VeChain Price Prediction: Will the third bounce restart the rally?

- VeChain price has risen 4% after falling 12% from the year-to-date high.

- Currently, VET is showing potential for a 16% downswing in the short term.

- The bearish thesis would be invalidated from a breach above $0.026.

VeChain price is displaying auction market behavior that should be closely watched. Key levels have been identified to determine when VET may create a profitable trading opportunity.

Vechain price is setting up a move

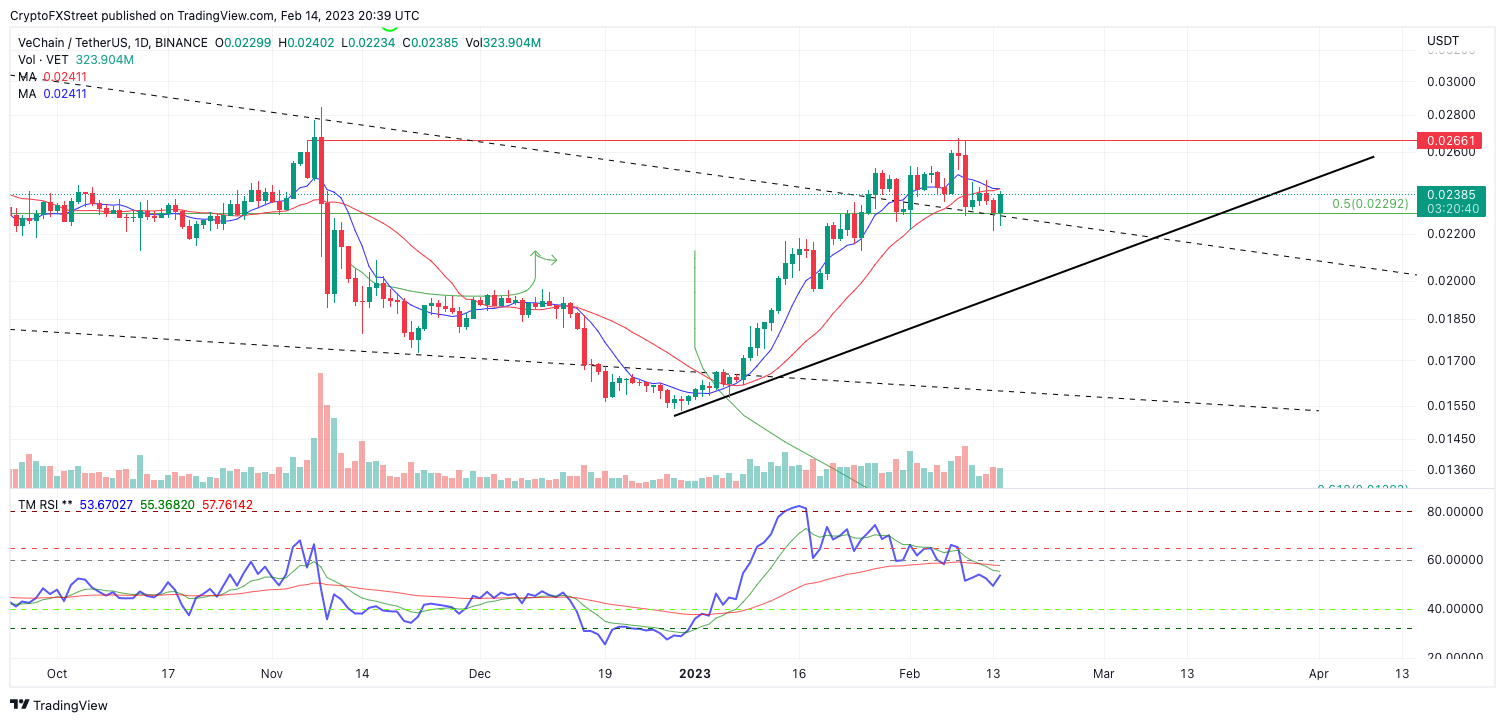

VeChain price is attempting to change the bearish narrative that has recently entered the market. On February 14, the digital currency token was up 4%. Earlier this month, the bears produced a bearish candle beneath the 8-day exponential moving average and 21-day simple moving average. The bulls have failed to retake the barrier during two previous counter-trend attempts.

VeChain is currently trading at $0.023, the third time in less than a week that the bulls are engaging with the $0.024 level where the moving averages are resting. There is a potential that the bulls will reclaim the boundary, but the barrier is currently acting as resistance. If this remains, it could lead to another 12% downswing, targeting $0.020 in the short term. This downswing move would challenge the support near the ascending trend line that catalyzed VET’s 75% winter rally.

Invalidation of the bearish thesis would occur if the bulls can reclaim the $0.028 level. Not only will they have to breach the level, but they should also produce a daily candlestick close above the barrier to confirm that the downtrend is over. If this happens, the bulls could reestablish the liquidity hunt towards the $0.028 level, resulting in a 20% increase from VeChain’s current price.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Decred

Decred  Basic Attention

Basic Attention  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  BUSD

BUSD  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD  Ren

Ren