Shiba Inu Price Prediction: Bulls seek to attain earlier swings

Shiba Inu is set to transcend immediate hurdles as whales enter SHIB waters, causing high tides. The spike in the delivery volume perishing through the multiple EMAs is an early gesture of an ample move. Bulls are now holding momentum, pausing near the important Fib level of 50%.Moreover, the token is well stimulating above its significant moving averages.

Shiba Inu is trading at $0.00001323 with a flat move of 0.01% (at press time). At the same time, the trading volume dropped by 29%. Bulls are stretching their muscles and aiming for a fresh breakout of a bullish flag pattern.

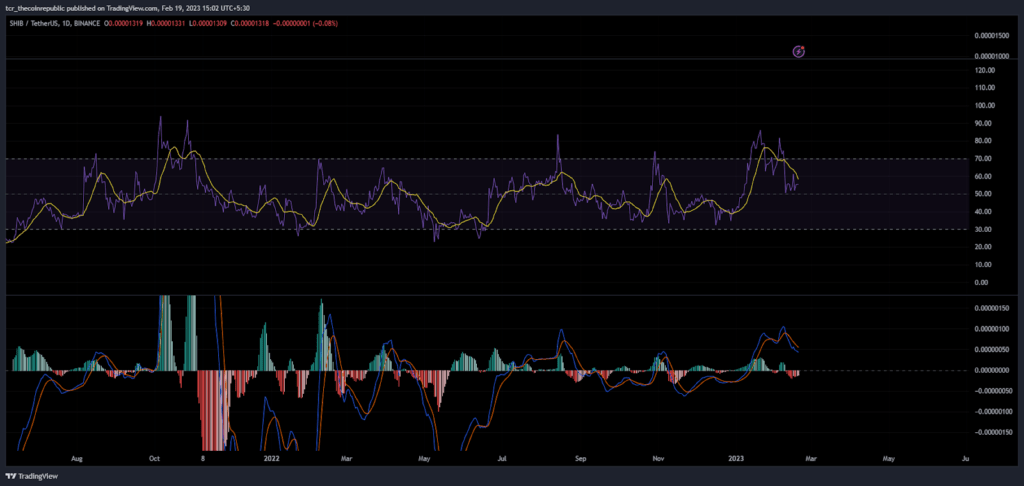

Daily chart shows clear sighting of a bullish pattern

Source: TradingView

On the daily chart, SHIBA token exhibits fairly bullish strings with the upright action of buyers. The price action indicates that the bulls are attempting to propel through the neckline of the flag pattern. Moreover, the token is keen to escape the supply zone of $0.00001500, which is the immediate hurdle.

When the token was in the correction phase in the past weeks, bulls made a base near $0.00000800 and shaped a double-bottom pattern. Afterwards, the buyers accumulated prices from the demand zone and leaped by 30% over the last 20 trading sessions.

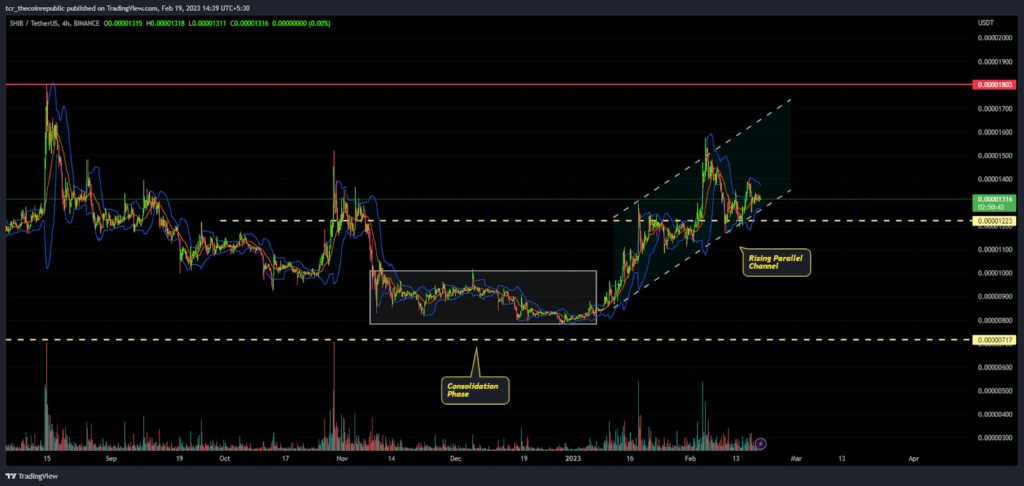

Short-term cart conveys incremental bent move

Source: TradingView

On the 4 hour-chart, SHIBA was trading inside the rising parallel channel forming higher highs and higher lows. This gradual upside action since the beginning of 2023 is a promising cue for the forthcoming months for buyers.

SHIBA token is now on the verge of showcasing a much-awaited move if it transits above $0.00001500 in the next few sessions. The Bollinger band is now converging and is likely to smash the upper end. Moreover, the token aims to retest the previous high of $0.00001800 (red line). Last year, the token was trading in a narrow range. The Bears are attempting to break the bulls’ stamina by pushing it back to the support zone.

What do the traditional indicators say?

Source: TradingView

RSI: The RSI curve is at 50, indicating mere neutral signs, taking a nap after the bulls’ prosperous comeback. The token lost momentum in the last 24 hrs.

MACD: The MACD indicator indicates mild bearish phenomena, but the crossover is yet to happen in the upcoming sessions, which favours the bulls.

Technical Levels

Support Levels:$ 0.00001100

Resistance Levels: $0.00001500 and $0.00001700

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Monero

Monero  LEO Token

LEO Token  Zcash

Zcash  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  TrueUSD

TrueUSD  Dash

Dash  Tezos

Tezos  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  DigiByte

DigiByte  0x Protocol

0x Protocol  Nano

Nano  Zilliqa

Zilliqa  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  BUSD

BUSD  Status

Status  Pax Dollar

Pax Dollar  Enjin Coin

Enjin Coin  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren  HUSD

HUSD