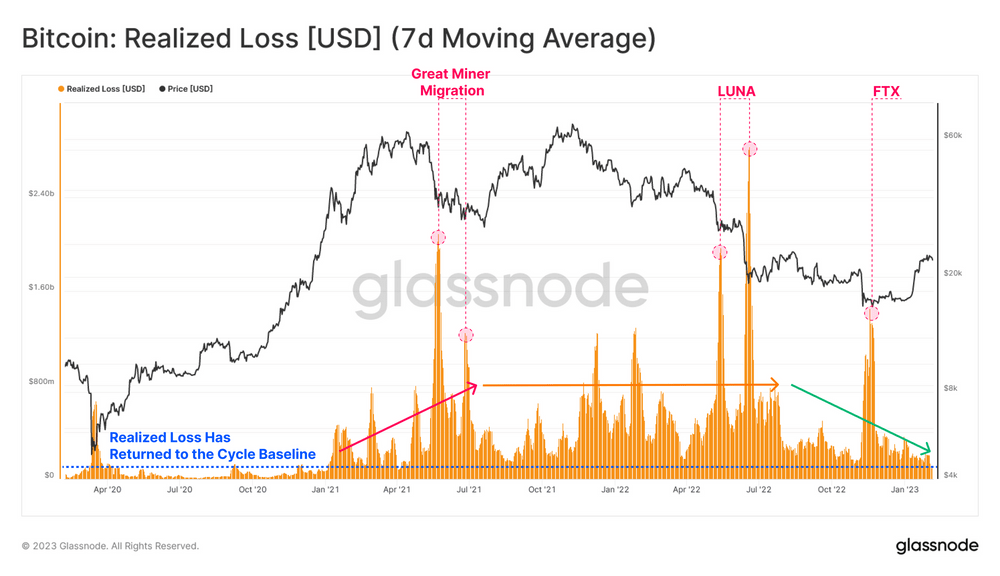

Using Glassnode’s on-chain analysis, the crypto market can see an explosion of profit-taking after October 2020 in response to monetary policy. According to Glassnode, this can decrease dramatically from the peak in January 2021, detoxing over the following two years and bringing the market back to 2020 levels.

Glassnode’s analysis suggests that the losses realized by the market over this period began to widen after January 2021, reaching an initial peak in the May 2021 sell-off after digital assets, equities, and bonds struggled under tightening monetary conditions.

Following the collapse in price action after reaching an all-time high (ATH) in November 2021, the market is witnessing the first sustained period of profitability since the liquidity exit in April 2022, suggesting the first signs of a change in the profitability regime.

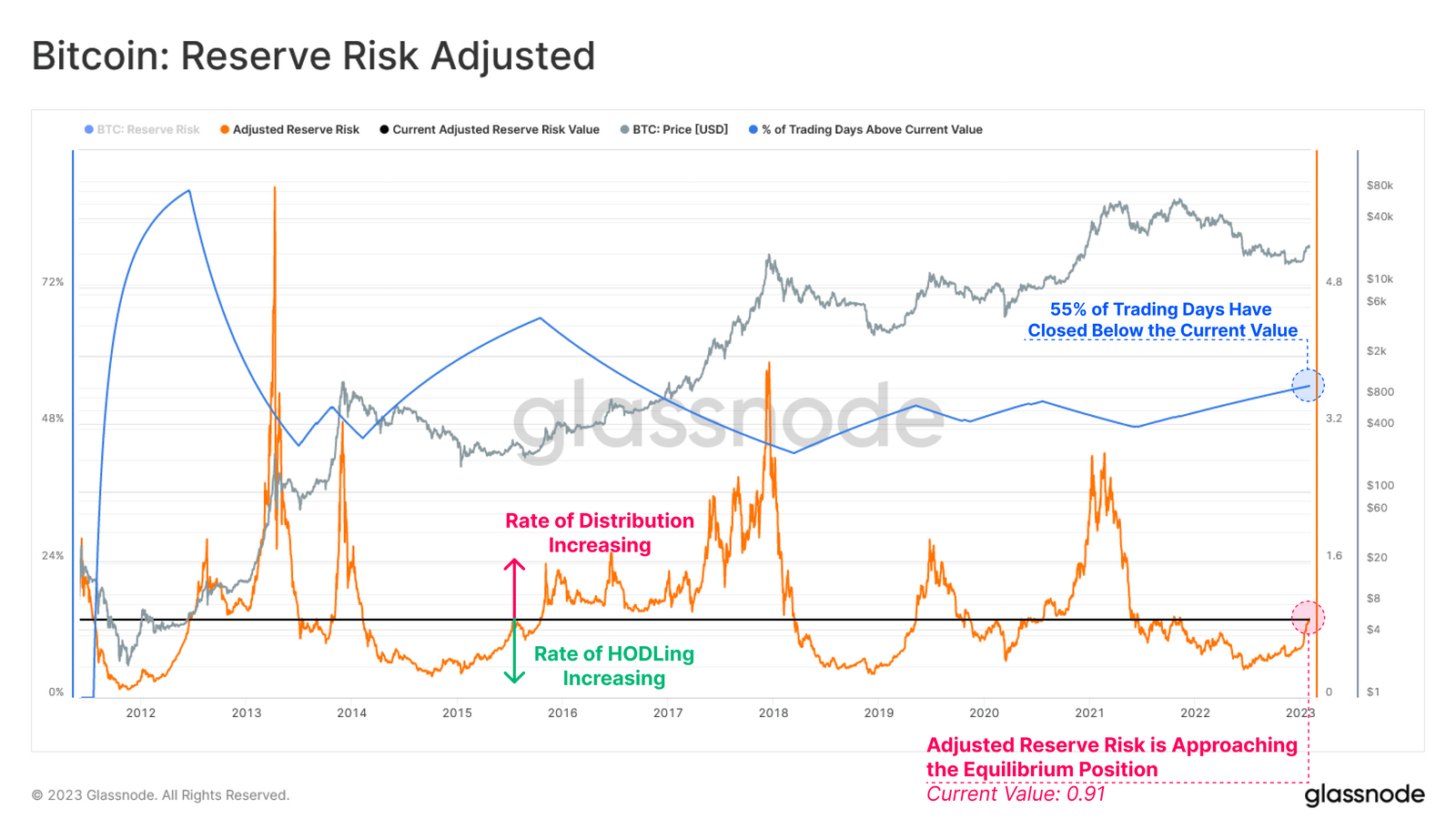

Glassnode’s Reserve Risk metric can be used to contextualize the behavior of the HODLer class. This cyclical oscillator quantifies the balance between the aggregate incentive to sell and the actual spending of long-dormant coins.

Higher values indicate that price and HODLer spending is increasing, while lower values indicate that price and HODLer spending are decreasing.

As this oscillator continues to move toward its equilibrium position, it may indicate that the opportunity cost of HODLing is decreasing while the incentive to sell is increasing.

Previous breakouts above the equilibrium position have marked a transition from a regime of HODLing to one of increasing profit realization and a rotation of capital from bear market accumulators back to newer investors and speculators, according to the Glassnode analysis.

From a Crypto-Winter To a Thaw

After long months of the bear market and its aftermath, which has frozen large cryptocurrencies, Glassnode says there are signs of a “full detox,” and a cyclical transition may be underway.

For Glassnode, the market appears to be in transition, moving from the late stages of a bear market to the beginning of a new cycle. Past cycles should serve as a guide, but for Glassnode, the road ahead remains challenging, with 2015 and 2019 as critical examples.

In short, Glassnode concludes that these transition periods have historically been characterized by extended sideways price action in the market, with local volatility moves in both directions.

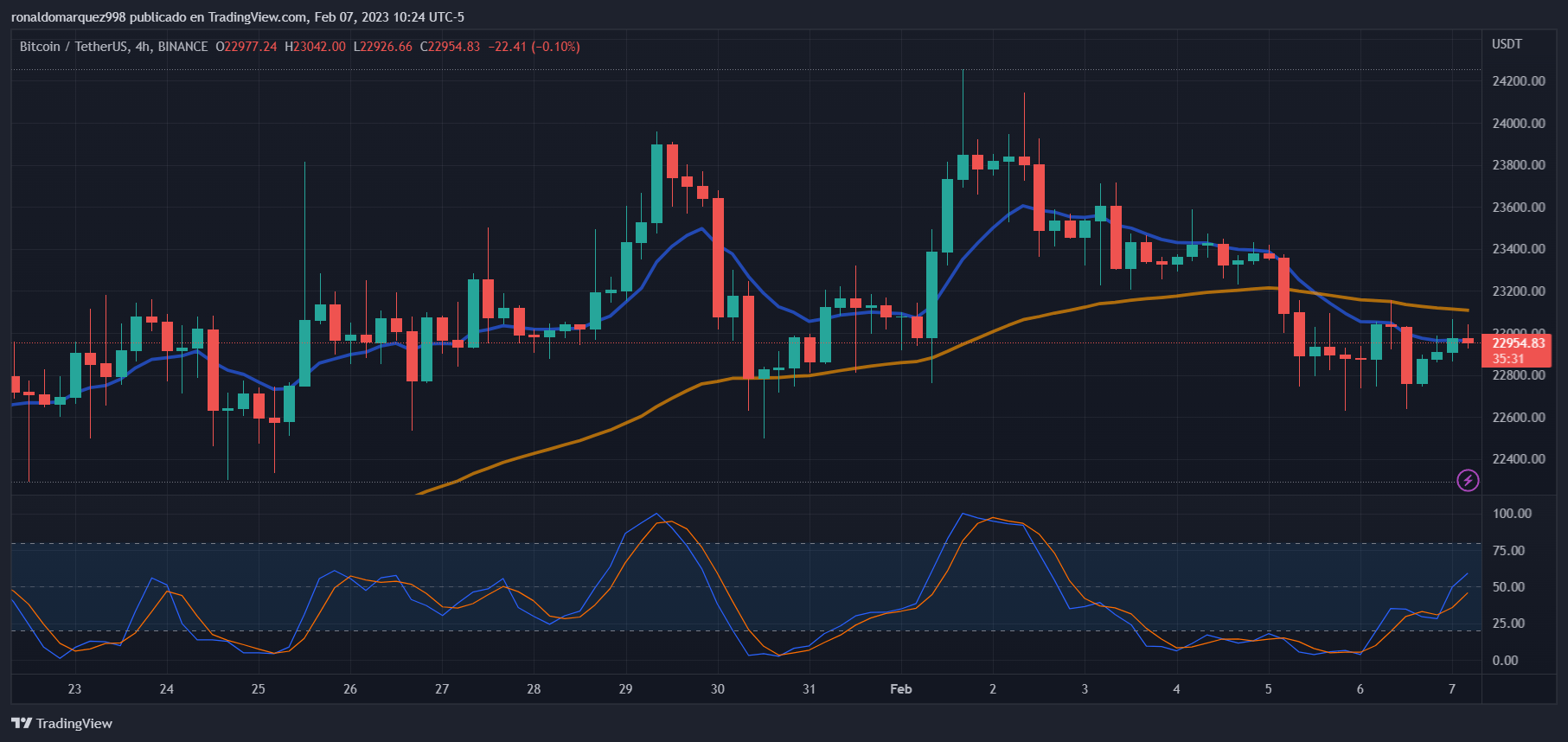

Bitcoin continues to hold the line of support at $22,600, with sideways price action in recent days. BTC is currently trading at $22,950 with a gain of 0.9% in the last 24 hours and a slight recovery of 0.6% in the previous seven days.

Related Reading: XRP Price Still Looks Bearish, But This Ripple Visa Rumor Might Change It

With a market cap of $443 billion, Bitcoin has the signs and the favorable wind to narrow the gap between its ATH of $69,000 and the current price. Bitcoin is currently consolidating around the $23,000 level and is aiming to find new yearly highs and remain in the green land for the rest of the year.

Featured image from Unsplash, charts from Glassnode, and Tradingview.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  TrueUSD

TrueUSD  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Pax Dollar

Pax Dollar  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD